PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766186

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766186

Utility Scale Substation Monitoring System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

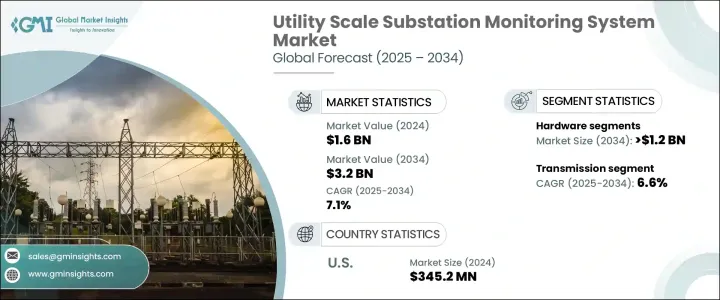

The Global Utility Scale Substation Monitoring System Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 3.2 billion by 2034. The Global Utility Scale Substation Monitoring System Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 3.2 billion by 2034. This growth is primarily driven by the ongoing integration of renewable energy sources like wind and solar power into existing grids, which demand advanced supervision to manage fluctuations and ensure grid stability. The adoption of technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and cloud computing has revolutionized substation monitoring.

IoT-enabled sensors allow for real-time equipment monitoring, AI powers predictive maintenance analytics, and cloud platforms facilitate efficient data management-collectively enhancing the reliability and efficiency of power grids. Emerging technologies are further complemented by the rise of edge computing, which significantly impacts how substations are monitored. By processing data directly within the substation, edge devices reduce latency and bandwidth consumption while improving response times for critical operations like fault detection and load balancing. This local intelligence enables faster, real-time decision-making without depending on remote data centers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 7.1% |

Looking at components, the hardware segment is projected to reach USD 1.2 billion by 2034, driven by rising demand for intelligent electronic devices (IEDs), smart sensors, phasor measurement units (PMUs), and advanced communication modules. These hardware elements form the core of substation automation and monitoring systems by enabling real-time data collection, equipment health tracking, and fault identification.

The distribution segment is expected to reach USD 1.1 billion by 2034, fueled by increasing electrification across residential and commercial sectors, integration of distributed energy resources (DERs), and the growing necessity for efficient load management. As utilities contend with the challenges of reliable power delivery and managing bidirectional flows from sources like rooftop solar and electric vehicles, substation monitoring systems become indispensable.

U.S. Utility Scale Substation Monitoring System Market was valued at USD 345.2 million in 2024. With a 2.8% growth in real GDP that year and over USD 100 billion in private investments flowing into the solar and energy storage sectors, the market's growth prospects look promising. These substantial investments underscore strong investor confidence driven by favorable policies, technological progress, and rising energy demands.

Leading companies in the Utility Scale Substation Monitoring System Market include Eaton Corporation, GE Vernova, Schneider Electric, Cisco, ABB Ltd., Honeywell, iGRID t&D, Novatech, Trilliant Holdings Inc., Schweitzer Engineering Laboratories, Inc., Emerson Electric, Cadillac Automation and Controls, Siemens, Tekvel, and Sentient Energy. To enhance their foothold in the utility-scale substation monitoring system market, companies focus heavily on advancing R&D to develop cutting-edge, integrated monitoring solutions that combine IoT, AI, and cloud technologies for superior real-time data insights. Strategic partnerships with utility providers and technology firms allow for tailored, scalable systems that address evolving grid requirements. Emphasizing edge computing capabilities to reduce latency and improve reliability is a key priority. Firms are also investing in expanding global manufacturing capacities to meet growing demand efficiently while ensuring compliance with international standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Size and Forecast, By Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Transmission

- 6.3 Distribution

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Wired

- 7.3 Wireless

Chapter 8 Market Size and Forecast, By Deployment, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 On premises

- 8.3 Cloud based

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.5.4 South Africa

- 9.5.5 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB Ltd.

- 10.2 Cadillac Automation and Controls

- 10.3 Cisco

- 10.4 Eaton Corporation

- 10.5 Emerson Electric

- 10.6 GE Vernova

- 10.7 Honeywell

- 10.8 iGRID t&D

- 10.9 Novatech

- 10.10 Schneider Electric

- 10.11 Schweitzer Engineering Laboratories, Inc.

- 10.12 Sentient Energy

- 10.13 Siemens

- 10.14 Tekvel

- 10.15 Trilliant Holdings Inc.