PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876796

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876796

Wound Care Therapy Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

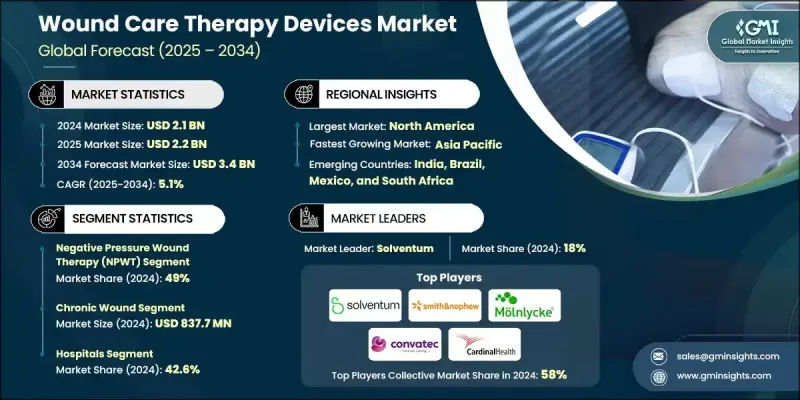

The Global Wound Care Therapy Devices Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 3.4 billion by 2034.

The growing prevalence of chronic wounds, particularly among elderly populations, is a major driver of market expansion. Wound care therapy devices are advanced medical systems developed to facilitate and accelerate healing in both acute and chronic wounds. Unlike conventional wound dressings, these technologies actively regulate the wound environment through methods such as negative pressure, oxygen delivery, or electrical stimulation. Such mechanisms help enhance tissue regeneration, minimize the risk of infection, and support faster recovery. Ongoing technological progress has enabled the development of smart wound therapy systems capable of tracking wound parameters like temperature, moisture, and infection indicators in real time. These innovations enable clinicians to make timely and precise treatment decisions, improving healing outcomes and reducing complications. Portable wound care systems, including compact negative pressure wound therapy (NPWT) devices, are becoming increasingly popular for use in homecare and outpatient settings, reducing hospital dependency and healthcare expenses. The rising number of diabetic patients who are at higher risk of developing chronic wounds such as diabetic foot ulcers further contributes to the market's continued growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 5.1% |

The negative pressure wound therapy (NPWT) accounted for a 49% share in 2024. This therapy enhances wound closure by drawing wound edges together, stimulating tissue granulation, and promoting improved blood circulation at the site. By efficiently removing fluids, exudates, and bacteria, NPWT minimizes the chances of infection and accelerates healing, making it particularly valuable in managing complex wounds caused by trauma or surgery.

The hospitals segment held 42.6% share in 2024 and is expected to reach USD 1.5 billion by 2034. Hospitals continue to be the primary centers for wound care management, offering comprehensive treatment for surgical, acute, and chronic wounds. Their access to a wide range of advanced therapy devices including NPWT systems, electrical stimulation units, and oxygen-based treatment solutions consolidates their position as the leading end users within the market.

U.S. Wound Care Therapy Devices Market reached USD 697.4 million in 2024. The increasing rate of diabetes in the U.S. has substantially influenced market growth, as diabetic patients are prone to chronic ulcers that require advanced wound therapy systems. The growing preference for modern, efficient wound management technologies continues to strengthen the country's leadership in the global market.

Prominent players operating in the Global Wound Care Therapy Devices Market include Accel-Heal Technologies, Cardinal Health, ConvaTec, DeRoyal Industries, Medaxis, Molnlycke Health Care, Sky Medical Technology, Smith+Nephew, Solventum, Talley Group, and WoundEL Health Care. Leading companies in the Global Wound Care Therapy Devices Market are prioritizing innovation, partnerships, and product diversification to strengthen their market presence. Continuous investment in research and development enables them to introduce advanced wound healing solutions with enhanced functionality, portability, and patient comfort. Many firms are expanding their portfolios with smart wound management systems that incorporate sensors and digital connectivity for remote monitoring and data analysis.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic wounds

- 3.2.1.2 Increasing number of surgical procedures

- 3.2.1.3 Surge in government initiatives regarding wound care treatment

- 3.2.1.4 Technological advancements in wound care therapy devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced devices

- 3.2.2.2 Lack of skilled healthcare professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of smart technologies

- 3.2.3.2 Home healthcare and remote monitoring

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Asia Pacific

- 3.4.3 Europe

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis, 2024

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Negative pressure wound therapy

- 5.3 Oxygen and hyperbaric oxygen equipment

- 5.4 Electric stimulation devices

- 5.5 Pressure relief devices

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Chronic wounds

- 6.2.1 Diabetic foot ulcers

- 6.2.2 Pressure ulcers

- 6.2.3 Venous legs ulcers

- 6.2.4 Other chronic wounds

- 6.3 Acute wounds

- 6.3.1 Surgical wounds

- 6.3.2 Traumatic wounds

- 6.3.3 Burns

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Home care settings

- 7.5 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Accel-Heal Technologies

- 9.2 Cardinal Health

- 9.3 ConvaTec

- 9.4 DeRoyal Industries

- 9.5 Medaxis

- 9.6 Molnlycke Health Care

- 9.7 Sky Medical Technology

- 9.8 Smith+Nephew

- 9.9 Solventum

- 9.10 Talley Group

- 9.11 WoundEL Health Care