PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766196

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766196

Europe EV Fleet Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

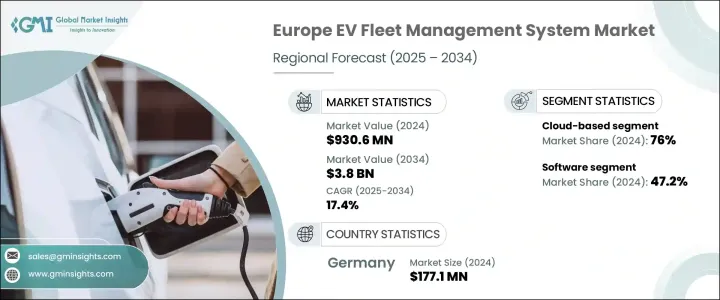

Europe EV Fleet Management System Market was valued at USD 930.6 million in 2024 and is estimated to grow at a CAGR of 17.4% to reach USD 3.8 billion by 2034. Growth is being driven by the rapid electrification of fleet operations, particularly within logistics and delivery services, and the ongoing expansion of regional charging infrastructure. The increasing focus on reducing urban emissions and meeting sustainability goals is pushing fleet operators to transition to electric vehicles, with fleet management systems playing a key role in optimizing daily operations. These platforms are essential for real-time vehicle tracking, battery monitoring, smart dispatching, and cost control, helping companies maintain high service standards while maximizing energy efficiency.

The evolving regulatory landscape across Europe, which now emphasizes emission transparency and data accountability, is further accelerating adoption. EV fleet platforms now incorporate advanced analytics to monitor vehicle performance, CO? output, and energy usage, supporting compliance with EU mandates and improving operational decision-making. With strong momentum from both policy and industry, the Europe EV fleet management system market is expected to witness substantial investment and adoption over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $930.6 Million |

| Forecast Value | $3.8 Billion |

| CAGR | 17.4% |

Operators across Europe are adopting unified EV fleet platforms that are compatible with multiple vehicle classes and manufacturers. This interoperability allows seamless management of mixed fleets-ranging from electric vans and trucks to passenger cars-through a single interface, reducing IT complexity and enabling faster onboarding. With minimal training and simplified deployment, this modular approach offers fleet managers flexibility and scalability while lowering operational costs. Regulatory initiatives such as the EU Green Deal continue to reinforce the need for traceable, low-emission transport solutions, increasing the demand for platforms equipped with sustainability-focused tools like real-time emissions tracking, energy reporting, and smart routing.

In 2024, the software segment held the largest market share, accounting for 47.2%, and is projected to grow at a CAGR of 18% through 2034. Software platforms are the core of EV fleet management, offering integrated tools for energy consumption monitoring, driver behavior analysis, scheduling, and route optimization. Their ability to deliver actionable insights through real-time data not only supports energy savings but also ensures fleet-wide efficiency across both public and private sectors.

Cloud-based fleet management systems segment held 76% share in 2024 and is projected to grow at a CAGR of 18.5% between 2025 and 2034. These solutions provide real-time visibility and centralized control over fleet operations spread across various European regions. The convenience of remote access, seamless updates, and low infrastructure requirements make cloud platforms especially appealing to large-scale logistics providers, corporate fleets, and public transportation agencies. With functionalities such as remote diagnostics, automated compliance logs, and cross-device compatibility, cloud-based EV management systems are empowering fleet managers to make faster, data-backed decisions and respond swiftly to dynamic operational challenges.

Germany EV Fleet Management System Market accounted for 33.3% share in 2024, generating around USD 177.1 million. The country leads the Western European region owing to its strong automotive infrastructure, efficient logistics networks, and progressive support for e-mobility initiatives. As a central hub for vehicle production and fleet innovation, Germany is investing heavily in the deployment of advanced EV fleet platforms across both municipal and commercial segments. German companies are actively integrating intelligent fleet solutions into transport systems to streamline operations, reduce emissions, and enhance mobility. Tech providers based in Germany such as SAP, Webfleet (a Bridgestone company), and Siemens Mobility offer tailored EV fleet solutions with capabilities including battery health tracking, smart charging management, predictive maintenance, and route optimization-enabling operators to lower emissions and operational expenses through data-driven automation.

Key players in the Europe EV Fleet Management System Market include ABAX, AddSecure Smart Transport, Fleet Complete, Geotab, OCTO Telematics, Targa Telematics, Teletrac Navman, TomTom Telematics, Verizon Connect, and Webfleet (a Bridgestone company). Leading companies in the Europe EV fleet management system market are prioritizing innovation, cloud-based technology adoption, and regional expansion to reinforce their market standing. Firms like Teletrac Navman, AddSecure Smart Transport, Geotab, ABAX, and Targa Telematics are enhancing their platforms with real-time data analytics, AI-powered routing, and smart energy optimization features.

Strategic collaborations with EV manufacturers and charging infrastructure providers are helping them offer integrated solutions tailored to large-scale fleet requirements. Additionally, many companies are building compliance-ready tools to support sustainability regulations under EU policies. Investments in mobile accessibility, driver training interfaces, and cybersecurity further strengthen these platforms, making them indispensable for modern fleet operators looking to streamline performance and meet environmental goals.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment Mode

- 2.2.4 Vehicle

- 2.2.5 Organization Size

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand from logistics & delivery sectors

- 3.2.1.2 Advancements in telematics & analytics

- 3.2.1.3 Expansion of charging infrastructure

- 3.2.1.4 Integration with smart city initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment

- 3.2.2.2 Battery performance concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with renewable energy sources

- 3.2.3.2 Development of Vehicle-to-Grid (V2G) technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Production statistics

- 3.8.1 Production hubs

- 3.8.2 Consumption hubs

- 3.9 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Use cases

- 3.14 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 Fleet tracking & monitoring

- 5.2.2 Charging management

- 5.2.3 Vehicle diagnostics

- 5.2.4 Route optimization

- 5.2.5 Battery health management

- 5.3 Hardware

- 5.3.1 Telematics devices

- 5.3.2 GPS trackers

- 5.3.3 On-board Diagnostics (OBD) Devices

- 5.4 Services

- 5.4.1 Installation & integration

- 5.4.2 Maintenance & support

- 5.4.3 Consulting services

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud-Based

- 6.3 On-premises

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Sedans

- 7.2.2 Hatchbacks

- 7.2.3 SUVs

- 7.3 Commercial vehicles

- 7.3.1 Light duty

- 7.3.2 Medium duty

- 7.3.3 Heavy duty

Chapter 8 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large Enterprises

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Logistics & transportation

- 9.3 Government fleets

- 9.4 Corporate fleets

- 9.5 Ride-Hailing & taxi services

- 9.6 Utilities

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 Western Europe

- 10.2.1 Germany

- 10.2.2 Austria

- 10.2.3 France

- 10.2.4 Switzerland

- 10.2.5 Belgium

- 10.2.6 Luxembourg

- 10.2.7 Netherlands

- 10.2.8 Portugal

- 10.3 Eastern Europe

- 10.3.1 Poland

- 10.3.2 Romania

- 10.3.3 Czechia

- 10.3.4 Slovenia

- 10.3.5 Hungary

- 10.3.6 Bulgaria

- 10.3.7 Slovakia

- 10.3.8 Croatia

- 10.4 Northern Europe

- 10.4.1 UK

- 10.4.2 Denmark

- 10.4.3 Sweden

- 10.4.4 Finland

- 10.4.5 Norway

- 10.5 Southern Europe

- 10.5.1 Italy

- 10.5.2 Spain

- 10.5.3 Greece

- 10.5.4 Bosnia and Herzegovina

- 10.5.5 Albania

Chapter 11 Company Profiles

- 11.1 ABAX

- 11.2 AddSecure Smart Transport

- 11.3 Fleet Complete

- 11.4 Frotcom

- 11.5 Geotab

- 11.6 GreenRoad Technologies

- 11.7 Gurtam

- 11.8 Inseego

- 11.9 Masternaut

- 11.10 OCTO Telematics

- 11.11 Quartix Technologies

- 11.12 Radius Telematics

- 11.13 Targa Telematics S.p.A.

- 11.14 Teletrac Navman

- 11.15 TomTom Telematics

- 11.16 Verizon Connect

- 11.17 Via Transportation

- 11.18 Vimcar

- 11.19 Webfleet (a Bridgestone company)

- 11.20 Zubie