PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766217

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766217

Low Fat Content Kefir Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

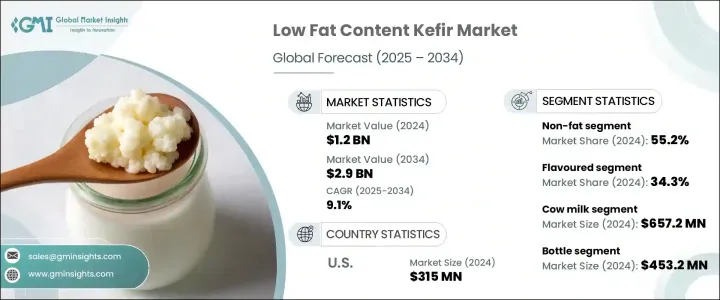

The Global Low Fat Content Kefir Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 2.9 billion by 2034. This growth aligns with the increasing consumer focus on weight management and the rising demand for nutritious dairy products that promote digestive and immune health. Low-fat kefir appeals to consumers seeking high-protein, low-saturated-fat probiotic beverages. Lifestyle changes, particularly among millennials and urban professionals, have driven demand for convenient, functional, low-fat nutrition options. The market is evolving with a growing preference for clean-label dairy products, presenting opportunities for both traditional dairy and plant-based kefir producers.

Organic, grass-fed, and lactose-free low-fat options are becoming more widely available, supported by expanding e-commerce and health food retail channels. Consumers increasingly prefer products with low sugar content and clean-label attributes, prompting brands to fortify low-fat kefir with added probiotics, vitamins, and minerals. Technological advances in fermentation, precision probiotic strains, and microencapsulation ensure probiotic stability, boosting product quality and shelf life.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.9 Billion |

| CAGR | 9.1% |

Non-fat kefir segment held a 55.2% share in 2024 and is expected to grow at a CAGR of 9.2% through 2034. The rising demand for low-calorie and healthier dairy choices is driving this segment's growth. Individuals managing conditions like diabetes, heart disease, or cholesterol increasingly prefer non-fat kefir, which delivers high protein and probiotic benefits without the fat content found in other dairy products. This trend is particularly notable in North America and Europe, regions known for embracing clean-label and low-fat diets. Lactose-intolerant consumers also favor non-fat kefir when it is fortified with lactase or produced from lactose-free milk. The creamy texture and rich flavor of non-fat kefir, despite its lack of fat, have made it popular, especially in ready-to-drink and on-the-go functional beverage categories.

Flavored kefir segment captured a 34.3% share in 2024 and is projected to grow at a faster CAGR of 9.4% by 2034. Its widespread appeal comes from the incorporation of natural flavors like fruits, honey, and vanilla, which attract younger consumers and those new to kefir. Flavored varieties encourage first-time purchases and foster customer loyalty through repeat buying. Meanwhile, unflavored or plain kefir maintains a strong following among health-conscious consumers and those who prefer to use it as a smoothie base. The clean-label movement and innovation driven by health claims have boosted the popularity of organic kefir, though conventional kefir remains dominant due to affordability and accessibility. Greek-style kefir, known for its thicker texture and higher protein content, is gaining traction. Additionally, frozen kefir is emerging as a functional dessert alternative, broadening the product's versatility in the market.

United States Low Fat Content Kefir Market was valued at USD 315 million in 2024 and is forecast to grow at a CAGR of 9.2% through 2034. The country's leadership stems from strong consumer demand for low-calorie, probiotic-rich dairy products that support health and wellness. Major companies have developed extensive distribution networks, offering innovative and appealing products tailored to health-conscious consumers. The well-established retail infrastructure-including supermarkets, hypermarkets, and online channels-adds convenience and accessibility. Moreover, growing consumer awareness about functional foods that improve digestion and immunity fuels the popularity of low-fat kefir. The U.S. market's focus on clean-label and organic offerings further strengthens consumer trust and loyalty.

Leading companies in the Global Low Fat Content Kefir Market include Wallaby Yogurt Company, Maple Hill Creamery, LLC, Green Valley Creamery, Danone S.A., and Lifeway Foods, Inc. To strengthen their market positions, companies in the low-fat kefir sector focus heavily on innovation and product differentiation. They invest in developing new formulations that include organic, lactose-free, and grass-fed options to meet diverse consumer needs. Expanding flavor varieties and fortified products with added probiotics, vitamins, and minerals help boost appeal and repeat purchase rates. Market leaders build strong distribution networks, leveraging e-commerce and health-focused retail channels to improve accessibility. Collaborations with health experts and influencers promote product credibility and consumer trust.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Fat content

- 2.2.3 Product type

- 2.2.4 Sources

- 2.2.5 Packaging type

- 2.2.6 Distribution channel

- 2.2.7 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only )

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Manufacturing process analysis

- 3.13.1 Milk preparation & standardization

- 3.13.2 Fermentation process

- 3.13.3 Flavour addition & formulation

- 3.13.4 Packaging & quality control

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Fat Content, 2021 - 2034 (USD Million) (Thousand Liters)

- 5.1 Key trend

- 5.2 Non-fat (0–0.5% fat)

- 5.3 Low-fat (1–2% fat)

- 5.4 Reduced-fat (2–3% fat)

- 5.5 Other fat content levels

Chapter 6 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million) (Thousand Liters)

- 6.1 Key trend

- 6.2 Plain/unflavoured

- 6.3 Flavoured

- 6.3.1 Fruit flavors

- 6.3.2 Vanilla

- 6.3.3 Chocolate

- 6.3.4 Other flavors

- 6.4 Organic

- 6.5 Conventional

- 6.6 Greek-style

- 6.7 Frozen

- 6.8 Other product types

Chapter 7 Market Estimates & Forecast, By Source, 2021 - 2034 (USD Million) (Thousand Liters)

- 7.1 Key trend

- 7.2 Cow milk

- 7.3 Goat milk

- 7.4 Sheep milk

- 7.5 Plant-based alternatives

- 7.5.1 Coconut-based

- 7.5.2 Almond-based

- 7.5.3 Soy-based

- 7.5.4 Oat-based

- 7.5.5 Other plant-based alternatives

- 7.6 Other sources

Chapter 8 Market Estimates & Forecast, By Packaging Type, 2021 - 2034 (USD Million) (Thousand Liters)

- 8.1 Key trend

- 8.2 Bottles

- 8.2.1 Plastic bottles

- 8.2.2 Glass bottles

- 8.3 Pouches

- 8.4 Tetra packs

- 8.5 Cups & tubs

- 8.6 Other packaging types

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Thousand Liters)

- 9.1 Key trend

- 9.2 Supermarkets & hypermarkets

- 9.3 Convenience stores

- 9.4 Specialty stores

- 9.4.1 Health food stores

- 9.4.2 Natural product retailers

- 9.4.3 Other specialty stores

- 9.5 Online retail

- 9.6 Foodservice

- 9.6.1 Cafes & restaurants

- 9.6.2 Smoothie & juice bars

- 9.6.3 Other foodservice channels

- 9.7 Direct sales

- 9.8 Other distribution channels

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Liters)

- 10.1 Key trend

- 10.2 Breakfast

- 10.3 Snacking

- 10.4 Post-workout

- 10.5 Dessert alternative

- 10.6 Cooking & recipe ingredient

- 10.7 Other consumption occasions

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million) (Thousand Liters)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East & Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East & Africa

Chapter 12 Company Profiles

- 12.1 Andechser Natur

- 12.2 Biotiful Dairy Ltd.

- 12.3 Danone S.A.

- 12.4 Evolve Kefir

- 12.5 Green Valley Creamery

- 12.6 Harmonica

- 12.7 Lifeway Foods, Inc.

- 12.8 Maple Hill Creamery, LLC

- 12.9 Miil

- 12.10 Redwood Hill Farm & Creamery

- 12.11 Valio Ltd.

- 12.12 Wallaby Yogurt Company