PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848026

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848026

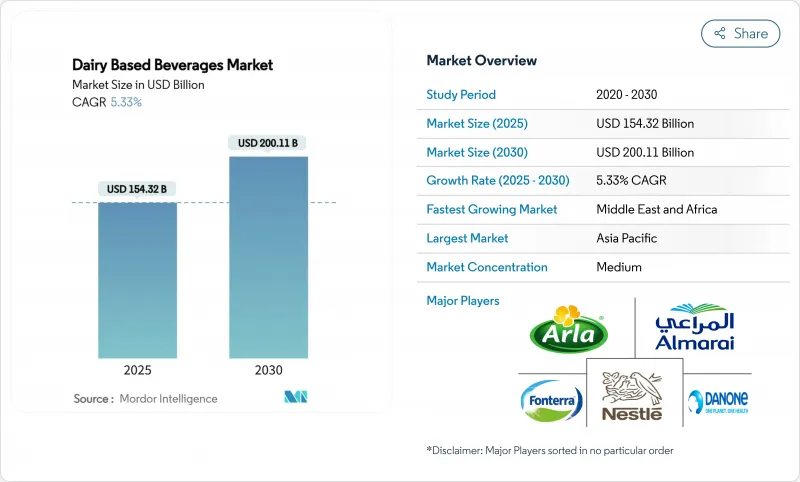

Dairy Based Beverages - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The dairy-based beverages market size is estimated to be USD 154.32 billion in 2025 and is projected to reach USD 200.11 billion by 2030, advancing at a steady 5.33% CAGR.

The market growth stems from consumer demand for nutritious beverages combining functional benefits with taste appeal. Urban millennials' consumption patterns have transformed protein-enriched, probiotic, and clean-label products from specialized offerings into mainstream market segments. Dairy beverages retain a significant market share despite plant-based competition, primarily due to established taste preferences and nutritional content that aligns with balanced dietary requirements. Market expansion in Asia-Pacific, and Middle East and Africa continues through increased consumer purchasing power and enhanced cold-chain logistics infrastructure, enabling broader distribution of both chilled and shelf-stable dairy products. The competitive environment comprises global corporations, regional cooperatives, and technology-focused startups, with firms investing in product development, sustainability initiatives, and direct distribution channels to address consumer requirements. Market performance depends on companies' operational flexibility in responding to evolving consumer preferences.

Global Dairy Based Beverages Market Trends and Insights

Growing demand for high-protein functional drinks among millennials

The protein-rich dairy beverages segment is experiencing substantial growth, driven by millennials and Gen Z consumers who increasingly regard protein as a vital nutritional component. This demographic shift is transforming the global functional beverage market. Protein is widely acknowledged for its role in muscle development, weight management, satiety, and overall wellness. With a growing emphasis on fitness, consumers are seeking nutrient-dense beverages that deliver both refreshment and functional benefits, which dairy-based protein drinks effectively provide. According to Sport England, participation in sports and physical activities among adults in England reached 30 million weekly participants during 2023-2024, demonstrating an increase of 2.4 million individuals . This trend has expanded beyond traditional sports nutrition, as consumers actively integrate protein into their daily diets. In response, key industry players are introducing strategic innovations. For instance, in May 2025, Oikos expanded its product portfolio with shelf-stable protein shakes, marking its first venture beyond dairy products. The new protein shakes contained 30g of complete protein to support muscle strength and satiety, along with 5g of prebiotic fiber for digestive health. The product contained no artificial sweeteners.

Growth in foodservice and cafe culture

As coffee houses and specialty cafes continue to expand, they are driving a notable increase in dairy consumption within beverages, thereby strengthening the interconnection between the coffee and dairy sectors. According to the Ministry of Health, Labour and Welfare of Japan, the number of licensed coffee shops in the country reached 47,530 in 2024 . This trend is particularly evident in the quick service restaurant (QSR) market, where the growing demand for specialty coffee beverages has significantly elevated the use of dairy, establishing milk-based drinks as essential offerings on cafe menus worldwide. Moreover, the increased trend of urban consumers socializing and working in cafes drove the demand for milk-based beverages, including lattes, frappes, and specialty flavored milk drinks. Foodservice chains and quick-service restaurants expanded their dairy beverage offerings to cater to younger consumers who sought trendy options. This trend was particularly evident in metropolitan areas, where cafe culture aligned with lifestyle preferences and convenience. Starbucks and Costa Coffee played a significant role in popularizing cold brew with milk, flavored lattes, and dairy-based specialty beverages worldwide.

Rise of plant-based alternatives cannibalizing dairy shelf space

Traditional dairy beverages are increasingly encountering significant competitive pressure from the expanding plant-based milk sector. Globally, products such as almond milk, oat milk, soy milk, and coconut milk are not only gaining widespread consumer acceptance but are also becoming essential components of modern diets. These plant-based beverages are now available in a wide range of flavors and are frequently fortified with nutrients or enriched with protein, positioning them as strong competitors to traditional dairy beverages. Marketed as "cleaner" and "healthier" alternatives, these products emphasize key benefits such as lower cholesterol levels and the absence of hormones and antibiotics, which resonate strongly with health-conscious consumers. However, it is crucial to recognize that price fluctuations tend to impact plant-based alternatives more acutely than traditional dairy products. This indicates that, despite their growing shelf presence and increasing popularity, plant-based beverages remain susceptible to economic pressures and continue to face challenges in overcoming consumer loyalty to the taste and nutritional benefits traditionally associated with dairy products.

Other drivers and restraints analyzed in the detailed report include:

- Cold-chain expansion enabling ambient yogurt drinks

- Premiumization driving artisan kefir and cultured smoothies

- Farm-gate milk price volatility squeezing processor margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Yogurt beverages held 24.11% of the dairy beverages market in 2024, driven by consumer demand for products containing live cultures. Yogurt drinks maintained their strong market position through diverse flavor offerings and their association with digestive health benefits. Their commercial momentum continues as processors introduce lactose-free versions to attract sensitive consumers. Parallel to this, kefir growth at a 6.47% CAGR outpaces the parent category, powered by medical studies linking its multispecies microbiota to gut-barrier integrity. Shelf-stable probiotic formats remove refrigeration barriers, supporting volume gains in emerging geographies where cold-chain coverage lags.

Kefir's tangy flavour profile, once considered niche, is now normalised by crossover consumers seeking sour notes similar to kombucha. The product's thicker mouthfeel enables meal-replacement positioning, creating incremental use occasions beyond refreshment. Innovation is accelerating: brands combine kefir with fruit purees, ancient grains, and plant-derived sweeteners, tapping flexitarian preferences while maintaining dairy provenance. Additionally, the dairy beverages market capitalises on these launches to defend probiotic mindshare against non-dairy ferments. As fermented SKUs proliferate, retailers allocate dedicated refrigeration bays, cementing their status as a core sub-category rather than a specialty aisle curiosity.

In 2024, whole-fat beverages accounted for 50.62% of the dairy market, reflecting a sustained preference for rich flavors and satiety. Millennials have emerged as key adopters of whole milk, challenging traditional dietary norms that previously stigmatized fats. Sensory evaluations indicate that consumers can readily detect reductions in fat content. These findings have driven manufacturers to prioritize maintaining creaminess while employing protein filtration and lactose hydrolysis to enhance nutritional value.

Meanwhile, low-fat products are projected to grow at a 5.50% CAGR by 2030, supported by advancements in stabilizers that restore texture lost during the skimming process. Innovations such as micro-filtered milk concentrate solids-not-fat are improving mouthfeel without increasing butterfat levels. The dairy beverages market addresses both ends of the fat spectrum, recognizing the diverse lifestyle preferences of consumers. By maintaining a balanced portfolio, companies can ensure market resilience, adapting to regulatory shifts that alternate between favoring low-fat guidelines and whole-food advocacy, thereby navigating ongoing nutritional debates effectively.

The Dairy Based Beverages Market Report is Segmented by Product Type (Probiotic Milk, Yogurt Drink, Kefir and Other Fermented Dairy Drinks, and Others), Fat Content (Whole/Fat, Low-Fat, and Skimmed/Non-Fat), Packaging Type (Cartons, Bottles, Pouches, Cans, and Others), Distribution Channel (Off-Trade and On-Trade), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Liters).

Geography Analysis

In 2024, Asia-Pacific holds a commanding 35.43% share of the global dairy beverages market, driven by population growth, rising incomes, and shifting consumption patterns. China and India are the primary contributors to this growth. In India, urbanization and increasing incomes support higher per capita milk consumption, highlighting the region's capacity for innovation. The rise in milk production enables the development of a diverse range of dairy beverages, including flavored milk, yogurt drinks, lassi, and chaas. According to the Ministry of Fisheries, Animal Husbandry and Dairying, India produced 239.3 million tons of milk in 2024 , ensuring a stable supply of raw materials to support large-scale processing and innovation.

The Middle East and Africa are positioned as the fastest-growing region for dairy beverages, with a projected CAGR of 7.23% from 2025 to 2030, presenting significant opportunities for market expansion. This growth is attributed to advancements in cold chain infrastructure and increasing disposable incomes across the continent. The region's dairy farming systems are undergoing transformation, characterized by trends such as the semi-intensification of production systems and the settlement of nomadic herders. However, challenges remain in milk purchasing and consumption patterns, particularly among low-income households. Despite these obstacles, with consumption levels below recommended standards, the region offers substantial growth potential as incomes rise and formal distribution channels expand.

Europe and North America, while mature markets with established consumption patterns, continue to lead in innovation, particularly in premium and functional dairy beverages. North America maintains a leading market share, supported by growing demand for functional beverages. In Europe, significant growth opportunities exist, especially in hybrid dairy products that combine dairy and plant-based ingredients. This trend reflects the increasing number of flexitarian consumers seeking to incorporate more plant-based options while retaining dairy in their diets.

- Nestle S.A.

- Arla Foods amba

- Danone S.A.

- China Mengniu Dairy Co. Ltd.

- Inner Mongolia Yili Industrial Group Co. Ltd.

- Lactalis Group

- Fonterra Co-operative Group Limited

- Morinaga Milk Industry Co., Ltd.

- Chobani LLC

- General Mills Inc.

- Yakult Honsha Co., Ltd.

- Yeo Valley Organic Limited

- National Agricultural Development Company (NADEC)

- Almarai Company

- Al Othman Holding

- Gujarat Cooperative Milk Marketing Federation

- Vinamilk

- Karnataka Cooperative Milk Producers' Federation Limited

- Clover Sonoma

- Lifeway Foods, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for high-protein functional drinks among millennials

- 4.2.2 Growth in foodservice and cafe culture

- 4.2.3 Cold-chain expansion enabling ambient yogurt drinks

- 4.2.4 Premiumization driving artisan kefir and cultured smoothies

- 4.2.5 Rising awareness of gut health fuels demand for probiotic dairy drinks

- 4.2.6 Innovation in packaging enhances consumer convenience

- 4.3 Market Restraints

- 4.3.1 Rise of plant-based alternatives cannibalizing dairy shelf space

- 4.3.2 Farm-gate milk price volatility squeezing processor margins

- 4.3.3 Shelf life and cold chain limitations

- 4.3.4 Increasing consumer concerns over lactose intolerance and dairy allergies are further restraining market growth

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Probiotic Milk

- 5.1.2 Yogurt Drink

- 5.1.3 Kefir and Other Fermented Dairy Drinks

- 5.1.4 Others

- 5.2 By Fat Content

- 5.2.1 Whole/Fat

- 5.2.2 Low-fat

- 5.2.3 Skimmed/Non-fat

- 5.3 By Packaging Type

- 5.3.1 Cartons

- 5.3.2 Bottles

- 5.3.3 Pouches

- 5.3.4 Cans

- 5.3.5 Others

- 5.4 By Distribution Channel

- 5.4.1 Off-Trade

- 5.4.1.1 Supermarkets/Hypermarkets

- 5.4.1.2 Convenience Stores

- 5.4.1.3 Specialty Stores

- 5.4.1.4 Online Retail

- 5.4.1.5 Others (Vending, Institutional)

- 5.4.2 On-Trade

- 5.4.1 Off-Trade

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Peru

- 5.5.2.5 Chile

- 5.5.2.6 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Netherlands

- 5.5.3.7 Sweden

- 5.5.3.8 Poland

- 5.5.3.9 Belgium

- 5.5.3.10 Rest of Europe

- 5.5.4 Middle East and Africa

- 5.5.4.1 Saudi Arabia

- 5.5.4.2 United Arab Emirates

- 5.5.4.3 South Africa

- 5.5.4.4 Nigeria

- 5.5.4.5 Egypt

- 5.5.4.6 Morocco

- 5.5.4.7 Turkey

- 5.5.4.8 Rest of Middle East and Africa

- 5.5.5 Asia-Pacific

- 5.5.5.1 China

- 5.5.5.2 India

- 5.5.5.3 Japan

- 5.5.5.4 South Korea

- 5.5.5.5 Australia

- 5.5.5.6 Indonesia

- 5.5.5.7 Singapore

- 5.5.5.8 Thailand

- 5.5.5.9 Rest of Asia-Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nestle S.A.

- 6.4.2 Arla Foods amba

- 6.4.3 Danone S.A.

- 6.4.4 China Mengniu Dairy Co. Ltd.

- 6.4.5 Inner Mongolia Yili Industrial Group Co. Ltd.

- 6.4.6 Lactalis Group

- 6.4.7 Fonterra Co-operative Group Limited

- 6.4.8 Morinaga Milk Industry Co., Ltd.

- 6.4.9 Chobani LLC

- 6.4.10 General Mills Inc.

- 6.4.11 Yakult Honsha Co., Ltd.

- 6.4.12 Yeo Valley Organic Limited

- 6.4.13 National Agricultural Development Company (NADEC)

- 6.4.14 Almarai Company

- 6.4.15 Al Othman Holding

- 6.4.16 Gujarat Cooperative Milk Marketing Federation

- 6.4.17 Vinamilk

- 6.4.18 Karnataka Cooperative Milk Producers' Federation Limited

- 6.4.19 Clover Sonoma

- 6.4.20 Lifeway Foods, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK