PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766221

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766221

Labeling and Coding Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

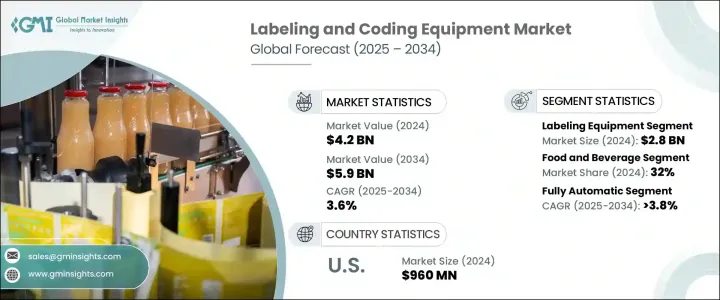

The Global Labeling and Coding Equipment Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 3.6% to reach USD 5.9 billion by 2034. The market growth is being driven by the continued expansion of e-commerce and logistics, technological advancements, and a focus on precision and quality assurance. Improvements in printing technologies, such as laser coding, thermal inkjet, and continuous inkjet printing, have significantly increased the effectiveness and accuracy of labeling processes. Furthermore, the combination of artificial intelligence (AI) and the Internet of Things (IoT) has revolutionized the industry, offering real-time monitoring, predictive maintenance, and higher levels of automation that reduce downtime and operating costs.

Labeling and coding equipment is essential in various industries such as chemicals, cosmetics, pharmaceuticals, food and beverage, agriculture, and electronics, where it is used to attach labels on containers, bottles, and vials. The market for automatic labeling machines is expanding rapidly due to the rising demand for high-speed, efficient, and automated labeling systems. These machines, capable of rejecting mislabeled products automatically, are in high demand, especially in regions such as Asia Pacific and North America, where the growing middle class and increased disposable income are driving the expansion of these industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 3.6% |

In 2024, the labeling equipment segment generated USD 2.8 billion, and it is anticipated to grow at a CAGR of 3.9% throughout 2034. A key factor behind this continued growth is the significant technological progress in labeling equipment. Innovations such as the integration of artificial intelligence (AI) and machine vision systems have significantly enhanced labeling processes. These technologies enable machines to scan labels and detect potential errors or misalignments in real-time, ensuring that labels are properly applied and that they meet regulatory standards. This level of automation not only minimizes human error but also ensures compliance with stringent industry regulations, making these machines more reliable and efficient.

The food & beverage segment held a 32% share in 2024. The demand for precise and high-speed labeling technologies is driven by the growing emphasis on compliance with food safety regulations, including the FDA's Food Safety Modernization Act (FSMA) and the European Union's labeling standards. These regulations have pushed manufacturers in the food and beverage sector to adopt advanced labeling systems, such as thermal inkjet and laser coding machines, to ensure product traceability and provide consumers with accurate information. Not only do these technologies help ensure regulatory compliance, but they also boost production efficiency. With faster printing speeds, reduced downtime, and fewer labeling errors, they play an essential role in improving the overall packaging process, thereby enhancing product turnaround times and ensuring that goods are labeled correctly and swiftly for the market.

United States Labeling and Coding Equipment Market held an 82% share and generated USD 960 million in 2024. The rapid growth of e-commerce and logistics, combined with advancements in technology, is a key driver of the U.S. labeling and coding equipment market. The logistics industry, fueled by rising customer demands, global e-commerce, and trade agreements, has seen significant growth, encouraging U.S.-based manufacturers and retailers to invest in innovative logistics solutions. This shift is enabling companies to leverage their supply chain capabilities for greater service delivery.

Some of the prominent companies operating in the Global Labeling and Coding Equipment Market include Ambrose Packaging, CVC Technologies, BellatRx, BW Integrated Systems, Markem-Imaje, Hitachi IESA, and Videojet. These companies are constantly innovating to develop more efficient and reliable labeling solutions to cater to the increasing demand from various industries. To strengthen their market position, companies in the labeling and coding equipment industry are adopting several strategies. These include a strong focus on technological advancements such as AI integration and machine vision systems, which improve the precision and speed of labeling processes. Companies are also expanding their product portfolios by offering a diverse range of customizable solutions, including advanced coding and labeling systems that cater to various industries. Furthermore, strategic partnerships and acquisitions are being used to increase market penetration and expand the geographical reach of these companies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 End use industry

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of e-commerce and logistics

- 3.2.1.2 Technological advancement

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Cybersecurity and data integrity risks

- 3.2.3 Opportunities

- 3.2.3.1 Growing demand for product traceability

- 3.2.3.2 Rising sustainability and eco-friendly packaging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Labeling equipment

- 5.2.1 Pressure-sensitive labelers

- 5.2.2 Print-and-apply labeling systems

- 5.2.3 Sleeve labelers

- 5.2.4 Others (roll-fed labelers etc.)

- 5.3 Coding equipment

- 5.3.1 Inkjet coding machine

- 5.3.2 Thermal transfer coders

- 5.3.3 Laser coders

- 5.3.4 Others (thermal inkjet printers etc.)

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates & Forecast, By Print Medium, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Primary packaging

- 7.3 Secondary packaging

- 7.4 Tertiary packaging

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Food and beverages

- 8.3 Pharmaceutical

- 8.4 Cosmetics and personal care

- 8.5 Electronics

- 8.6 Logistics and retail

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Ambrose Packaging

- 11.2 BellatRx

- 11.3 BW Integrated Systems

- 11.4 CVC Technologies

- 11.5 Domino Printing Sciences

- 11.6 HERMA

- 11.7 Hitachi IESA

- 11.8 Leibinger

- 11.9 Markem-Imaje

- 11.10 Pack Leader USA

- 11.11 PrintJet Corporation

- 11.12 ProMach

- 11.13 Sneed Coding Solutions

- 11.14 Squid Ink

- 11.15 Videojet