PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766230

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766230

Commercial and Industrial Pressure Washers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

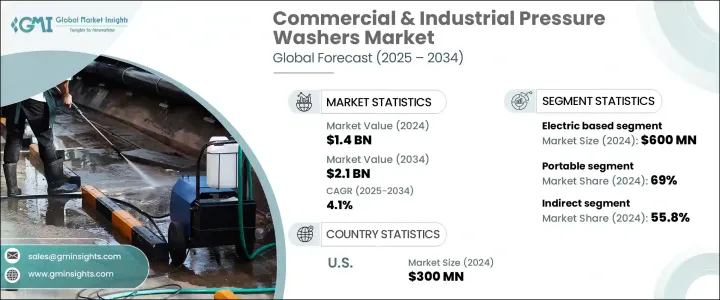

The Global Commercial and Industrial Pressure Washers Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 4.1% to reach USD 2.1 billion by 2034. A significant surge in demand is being seen across the automotive and transportation sectors, where the increasing number of vehicles worldwide has made high-pressure cleaning equipment essential. Pressure washers are becoming an integral part of maintaining the functionality and appearance of various types of vehicles. The fast-paced growth of car wash services, driven by the need for fast and consistent vehicle cleaning, is boosting the demand for advanced pressure washing systems.

Delivery services, logistics providers, and public transport fleets are now depending more on industrial-grade washers. Transportation facilities-such as airports, ports, and train stations-are increasingly utilizing these machines for maintaining hygiene in high-traffic environments. Following the global health crisis, organizations like the Centers for Disease Control and Prevention highlighted the need for thorough cleaning, further driving adoption. Additionally, the continued expansion of e-commerce and distribution networks has led to heightened usage of pressure washers in warehouses and logistics hubs. Increased environmental awareness and stricter regulations are also encouraging a shift from fuel-powered to electric and battery-powered alternatives within the industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 4.1% |

In 2024, the electric-powered pressure washers segment generated USD 600 million in 2024 and is expected to grow at a CAGR of 4.8% between 2025 and 2034. The shift toward electrification is accelerating due to growing environmental concerns, cost efficiency, and evolving compliance standards. Although gas and diesel-powered models once dominated the landscape, electric variants are gaining preference for commercial and lighter industrial applications. These electric machines are favored for use in enclosed or semi-enclosed areas due to their zero direct emissions and minimal noise levels. Facilities such as processing units, indoor cleaning operations, and institutional environments are prioritizing electric washers as they meet rigorous safety and air quality requirements. Their simplified design also reduces maintenance needs, translating into long-term savings for businesses that rely on them consistently.

Portable pressure washers segment held 69% share in 2024 and is expected to grow at a CAGR of 4.4% through 2034. Their ease of transport, compact design, and adaptability make them highly appealing across multiple sectors. Equipped with wheels or handles, these units offer mobility that enhances productivity for maintenance teams, cleaning crews, and service providers. Whether moving across large facilities or between job sites, portable washers offer a high level of convenience. Their flexible nature makes them an ideal fit for professionals operating in industries like property management, hospitality, retail, and equipment maintenance.

North America Commercial and Industrial Pressure Washers Market is also witnessing robust growth. The United States was valued at USD 300 million in 2024 and is expected to grow at a CAGR of 4.8% between 2025 and 2034. Demand across the region is driven by increasing activity in the construction, automotive, and logistics sectors-all of which require reliable and frequent cleaning solutions. Strict hygiene regulations within sectors like healthcare and food processing further amplify this demand. The presence of established facilities management and professional cleaning firms enhances market traction. The US, in particular, benefits from a solid industrial base and the adoption of advanced, sustainable cleaning technologies.

Leading players shaping the competitive landscape of the Commercial and Industrial Pressure Washers Market include Simpson Cleaning, Pressure-Pro, MTM Hydro, Stanley Black & Decker, Honda Power Equipment, Bosch, Nilfisk, Ryobi, Generac Power Systems, Karcher, Sun Joe, Be Pressure, Hotsy, Craftsman, and Troy-Bilt. Companies operating in the commercial and industrial pressure washer industry are deploying a range of strategies to solidify their market positions. One major focus is innovation-brands are increasingly investing in the development of eco-friendly and energy-efficient pressure washer models to align with regulatory trends and consumer expectations. Many are expanding their product lines to include battery-powered and electric units that reduce operational costs and emissions. Strategic partnerships with distribution networks and e-commerce platforms are helping businesses reach a broader customer base. In addition, brands are concentrating on enhancing after-sales services and customer support to improve loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Type

- 2.2.4 Component

- 2.2.5 Water operation

- 2.2.6 PSI pressure

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for facility maintenance

- 3.2.1.2 Expansion of the automotive and transportation sectors

- 3.2.1.3 Rising construction & manufacturing activities

- 3.2.1.4 Stringent government regulations on cleanliness

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial and maintenance cost

- 3.2.2.2 Water and power consumption issues

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Electric-based

- 5.3 Gas-based

- 5.4 Fuel-based

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Portable

- 6.3 Non-portable

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Water pump

- 7.3 Electric motor/gas engine

- 7.4 High-pressure hose

- 7.5 Nozzle

Chapter 8 Market Estimates & Forecast, By Water Operation, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Hot water

- 8.3 Cold water

Chapter 9 Market Estimates & Forecast, By PSI Pressure, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends 0- 1500 PSI

- 9.2 1501-3000 PSI

- 9.3 3001-4000 PSI

- 9.4 ABOVE 4000 PSI

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Commercial

- 10.3 Industrial

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 Saudi Arabia

- 12.6.2 UAE

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 Be Pressure

- 13.2 Bosch

- 13.3 Craftsman

- 13.4 Generac Power Systems

- 13.5 Hotsy

- 13.6 Honda Power Equipment

- 13.7 Karcher

- 13.8 MTM Hydro

- 13.9 Nilfisk

- 13.10 Pressure-Pro

- 13.11 Ryobi

- 13.12 Simpson Cleaning

- 13.13 Stanley Black & Decker

- 13.14 Sun Joe

- 13.15 Troy-Bilt