PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892879

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892879

Pressure Washer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

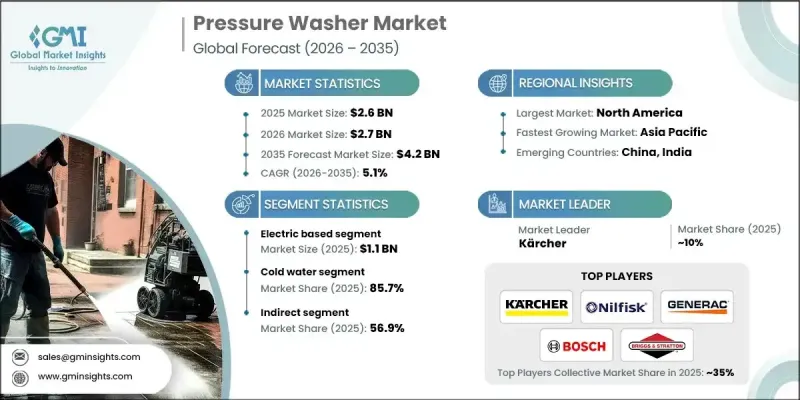

The Global Pressure Washer Market was valued at USD 2.6 billion in 2025 and is estimated to grow at a CAGR of 5.1% to reach USD 4.2 billion by 2035.

The expanding preference for handling household cleaning and maintenance tasks independently is one of the strongest contributors to market growth. Homeowners are increasingly taking on projects such as cleaning outdoor areas, vehicles, and home exteriors to save costs, gain greater control over their surroundings, and enjoy the personal satisfaction that comes with maintaining their living spaces. This shift has driven strong demand for compact, budget-friendly, and user-oriented pressure washer models, which have become a standard component of many households. Simultaneously, rapid urban expansion and ongoing infrastructure development continue to generate steady demand across commercial and industrial settings. Growing cities require regular upkeep of public spaces and construction environments, fueling interest in high-capacity equipment built for durability and constant use. As urban projects become more frequent and widespread, the need for efficient cleaning systems is set to rise steadily throughout the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.6 Billion |

| Forecast Value | $4.2 Billion |

| CAGR | 5.1% |

The electric-based segment reached USD 1.1 billion in 2025 and is forecast to grow at a CAGR of 5.4% through 2035. Electric models remain a leading choice due to their cost efficiency, low maintenance needs, and ease of operation. They are widely adopted for everyday residential tasks ranging from patio cleaning to vehicle washing. Increasing environmental awareness and global initiatives aimed at lowering emissions have further boosted the appeal of electric pressure washers, as their designs align with sustainable usage goals.

The cold-water category accounted for an 85.7% share in 2025 and is expected to grow at a CAGR of 5% between 2026 and 2035. These systems dominate because of their affordability, lightweight structure, and suitability for routine household cleaning. Their energy-efficient nature and convenient availability through retail and online channels reinforce their status as the preferred option for DIY users. While hot-water systems remain important in heavy-duty industrial settings, cold-water units continue to lead due to their accessibility and versatility.

U.S. Pressure Washer Market generated USD 500 million in 2025 and is predicted to grow at a CAGR of 5.9% from 2026 to 2035. The country's well-established market benefits from strong uptake across residential, commercial, and industrial sectors. Household improvement trends and a robust DIY culture contribute to consistent sales of electric units. At the same time, sectors such as agriculture, construction, and automotive rely on durable gas-powered models to meet operational demands. Growing online sales, evolving consumer expectations, and rapid product innovation continue to shape purchasing decisions across the region.

Key companies in the Pressure Washer Market include Be Pressure, Bosch, Craftsman, Generac Power Systems, Hotsy, Honda Power Equipment, Karcher, MTM Hydro, Nilfisk, Pressure-Pro, Ryobi, Simpson Cleaning, Stanley Black & Decker, Sun Joe, and Troy-Bilt. Companies in the Global Pressure Washer Market are employing multiple strategies to strengthen their competitive stance. Many are broadening their product portfolios by introducing models with improved energy efficiency, enhanced ergonomics, and advanced safety features, appealing to both residential and professional users. Firms are also expanding their presence in e-commerce channels to improve accessibility and reach a broader audience. Strategic collaborations with retailers and distributors help accelerate market penetration, especially in emerging regions. Manufacturers are investing in sustainability-focused design and electric-powered technologies to meet stricter environmental expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Type

- 2.2.4 Component

- 2.2.5 Water operation

- 2.2.6 PSI pressure

- 2.2.7 Application

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for DIY home improvement

- 3.2.1.2 Rising urbanization and infrastructure development

- 3.2.1.3 Advancements in technology

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 High initial investment for gas-based models

- 3.2.2.2 Limited awareness in emerging markets

- 3.2.3 Opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Growth of eco-friendly and energy-efficient models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS Code - 8424)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Electric based

- 5.3 Gas based

- 5.4 Fuel based

Chapter 6 Market Estimates & Forecast, By Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Portable

- 6.3 Non-portable

Chapter 7 Market Estimates & Forecast, By Component, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Water pump

- 7.3 Electric motor/gas engine

- 7.4 High pressure hose

- 7.5 Nozzle

Chapter 8 Market Estimates & Forecast, By Water Operation, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Hot water

- 8.3 Cold water

Chapter 9 Market Estimates & Forecast, By PSI Pressure, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 0-1500 PSI

- 9.3 1501-3000 PSI

- 9.4 3001-4000 PSI

- 9.5 ABOVE 4000 PSI

Chapter 10 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Car washer

- 10.3 Garden washer

- 10.4 Home exterior washer

- 10.5 Industrial

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 Saudi Arabia

- 12.6.2 UAE

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 Be Pressure

- 13.2 Bosch

- 13.3 Craftsman

- 13.4 Generac Power Systems

- 13.5 Hotsy

- 13.6 Honda Power Equipment

- 13.7 Karcher

- 13.8 MTM Hydro

- 13.9 Nilfisk

- 13.10 Pressure-Pro

- 13.11 Ryobi

- 13.12 Simpson Cleaning

- 13.13 Stanley Black & Decker

- 13.14 Sun Joe

- 13.15 Troy-Bilt