PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766240

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766240

Europe Electric Commercial Vehicle Battery Pack Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

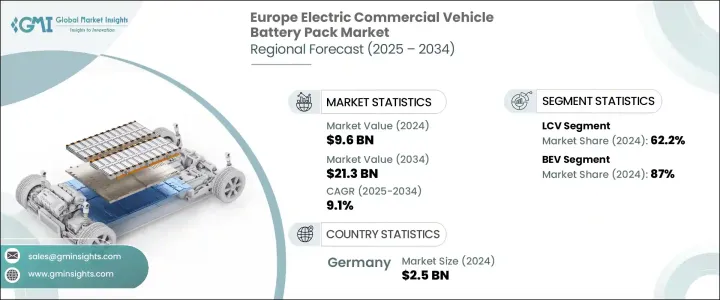

Europe Electric Commercial Vehicle Battery Pack Market was valued at USD 9.6 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 21.3 billion by 2034. This growth is primarily supported by surging e-commerce activity and increasing urban last-mile delivery demands across the region. As more delivery networks electrify their fleets to meet stricter emission regulations and consumer expectations for eco-friendly services, demand for efficient and durable battery packs has significantly increased. Battery pack performance, fast-charging capability, and long-cycle durability are top priorities, particularly for vehicles operating in urban environments where downtime can reduce service efficiency.

In response to this, European OEMs and fleet operators are moving toward standardized, modular battery solutions that fit various commercial vehicle types. The use of flexible battery platforms helps streamline maintenance, enables quick upgrades, and lowers overall operating costs. In addition, new regulations under the EU Battery Regulation mandate sustainable and transparent sourcing of battery components, pushing buyers to favor packs with traceable raw materials, lower emissions, and improved recyclability-ultimately influencing procurement standards across Europe.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.6 Billion |

| Forecast Value | $21.3 Billion |

| CAGR | 9.1% |

In 2024, light commercial vehicles (LCVs) led the regional battery pack market with a 62.2% share and are projected to grow at 9.8% CAGR throughout 2034. LCVs remain the vehicle of choice for inner-city delivery, parcel logistics, and public services due to their size, mobility, and optimal payload design. Battery packs engineered for these vehicles typically fall between 40 kWh and 100 kWh, delivering sufficient range, high energy efficiency, and compatibility with fast-charging infrastructure. These configurations support the operational needs of short-distance, high-frequency applications without compromising affordability or performance. The LCV market's steady growth continues to be supported by scalable electrification solutions and the increasing use of digital platforms for route and fleet optimization.

Battery electric vehicles (BEVs) represented the dominant vehicle type in 2024, capturing an 87% share of the Europe electric commercial vehicle battery pack market. The segment is forecast to maintain strong momentum, growing at 9.6% CAGR through 2034. BEVs, which operate without hybrid support, rely solely on electric drivetrains, making battery packs their most critical component. These high-capacity packs are optimized for long-range use and are built to withstand intensive urban and regional delivery cycles. BEV adoption is fueled by continued improvements in lithium-ion battery technology, enhanced energy density, and decreasing costs per kilowatt-hour. Designed for high-discharge and fast-charging operations, BEV battery packs are ideal for electric vans, trucks, and buses operating on dense logistics routes or in urban transit systems, where vehicle uptime and emissions compliance are paramount.

Germany Electric Commercial Vehicle Battery Pack Market held a 56.3% share and generated USD 2.5 billion in 2024. This leadership stems from Germany's mature automotive production infrastructure, well-established research and development ecosystem, and aggressive policies promoting sustainable transport solutions. As one of the central manufacturing and R&D hubs for electric commercial vehicles in Europe, Germany plays a critical role in shaping regional innovation and battery pack deployment. Key German companies, including Varta AG, BMW's battery division, and MAN, are heavily investing in the development of next-gen battery chemistries and modular energy storage platforms to serve light, medium, and heavy-duty electric vehicles. These firms are also pursuing vertical integration strategies to enhance control over component supply chains and improve energy performance across commercial applications.

Key players in the Europe Electric Commercial Vehicle Battery Pack Market include Samsung, Panasonic, LG, Toshiba, Northvolt, Varta AG, SAIC, BYD, CATL, and Leclanche SA. Companies in the Europe electric commercial vehicle battery pack sector are strengthening their market positions through innovation, partnerships, and vertical integration.

Key players are investing in modular battery platforms to offer scalable solutions for light to heavy commercial vehicles. Several firms are expanding local battery cell manufacturing and establishing joint ventures with OEMs to secure long-term supply contracts. R&D investment is focused on enhancing energy density, improving lifecycle performance, and lowering the cost per kWh. Many are also aligning with EU regulations by adopting circular economy practices, such as recycling initiatives and material traceability.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Propulsion

- 2.2.4 Battery Chemistry

- 2.2.5 Battery Capacity

- 2.2.6 Battery Form Factor

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing e-commerce and urban delivery demand

- 3.2.1.2 Expansion of charging infrastructure

- 3.2.1.3 Rise in battery gigafactories in Europe

- 3.2.1.4 Advancements in LFP and high-density NMC chemistries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Cold climate performance issues

- 3.2.2.2 High upfront costs

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of advanced battery management systems

- 3.2.3.2 Growing focus on localized battery production and recycling

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 LCV

- 5.3 MCV

- 5.4 HCV

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 BEV

- 6.3 PHEV

Chapter 7 Market Estimates & Forecast, By Battery Chemistry, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 LFP (Lithium Iron Phosphate)

- 7.3 NCA (Nickel Cobalt Aluminum)

- 7.4 NMC (Nickel Manganese Cobalt)

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Battery Capacity, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Below 50 kWh

- 8.3 50–150 kWh

- 8.4 Above 150 kWh

Chapter 9 Market Estimates & Forecast, By Battery Form Factor, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Prismatic cells

- 9.3 Pouch cells

- 9.4 Cylindrical cells

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Western Europe

- 10.2.1 Germany

- 10.2.2 Austria

- 10.2.3 France

- 10.2.4 Switzerland

- 10.2.5 Belgium

- 10.2.6 Luxembourg

- 10.2.7 Netherlands

- 10.2.8 Portugal

- 10.3 Eastern Europe

- 10.3.1 Poland

- 10.3.2 Romania

- 10.3.3 Czechia

- 10.3.4 Slovenia

- 10.3.5 Hungary

- 10.3.6 Bulgaria

- 10.3.7 Slovakia

- 10.3.8 Croatia

- 10.4 Northern Europe

- 10.4.1 UK

- 10.4.2 Denmark

- 10.4.3 Sweden

- 10.4.4 Finland

- 10.4.5 Norway

- 10.5 Southern Europe

- 10.5.1 Italy

- 10.5.2 Spain

- 10.5.3 Greece

- 10.5.4 Bosnia and Herzegovina

- 10.5.5 Albania

Chapter 11 Company Profiles

- 11.1 Akasol

- 11.2 Automotive Cells Company (ACC)

- 11.3 BMZ Group

- 11.4 BYD

- 11.5 CATL

- 11.6 Draxlmaier

- 11.7 INTILION

- 11.8 Leclanche SA

- 11.9 LG

- 11.10 Microvast Holdings

- 11.11 Northvolt

- 11.12 Panasonic

- 11.13 ProLogium

- 11.14 SAIC

- 11.15 Samsung

- 11.16 Super B Lithium Power

- 11.17 SVOLT Energy Technology

- 11.18 Toshiba

- 11.19 Valeo

- 11.20 Varta AG