PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766253

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766253

Quick-change Tooling System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

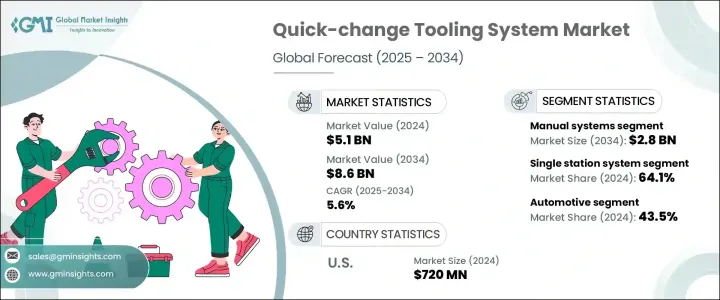

The Global Quick-change Tooling System Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 8.6 billion by 2034. The rise in demand for manufacturing flexibility, operational speed, reduced setup times, and overall productivity is pushing companies across the automotive, aerospace, electronics, and medical device sectors to invest in quicker, more responsive tooling solutions. These industries face increasing pressure to streamline operations and reduce downtime while meeting evolving production goals.

Quick-change tooling systems allow faster tool replacements and significantly cut changeover durations, helping maintain consistent output levels. Their widespread use in CNC centers, molding units, stamping facilities, and other precision-driven environments underscores their value in smart manufacturing. As Industry 4.0 gains momentum, next-generation systems now integrate IoT and sensor technologies to enable real-time insights into tool performance, wear, and change intervals, allowing more predictive and data-driven operations. This growing shift toward automation and real-time monitoring is setting the stage for innovation and continuous improvement in tooling infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8.6 Billion |

| CAGR | 5.6% |

Manual quick-change systems led the market in 2024 with a valuation of USD 1.9 billion and are projected to hit USD 2.8 billion by 2034. Their popularity stems from easy integration with existing machinery, cost efficiency, and minimal training requirements. These systems remain ideal for operations that do not depend heavily on high-speed automation, offering a practical solution for small and medium businesses. They're also favored in segments like woodworking, plastic molding, and metal fabrication, where versatility and simplicity matter. The ability to function effectively in legacy machines further enhances their relevance in regions where modernization is slower and infrastructure investments are limited.

In 2024, the single-station tooling systems segment held a 64.1% share and is forecasted to grow at a CAGR of 5% through 2034. These systems are especially effective in applications requiring tool changes at fixed points, such as with individual CNC units or lathes. Their affordability, minimal setup complexity, and easy maintenance make them well-suited for mid-sized enterprises across manufacturing sectors. The use of these systems is prominent in industries like fabrication, plastics, and precision metalwork, which benefit from targeted and standalone machine applications.

United States Quick-change Tooling System Market was valued at USD 720 million in 2024 and is anticipated to grow at a CAGR of 6.1% between 2025 and 2034. The region's robust automotive, aerospace, and defense manufacturing sectors are major drivers of adoption. As manufacturers emphasize speed, customization, and lean production methods, there has been a notable shift toward automation-ready tooling systems. The U.S. benefits from a sophisticated industrial environment supported by skilled labor, cutting-edge R&D capabilities, and a strong demand for innovation. This combination supports rapid turnaround and tailored tooling applications, increasing demand for both manual and automated quick-change solutions.

Leading companies in the Quick-change Tooling System Industry include AMETEK, Inc., Nachi-Fujikoshi Corp, Illinois Tool Works Inc. (ITW), THK Co., Ltd., and Kennametal Inc. To reinforce their market positions, companies are investing in innovation by developing modular and scalable tooling systems that offer greater compatibility with automated machinery. Many are forming strategic alliances with OEMs and machine manufacturers to integrate their technologies directly into new production equipment. Firms are also enhancing product lines with IoT-enabled features for remote diagnostics and real-time monitoring. Continuous upgrades, focus on ergonomic designs and expansion into emerging economies are helping key players stay competitive while meeting demand for fast, flexible, and efficient tooling solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Operation mode

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Manual systems

- 5.3 Automatic systems

- 5.4 Hydraulic systems

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Operation mode, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Single-station systems

- 6.3 Multi-station systems

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Injection molding

- 7.3 Stamping & press tools

- 7.4 Robotic tooling

- 7.5 Welding systems

- 7.6 Assembly lines

- 7.7 Packaging machines

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace and defense

- 8.4 Consumer electronics

- 8.5 Medical devices

- 8.6 Packaging

- 8.7 Industrial machinery

- 8.8 Plastics and rubber

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 UAE

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AMETEK, Inc.

- 11.2 BIG DAISHOWA

- 11.3 Destaco

- 11.4 Diebold Goldring-Werkzeugfabrik

- 11.5 Erowa AG

- 11.6 Illinois Tool Works Inc. (ITW)

- 11.7 Jergens Inc.

- 11.8 Kennametal Inc. Co., Ltd

- 11.9 LANG Technik GmbH

- 11.10 Mate Precision Technologies

- 11.11 Nachi-Fujikoshi Corp

- 11.12 Rohm GmbH

- 11.13 SCHUNK GmbH & Co. KG

- 11.14 SMW Autoblok

- 11.15 THK Co., Ltd.