PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766258

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766258

Automotive Data Monetization Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

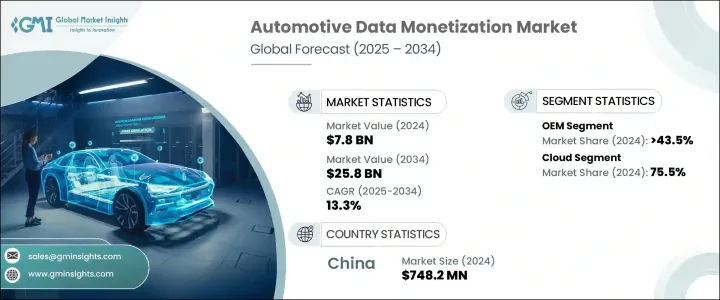

The Global Automotive Data Monetization Market was valued at USD 7.8 billion in 2024 and is estimated to grow at a CAGR of 13.3% to reach USD 25.8 billion by 2034. The growth in the market is primarily driven by the widespread adoption of connected vehicles. These vehicles generate vast amounts of real-time data through embedded sensors, telematics, and communication systems. Data gathered from connected cars, including driving behavior, environmental conditions, location, and even driver health, creates opportunities for automotive manufacturers, insurance providers, fleet operators, and service providers to develop new data-driven business models.

By leveraging cloud-based platforms and advanced analytics, the ability to process, analyze, and monetize vehicle data in near real-time has become increasingly essential. Government regulations and infrastructure developments are also contributing to the increasing demand for data transparency and the integration of vehicles with public systems. Additionally, advanced technologies, such as predictive maintenance, telematics-based insurance, and infotainment services, are enabling companies to unlock new revenue streams from automotive data.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.8 Billion |

| Forecast Value | $25.8 Billion |

| CAGR | 13.3% |

In 2024, the OEM (Original Equipment Manufacturer) segment held a dominant position in the market, valued at USD 3 billion and accounting for a 43.5% share. OEMs are key players in collecting and managing data from connected vehicles, as they integrate technologies that provide direct access to data on engine performance, user preferences, and vehicle diagnostics. By controlling and managing data flow, OEMs are in a unique position to offer personalized services such as subscription-based features, real-time infotainment, and predictive maintenance solutions. Additionally, OEMs are increasingly investing in their cloud platforms to manage data internally or collaborate with other businesses, maintaining strict control over data governance.

The cloud segment held a 75.5% share in 2024. Cloud platforms help in the automotive data monetization ecosystem, as they enable OEMs and service providers to scale storage and processing capabilities, crucial for managing massive volumes of real-time data generated by connected vehicles. These platforms support various services, including predictive maintenance, usage-based insurance (UBI), and mobility management, by enabling real-time analytics and machine learning models. The cloud infrastructure also reduces the need for expensive on-premises IT systems, offering a more cost-effective solution for data management and allowing companies to pay only for what they use. This has made the cloud an increasingly popular choice among businesses seeking efficient, scalable, and affordable solutions for data monetization.

Asia Pacific Automotive Data Monetization Industry held a 35% share and generated USD 748.2 million in 2024. China's rapid adoption of 5G networks and advancements in the Internet of Things (IoT) ecosystem have helped in driving the demand for connected vehicle services, including telematics and vehicle-to-everything (V2X) communication. Domestic vehicle manufacturers in China are investing heavily in cloud services, in-car artificial intelligence, and digital services platforms, which are fueling the growth of data-driven business models. Chinese consumers are more receptive to digital automotive products and services, enabling greater acceptance of connected car technologies and data monetization strategies.

Key players in the Global Automotive Data Monetization Industry include Bosch, IBM, Caruso GmbH, Continental, Airlinq Inc., Cox Automotive, Geotab, Harman International, Oracle, and Urgent.ly Inc (Otonomo). To strengthen their market position, companies in the automotive data monetization sector are focusing on expanding their partnerships with OEMs, insurance firms, and service providers. This approach enhances their ability to offer comprehensive, data-driven solutions. Additionally, many companies are investing in building robust cloud-based platforms to offer scalable and cost-efficient data management services. Emphasizing advanced analytics and machine learning capabilities, these firms aim to provide more valuable insights and predictive features to their clients. Furthermore, companies are developing tailored solutions for specific regions, leveraging local infrastructure, regulations, and customer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.5 Forecast model

- 1.6 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Deployment

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Proliferation of connected vehicles

- 3.2.1.2 Growth in predictive maintenance

- 3.2.1.3 Expansion of fleet and mobility services

- 3.2.1.4 Government regulations and smart infrastructure

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Data privacy and security concerns

- 3.2.2.2 Lack of standardization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Direct monetization

- 5.3 Indirect monetization

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Insurance

- 7.3 Predictive maintenance

- 7.4 Fleet management

- 7.5 Mobility-as-a-service (MaaS)

- 7.6 Government & infrastructure

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Fleet operators

- 8.4 Third-party service providers

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Airlinq

- 10.2 Bosch

- 10.3 Caruso

- 10.4 Continental

- 10.5 Cox Automotive

- 10.6 Geotab

- 10.7 Harman

- 10.8 High Mobility

- 10.9 IBM

- 10.10 INRIX

- 10.11 Lear

- 10.12 Masternaut

- 10.13 Motorq

- 10.14 Nexar

- 10.15 Octo Telematics

- 10.16 Oracle

- 10.17 The Floow

- 10.18 Urgent.ly (Otonomo)

- 10.19 Vinchain

- 10.20 Vinli