PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871180

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871180

Automotive Data Logging and Analytics Hardware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

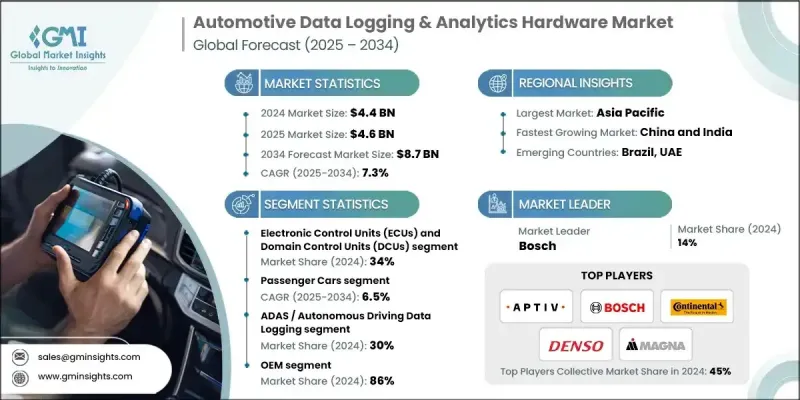

The Global Automotive Data Logging & Analytics Hardware Market was valued at USD 4.4 Billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 8.7 Billion by 2034.

The automotive industry is undergoing a fundamental transformation driven by vehicle electrification, automation, and connected mobility. At the core of this evolution lies the increasing reliance on data logging and analytics hardware, which is essential for enhancing performance, ensuring compliance, and improving vehicle safety. Governments worldwide are enforcing stricter regulations that require data logging systems in vehicles to ensure transparency and traceability. The transition toward software-defined vehicles (SDVs) is reshaping the demand for hardware capable of handling over-the-air updates, lifecycle management, and real-time telemetry. Compliance with global safety and cybersecurity standards, such as UNECE Regulations R155 and R156, is compelling automakers to adopt secure, high-performance data recording platforms. The rapid adoption of AI and edge computing in modern vehicles allows for faster local processing of sensor-generated data. Advanced data logging systems are now expected to capture terabytes of information daily while maintaining network throughput exceeding 1.2 GB/s and precise synchronization across more than 30 channels, reinforcing their critical role in the automotive ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 7.3% |

The Electronic Control Units (ECUs) and Domain Control Units (DCUs) segment held a share of 34% in 2024. Automotive design is increasingly shifting from distributed ECUs to centralized domain architectures that enable advanced integration of data logging features. These systems are required to manage multiple communication protocols, ensure data protection, and process information rapidly. The adoption of cybersecurity frameworks under global standards is encouraging the implementation of ECUs equipped with secure hardware modules, tamper-resistant logging, and authenticated system booting to ensure data integrity.

The ADAS and Autonomous Driving Data Logging segment accounted for a 30% share in 2024. The growing integration of advanced sensors and real-time computing in next-generation vehicles is accelerating demand for sophisticated data logging solutions. The continuous evolution of autonomous and semi-autonomous technologies necessitates high-speed, multi-channel data capture across radar, LiDAR, and camera systems simultaneously. This enables accurate analysis and validation of automated driving algorithms, supporting ongoing innovation in vehicle safety and autonomy.

China Automotive Data Logging & Analytics Hardware Market generated a significant share in 2024, owing to its extensive automotive production base and strong emphasis on intelligent connectivity. Government-led initiatives promoting intelligent and connected vehicle technologies have reinforced standards for real-time vehicle data collection and centralized management. Policies under the national intelligent vehicle development strategy accelerate the deployment of advanced logging hardware, ensuring safety compliance, automation, and data traceability across fleets.

Key companies shaping the Global Automotive Data Logging & Analytics Hardware Market include Continental, Denso, ZF Friedrichshafen, Aptiv, Hyundai Mobis, Lear, Bosch, Magna, Valeo, and Vector Informatik. Leading companies in the Automotive Data Logging & Analytics Hardware Market are focusing on innovation, partnerships, and product diversification to strengthen their market position. Many are investing in developing high-speed, AI-enabled hardware solutions capable of managing complex data streams generated by autonomous and connected vehicles. Strategic collaborations with automakers and technology providers are fostering advancements in real-time analytics, cybersecurity, and edge processing. Companies are also enhancing their R&D capabilities to design modular, scalable hardware compatible with evolving software-defined vehicle architectures.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of ADAS and autonomous driving systems

- 3.2.1.2 Expansion of electric vehicles (EVs) and battery management systems

- 3.2.1.3 Growing fleet digitization and predictive maintenance

- 3.2.1.4 Software-defined vehicle (SDV) adoption

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced logging hardware

- 3.2.2.2 Complexity in hardware-software integration

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of connected vehicle infrastructure

- 3.2.3.2 Growth of aftermarket retrofit solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability & environmental aspects

- 3.9.1 Carbon footprint assessment

- 3.9.2 Circular economy integration

- 3.9.3 E-Waste management requirements

- 3.9.4 Green manufacturing initiatives

- 3.10 Use cases and applications

- 3.11 Best-case scenario

- 3.12 Pricing analysis & trends

- 3.12.1 Historical price evolution (2019-2024)

- 3.12.2 Component price inflation impact

- 3.12.3 Semiconductor shortage cost impact

- 3.12.4 Volume pricing strategies

- 3.12.5 Regional price variations

- 3.12.6 Future price projections (2025-2034)

- 3.13 Global trade analysis

- 3.13.1 Import/Export volume & value analysis

- 3.13.2 Major exporting countries

- 3.13.3 Major importing markets

- 3.13.4 Trade flow patterns & dependencies

- 3.13.5 Tariff impact analysis

- 3.13.6 Supply chain disruption effects

- 3.14 Raw Material & component analysis

- 3.14.1 Semiconductor material requirements

- 3.14.2 Rare earth elements dependency

- 3.14.3 Plastic & metal housing materials

- 3.14.4 Battery & power management components

- 3.14.5 Material price volatility impact

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Electronic Control Units (ECUs) and Domain Control Units (DCUs)

- 5.3 Telematics Control Units (TCUs) and Connectivity Hardware

- 5.4 Sensor Interface and Data Acquisition Hardware

- 5.5 Gateway and network hardware

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger Cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial Vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 ADAS / Autonomous Driving Data Logging

- 7.3 Fleet management and telematics

- 7.4 EV battery management

- 7.5 Software-Defined Vehicle (SDV) Support

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Aptiv

- 10.1.2 Bosch

- 10.1.3 Continental

- 10.1.4 Denso

- 10.1.5 Harman International (Samsung)

- 10.1.6 Lear

- 10.1.7 Magna

- 10.1.8 Panasonic Automotive Systems

- 10.1.9 Valeo

- 10.1.10 ZF Friedrichshafen

- 10.2 Regional Players

- 10.2.1 Geotab

- 10.2.2 Vector Informatik

- 10.2.3 Verizon Connect

- 10.2.4 Webfleet Solutions

- 10.3 Technology Specialists & Emerging Players

- 10.3.1 Intrepid Control Systems

- 10.3.2 IPETRONIK

- 10.3.3 National Instruments

- 10.3.4 Samsara

- 10.3.5 Spireon

- 10.3.6 Trimble

- 10.4 Asian Market Leaders

- 10.4.1 BYD Electronic

- 10.4.2 Huawei Technologies

- 10.4.3 Hyundai Mobis

- 10.4.4 LG Electronics

- 10.4.5 Pioneer

- 10.5 Fleet Management Specialists

- 10.5.1 Azuga

- 10.5.2 Fleet Complete

- 10.5.3 Omnitracs