PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766259

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766259

Form-Fill-Seal (FFS) Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

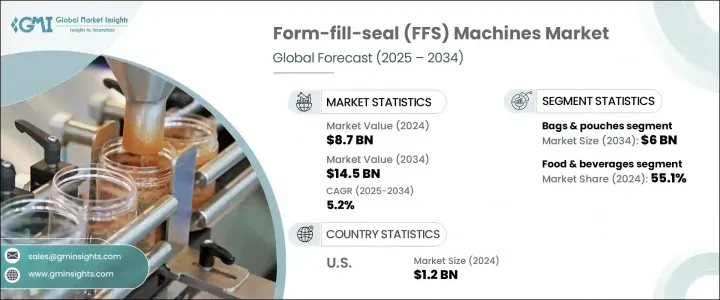

The Global Form-Fill-Seal Machines Market was valued at USD 8.7 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 14.5 billion by 2034. This growth is largely propelled by increasing regulatory pressure to phase out environmentally harmful materials and move toward sustainable packaging alternatives. FFS machines are evolving to process recyclable and biodegradable materials, aligning with global efforts to curb plastic waste. As regulations tighten and environmental awareness rises, companies are responding with investments in upgraded FFS technology to remain compliant and enhance their sustainability credentials. In addition to environmental compliance, the rise in automation is playing a major role in boosting the demand for FFS systems.

Packaging operations, especially in the food, pharmaceutical, and consumer goods industries, are becoming increasingly reliant on FFS solutions to improve output, minimize labor costs, and ensure product safety. These machines offer long-term value by increasing speed, accuracy, and consistency in packaging while reducing human error. Manufacturers continue to favor FFS systems due to their adaptability and ability to handle high-volume packaging with strict hygiene requirements, particularly in sectors where shelf life, tamper resistance, and product integrity are paramount.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.7 billion |

| Forecast Value | $14.5 billion |

| CAGR | 5.2% |

The bags and pouches segment held a 39.1% share and is estimated to generate USD 6 billion by 2034. The rising consumption of ready-to-eat foods and beverages is fueling demand for flexible, portable, and hygienic packaging solutions. The expansion of health-focused food markets is pushing manufacturers to adopt packaging technologies that help preserve freshness and product quality. As form-fill-seal systems advance, they now support innovations such as controlled atmosphere sealing and airtight barriers, helping to extend shelf life. The growing need for packaging that meets environmental standards has also led to the use of compostable and biodegradable substrates, further reinforcing the shift toward sustainable FFS technologies.

The food & beverage segment held a 55.1% share in 2024 and is expected to maintain its dominance throughout the forecast period. FFS machines are increasingly used to package solids, powders, and liquids into a wide range of pouch types, including flat, stand-up, and spouted variations. The versatility of FFS systems allows them to handle a wide spectrum of product formats using eco-conscious films. The rising influence of e-commerce and the growing demand for lightweight, protective, and customizable packaging have made FFS machines the go-to solution for many manufacturers aiming to cut down on material use without compromising quality or performance.

United States Form-Fill-Seal Machines Market generated USD 1.2 billion in 2024 and is forecast to grow at a CAGR of 5.4% through 2034. Rapid developments in the food, pharmaceutical, and personal care sectors are fueling the demand for flexible, high-performance packaging. The shift in consumer preference toward eco-friendly solutions is pushing companies in the U.S. to invest in next-generation FFS equipment that can deliver speed, compliance, and sustainability.

Prominent companies active in the Global Form-Fill-Seal Machines Market include ULMA Packaging, ProMach, All-Fill Inc., Bosch Packaging Technology, WeighPack Systems Inc., Coesia Group, Matrix Packaging Machinery, Barry-Wehmiller Group, PFM Packaging, Ilapak, Syntegon, Triangle Package Machinery Co., Bossar Packaging, IMA Group, and BW Flexible Systems. Leading manufacturers are advancing their product lines by incorporating automation, AI-powered controls, and IoT capabilities to improve speed, precision, and machine performance.

Many are investing in research to develop machines compatible with compostable and recyclable materials, helping customers align with global sustainability standards. Strategic alliances, mergers, and acquisitions are being pursued to expand geographical presence and strengthen distribution channels. Customization is another core strategy, with companies designing FFS systems tailored to unique product types and packaging formats. These efforts allow brands to offer versatile, scalable solutions to meet evolving industry requirements while staying ahead in a highly competitive market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 End use industry

- 2.2.4 Packaging type

- 2.2.5 Material type

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machine type

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034, (USD Billion)(Thousand Units)

- 5.1 Key trends

- 5.2 Horizontal ffs machines

- 5.3 Vertical ffs machines

- 5.4 Thermoform ffs machines

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021 - 2034, (USD Billion)(Thousand Units)

- 6.1 Key trends

- 6.2 Bags & pouches

- 6.3 Cups & trays

- 6.4 Bottles

- 6.5 Sachets

- 6.6 Cartons

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion)(Thousand Units)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals

- 7.4 Cosmetics & personal care

- 7.5 Chemicals

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Material Type, 2021 - 2034, (USD Billion)(Thousand Units)

- 8.1 Key trends

- 8.2 Plastic

- 8.3 Paper

- 8.4 Aluminum foil

- 8.5 Multi-layer films

- 8.6 Biodegradable materials

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion)(Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion)(Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 All-Fill Inc.

- 11.2 Barry-Wehmiller Group

- 11.3 Bosch Packaging Technology

- 11.4 Bossar Packaging

- 11.5 BW Flexible Systems

- 11.6 Coesia Group

- 11.7 Ilapak

- 11.8 IMA Group

- 11.9 Matrix Packaging Machinery

- 11.10 PFM Packaging

- 11.11 ProMach

- 11.12 Syntegon

- 11.13 Triangle Package Machinery Co.

- 11.14 ULMA Packaging

- 11.15 WeighPack Systems Inc.