PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766274

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766274

Bioactive Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

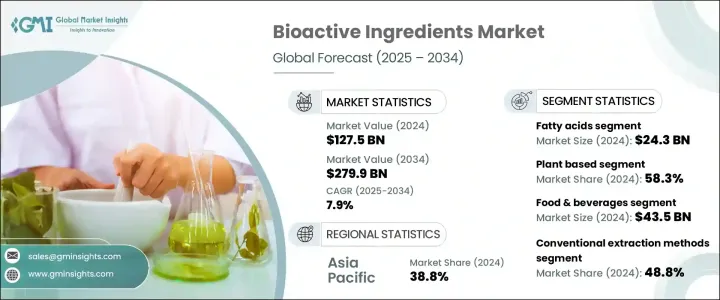

The Global Bioactive Ingredients Market was valued at USD 127.5 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 279.9 billion by 2034. Bioactive ingredients are naturally occurring compounds found in foods, supplements, and personal care products that offer health benefits beyond basic nutrition. These include polyphenols, probiotics, omega-3 fatty acids, plant extracts, and fibers, which support immunity, digestion, and overall wellness. The market's expansion is driven by increasing consumer awareness of health and wellness, a shift toward preventive healthcare, and a growing demand for clean-label, functional products.

Technological advancements in green extraction methods have also enhanced the efficacy and sustainability of bioactive ingredients, further fueling market growth. These innovative techniques-such as supercritical fluid extraction, ultrasound-assisted extraction, and enzyme-assisted extraction-not only improve yield and purity but also preserve the integrity of heat-sensitive compounds like polyphenols and omega fatty acids. This ensures higher bioavailability and better functional performance of the ingredients in end-use applications. Moreover, green extraction minimizes the use of harmful solvents and reduces environmental impact, aligning well with the industry's shift toward clean-label, eco-friendly production. As a result, manufacturers are increasingly adopting these advanced methods to meet regulatory requirements and growing consumer demand for safe, natural, and sustainable health and wellness solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $127.5 Billion |

| Forecast Value | $279.9 Billion |

| CAGR | 7.9% |

The fatty acids segment accounted for a 19.1% share in 2024, valued at USD 24.3 billion. This segment's dominance is attributed to rising consumer demand for these fatty acids, known for their benefits in heart health, cognitive function, and anti-inflammatory support. The increasing prevalence of lifestyle-related health conditions such as stress, fatigue, digestive issues, and vitamin deficiencies has led consumers to seek preventive healthcare solutions, thereby boosting this segment's growth.

Plant-based sources segment made up 58.3% share in 2024 and is expected to grow at a faster rate of 6.8% CAGR through 2034. This dominance is due to the rising global demand for clean-label, natural, and vegan products, especially in functional foods, supplements, and personal care. Fruits and vegetables, cereals and grains, herbs and spices, and oilseeds and pulses are among the sources of plant-based bioactives. Antioxidants, vitamins, polyphenols, and fibers present in these ingredients offer health benefits such as anti-inflammatory, anti-aging, and immunity-boosting properties.

Asia Pacific Bioactive Ingredients Market held a 38.8% share in 2024. China, India, and Japan are the leading contributors within the Asia Pacific region, with growth driven by rising consumer health awareness, rapid urbanization, and increasing popularity of functional foods and the supplement industry. Government policies supporting nutritional supplements, a growing aging population, and high demand for plant-based, herbal, and traditional medicine-based bioactives have further propelled the market. Post-pandemic, there has been an increased demand for immunity-enhancing supplements, leading to greater interest in functional foods and nutraceuticals.

Key players in the Global Bioactive Ingredients Market include FMC Corporation, Ingredion Incorporated, Mazza Innovation Ltd., Roquette, Sabinsa Corporation, Archer Daniels Midland, Cargill, BASF SE, Ajinomoto Co., and Arla Foods. These companies are focusing on product innovation, strategic partnerships, and expanding their global presence to strengthen their position in the market. Companies in the Bioactive Ingredients Market are adopting several key strategies to strengthen their presence. Product innovation is a primary tactic, with significant investments in research and development leading to the launch of new products that cater to the growing demand for functional ingredients across various end-user industries like food & beverage, dietary supplements, and personal care.

Strategic partnerships and acquisitions are also prevalent, allowing companies to expand their product portfolios and market reach. For instance, collaborations with regional partners enable companies to tap into emerging markets and leverage local expertise. Additionally, companies are focusing on sustainability by adopting green extraction technologies and sourcing raw materials responsibly to meet the increasing consumer demand for natural and organic products.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polyphenols

- 5.2.1 Single vitamins

- 5.2.2 Flavonoids

- 5.2.3 Phenolic acids

- 5.2.4 Lignans

- 5.2.5 Stilbenes

- 5.2.6 Others

- 5.3 Carotenoids

- 5.3.1 Beta-carotene

- 5.3.2 Lutein

- 5.3.3 Lycopene

- 5.3.4 Astaxanthin

- 5.3.5 Others

- 5.4 Prebiotics

- 5.4.1 Elderberry

- 5.4.2 Fructo-oligosaccharides

- 5.4.3 Galacto-oligosaccharides

- 5.4.4 Inulin

- 5.4.5 Others

- 5.5 Probiotics

- 5.5.1 Lactobacillus

- 5.5.2 Bifidobacterium

- 5.5.3 Streptococcus

- 5.5.4 Others

- 5.6 Fatty Acids

- 5.6.1 Omega-3 fatty acids

- 5.6.2 Omega-6 fatty acids

- 5.6.3 Others

- 5.7 Proteins & Amino Acids

- 5.7.1 Plant-based

- 5.7.2 Animal-based

- 5.7.3 Bioactive Peptides

- 5.8 Vitamins

- 5.9 Minerals

- 5.10 Fibres

- 5.11 Others

Chapter 6 Market Estimates and Forecast, By Source, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Plant based

- 6.2.1 Fruits & vegetables

- 6.2.2 Cereals & grains

- 6.2.3 Herbs & spices

- 6.2.4 Oilseeds & pulses

- 6.2.5 Others

- 6.3 Animal based

- 6.3.1 Dairy products

- 6.3.2 Meat & fish

- 6.3.3 Eggs

- 6.3.4 Others

- 6.4 Microbial

- 6.4.1 Bacteria

- 6.4.2 Fungi

- 6.4.3 Algae

- 6.4.4 Others

- 6.5 Marine

- 6.5.1 Seaweed

- 6.5.2 Fish

- 6.5.3 Others

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & Beverages

- 7.2.1 Functional foods

- 7.2.2 Functional beverages

- 7.2.3 Bakery & confectionery

- 7.2.4 Dairy products

- 7.2.5 Meat & poultry products

- 7.2.6 Others

- 7.3 Dietary Supplements

- 7.3.1 Tablets & capsules

- 7.3.2 Powders

- 7.3.3 Liquid

- 7.3.4 Others

- 7.4 Pharmaceuticals

- 7.4.1 Oral formulations

- 7.4.2 Topical formulations

- 7.4.3 Others

- 7.5 Cosmetics & personal care

- 7.5.1 Skincare

- 7.5.2 Haircare

- 7.5.3 Others

- 7.6 Animal Nutrition

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Extraction Technology, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Convention extraction methods

- 8.2.1 Solvent extraction

- 8.2.2 Maceration

- 8.2.3 Percolation

- 8.2.4 Others

- 8.3 Advanced extraction methods

- 8.3.1 Superficial fluid extraction (SFE)

- 8.3.2 Pressurized liquid extraction (PLE)

- 8.3.3 Microwave assisted extraction (MAE)

- 8.3.4 Ultrasound assisted extraction (UAE)

- 8.3.5 Enzyme assisted extraction

- 8.3.6 Others

- 8.4 Green extraction technologies

- 8.4.1 Deep eutectic solvents (DES)

- 8.4.2 Natural deep eutectic solvents (NADES)

- 8.4.3 Others

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Nestle S.A.

- 10.2 Fonterra Co-operative Group

- 10.3 Arla Foods

- 10.4 FrieslandCampina

- 10.5 Glanbia Nutritionals

- 10.6 Davisco Foods International

- 10.7 DSM

- 10.8 Cargill, Inc.

- 10.9 Archer Daniels Midland Company

- 10.10 DuPont

- 10.11 BASF SE

- 10.12 Ajinomoto Co., Inc.

- 10.13 Chr. Hansen Holding A/S

- 10.14 Kerry Group

- 10.15 Ingredion Incorporated

- 10.16 Tate & Lyle PLC

- 10.17 Koninklijke DSM N.V.

- 10.18 Roquette Freres

- 10.19 Symrise AG

- 10.20 Givaudan

- 10.21 Naturex (now part of Givaudan)

- 10.22 Frutarom (now part of IFF)

- 10.23 Kemin Industries

- 10.24 Kalsec Inc.

- 10.25 Dohler GmbH

- 10.26 Diana Group (now part of Symrise)

- 10.27 Mazza Innovation Ltd.

- 10.28 Sabinsa Corporation

- 10.29 Indena S.p.A.

- 10.30 Martin Bauer Group