PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766310

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766310

Commercial Electric Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

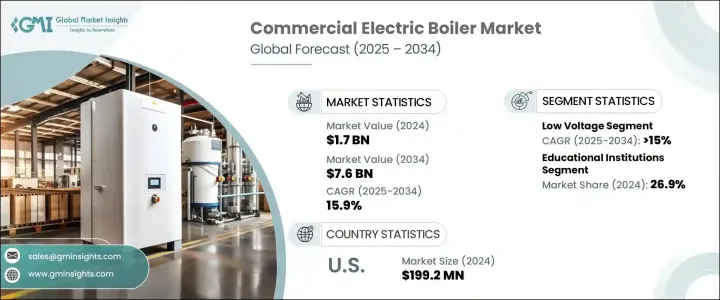

The Global Commercial Electric Boiler Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 15.9% to reach USD 7.6 billion by 2034. This growth is largely attributed to the increasing demand for energy-efficient heating solutions across commercial facilities. Businesses are gradually transitioning from conventional heating systems powered by fossil fuels to electric boilers, driven by heightened awareness around environmental sustainability and the rising cost of fossil-based energy sources. Additionally, government initiatives promoting clean energy usage through financial incentives and policy frameworks are further accelerating this transition.

As commercial establishments prioritize emission reduction strategies, electric boilers are becoming a key element in energy management plans. Their ability to deliver consistent heating performance with minimal emissions aligns with decarbonization targets, especially in regions with stringent environmental norms. Improved grid infrastructure and the integration of renewable energy systems are also supporting the shift, making electric boilers more viable both technically and economically. Notably, the capability of these systems to utilize surplus renewable electricity, store energy, and provide heating on demand enhances their operational efficiency, making them a desirable option for modern commercial infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $7.6 Billion |

| CAGR | 15.9% |

Segmented by voltage rating, the commercial electric boiler market includes medium voltage and low voltage systems. The low voltage segment is anticipated to grow at a CAGR exceeding 15% through 2034. This demand is driven by supportive regulatory policies and incentives aimed at reducing carbon footprints and promoting cleaner technologies in commercial settings. The compact design and reduced maintenance needs of low voltage electric boilers make them particularly attractive for small- to medium-scale operations. These systems are also easier to retrofit into existing infrastructure, which is a key advantage as older buildings move toward modernization. With increasing attention on minimizing reliance on gas or oil-fired units, low voltage electric boilers are positioned to gain substantial market share over the coming years.

By application, educational institutions held the largest market share in 2024, accounting for 26.9%. The preference for electric boilers in this segment is supported by widespread efforts to modernize heating systems in schools, colleges, and universities. Institutions are investing in the replacement of outdated units to achieve cost savings and comply with new efficiency standards. As educational facilities often operate on fixed budgets, the long-term cost advantages of electric heating solutions play a significant role in adoption. Additionally, the low noise, zero on-site emissions, and ease of installation make electric boilers an ideal fit for these settings.

Regionally, the United States has witnessed significant adoption in recent years, with market valuations rising from USD 159.9 million in 2022 to USD 199.2 million by 2024. This trend is reinforced by a national push toward reducing greenhouse gas emissions and the shift in building codes favoring electric over gas-based heating. As businesses align their operations with sustainability targets, demand for commercial electric boilers in the U.S. continues to gain traction. With a growing preference for electrified heating in office buildings, hospitals, and retail spaces, the country is poised to remain a prominent revenue generator in the global market.

Across the broader region, North America is expected to exhibit a CAGR of more than 18% through 2034. A strong commitment to environmental goals, coupled with rising investments in clean building technologies, is fueling the demand for efficient electric heating systems. Urban centers across the U.S. and Canada are especially active in this transition as municipalities implement low-emission development strategies. Infrastructure upgrades in commercial spaces, particularly in older buildings being brought up to modern standards, are also contributing to regional growth.

Leading companies in the commercial electric boiler market include ACV, Bosch Industriekessel, Acme Engineering Products, Chromalox, Cochrane Engineering, Cleaver-Brooks, Danstoker, Flexiheat UK, Ecotherm Austria, Fulton, Klopper-Therm, Hi-Therm Boilers, LAARS Heating Systems, KOSPEL Spolka, Lochinvar, S.A.S Lacaze Energies, Precision Boilers, Thermon, Thermona, and Vattenfall. These players are focusing on innovation, product efficiency, and system integration to meet the evolving needs of the commercial heating industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage Rating, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Low voltage

- 5.3 Medium voltage

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 ≤ 0.3 - 2.5 MMBTU/hr

- 6.3 > 2.5 - 10 MMBTU/hr

- 6.4 > 10 - 50 MMBTU/hr

- 6.5 > 50 - 100 MMBTU/hr

- 6.6 > 100 - 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Offices

- 7.3 Healthcare facilities

- 7.4 Educational institutions

- 7.5 Lodgings

- 7.6 Retail stores

- 7.7 Others

Chapter 8 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Hot water

- 8.3 Steam

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 France

- 9.3.2 UK

- 9.3.3 Poland

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Germany

- 9.3.7 Russia

- 9.3.8 Austria

- 9.3.9 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.4.7 Philippines

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 Iran

- 9.5.3 UAE

- 9.5.4 Egypt

- 9.5.5 Nigeria

- 9.5.6 Kenya

- 9.5.7 Morocco

- 9.5.8 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Colombia

- 9.6.4 Chile

Chapter 10 Company Profiles

- 10.1 Acme Engineering Products

- 10.2 ACV

- 10.3 Bosch Industriekessel

- 10.4 Chromalox

- 10.5 Cleaver-Brooks

- 10.6 Cochrane Engineering

- 10.7 Danstoker

- 10.8 Ecotherm Austria

- 10.9 Flexiheat UK

- 10.10 Fulton

- 10.11 Hi-Therm Boilers

- 10.12 Klopper

- 10.13 KOSPEL Spolka

- 10.14 LAARS Heating Systems

- 10.15 Lochinvar

- 10.16 Precision Boilers

- 10.17 S.A.S Lacaze Energies

- 10.18 Thermon

- 10.19 Thermona

- 10.20 Vattenfall