PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766323

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766323

Age-related Macular Degeneration Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

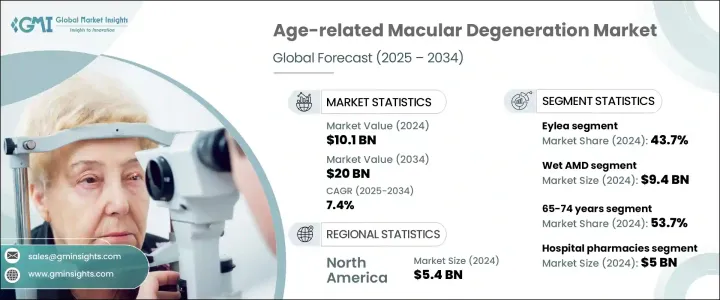

The Global Age-related Macular Degeneration Market was valued at USD 10.1 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 20 billion by 2034. The market growth is driven by a rising prevalence of AMD, an aging global population, increased awareness and early diagnosis, and ongoing innovations in treatment options. AMD is a progressive eye condition affecting individuals aged 50 and above, leading to central vision loss and significantly impacting quality of life. AMD is a progressive eye condition that primarily affects individuals aged 50 and above, leading to irreversible central vision loss and significantly impairing daily activities such as reading, driving, and recognizing faces, ultimately impacting the overall quality of life.

As the disease advances, it compromises the macula-the part of the retina responsible for sharp, central vision-resulting in blurred or dark spots in the visual field that cannot be corrected with glasses or contact lenses. This loss of independence often contributes to psychological effects such as anxiety, depression, and social isolation, especially among older adults. The growing burden of AMD is closely tied to the global aging trend, with its prevalence sharply increasing in populations over 65. The disease is also associated with other risk factors such as smoking, hypertension, obesity, genetic predisposition, and poor dietary habits-factors that are becoming more prevalent globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.1 Billion |

| Forecast Value | $20 Billion |

| CAGR | 7.4% |

By disease type, wet AMD dominated the market with USD 9.4 billion in 2024, driven by the widespread adoption of anti-VEGF therapies, which have proven effective in halting disease progression, minimizing retinal fluid accumulation, and preserving visual function. The success of agents like Eylea, Lucentis, and Beovu has positioned wet AMD as the most actively treated form of the disease. Meanwhile, dry AMD, historically lacking approved pharmacologic interventions, is now seeing renewed clinical focus. The launch of Syfovre, the first FDA-approved treatment for geographic atrophy (a severe form of dry AMD), along with a promising pipeline of complement pathway inhibitors and gene therapies, signals a transformative shift in managing this segment.

Anti-VEGF therapies such as Eylea, Lucentis, and Vabysmo have become the cornerstone of AMD treatment. Among these, the Eylea segment held 43.7% share owing to its efficacy in extending injection intervals and maintaining visual acuity. The drug's updated formulation, Eylea HD, is gaining further traction by offering extended dosing schedules that improve patient adherence and reduce treatment burden. New entrants like Vabysmo are rapidly gaining market share through dual-pathway inhibition (VEGF-A + Ang-2), addressing vascular instability and offering enhanced clinical outcomes.

North America Age-related Macular Degeneration Market will grow at a CAGR of 7% during 2025-2034, driven by robust healthcare infrastructure, early adoption of innovative therapies, and supportive regulatory frameworks. High diagnosis rates are further supported by widespread access to advanced imaging technologies such as OCT and an increasing focus on preventative eye care. Recent FDA approvals of novel, non-invasive therapies such as photobiomodulation for dry AMD underscore a regional shift toward less burdensome treatment modalities, aligning with patient preferences and improving long-term adherence.

To strengthen their position in the Age-related Macular Degeneration Market, companies like Xbrane Biopharma AB, Pfizer Inc., Formycon AG, Celltrion, Inc., Novartis AG, Amgen Inc., Sandoz Group AG, Apellis Pharmaceuticals, Inc., STADA Arzneimittel AG, F. Hoffmann-La Roche Ltd., Biocon Biologics Limited, Regeneron Pharmaceuticals Inc., Bayer AG, Biogen, Inc. are adopting strategic initiatives including R&D investments, biosimilar development, and long-acting formulations. Regeneron's launch of Eylea HD and Roche's introduction of Vabysmo demonstrate innovation-driven competition. Companies are also expanding through partnerships with CROs for clinical trials and leveraging digital tools for real-world data collection. Global market leaders focus on gene therapies, dual-pathway inhibitors, and complement-targeting drugs to diversify their portfolios. Additionally, pricing strategies, strategic licensing, and regulatory collaborations enable faster market access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Market size estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.5 Forecast model

- 1.6 Data mining sources

- 1.6.1 Global

- 1.6.2 Regional/Country

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 End Use

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of age-related macular degeneration (AMD)

- 3.2.1.2 Growth in aging population

- 3.2.1.3 Advancements in treatment options

- 3.2.1.4 Increased awareness and early diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Risk of complications from intravitreal injections

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe (excluding UK)

- 3.4.3 UK

- 3.4.4 India

- 3.4.5 Brazil

- 3.4.6 China

- 3.5 Technology landscape

- 3.5.1 Core technologies

- 3.5.2 Adjacent technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Pipeline analysis

- 3.9 Clinical trial landscape

- 3.9.1 Approved therapies

- 3.9.2 Emerging biosimilars under clinical trials

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Eylea

- 5.3 Lucentis

- 5.4 Beovu

- 5.5 Vabysmo

- 5.6 Syfovre

- 5.7 Avastin

- 5.8 Other products

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Wet AMD

- 6.3 Dry AMD

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 50–64 years

- 7.3 65–74 years

- 7.4 75 and above

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Specialty and retail pharmacies

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.4 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amgen

- 10.2 Apellis Pharmaceuticals

- 10.3 Bayer

- 10.4 Biocon Biologics

- 10.5 Biogen

- 10.6 Celltrion

- 10.7 F. Hoffmann-La Roche

- 10.8 Formycon

- 10.9 Novartis

- 10.10 Pfizer

- 10.11 Regeneron Pharmaceuticals

- 10.12 Sandoz Group

- 10.13 STADA Arzneimittel

- 10.14 Xbrane Biopharma