PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766371

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766371

PV Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

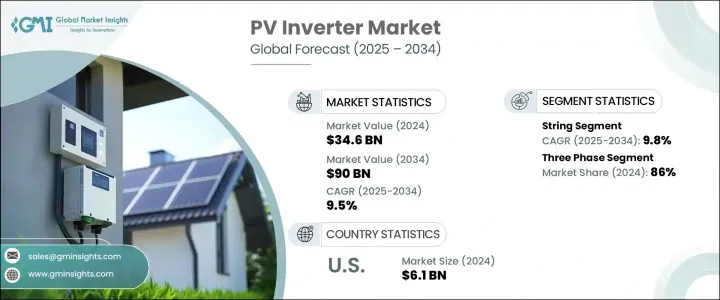

The Global PV Inverter Market was valued at USD 34.6 billion in 2024 and is estimated to grow at a CAGR of 9.5% to reach USD 90 billion by 2034. The global energy landscape is undergoing a notable transformation, with increasing emphasis on renewable power sources. This shift is accelerating the adoption of efficient photovoltaic systems, and inverters are now central to modern solar installations. As countries seek to reduce their dependence on fossil fuels, PV inverters are being integrated into energy infrastructure at a faster pace. These devices not only convert DC to AC power but also enhance system reliability and energy yield, making them indispensable across various applications.

The growing focus on sustainability, combined with favorable energy policies and supportive investment from the public and private sectors, is creating a conducive environment for PV inverter deployment. Regulations aimed at cutting carbon emissions and optimizing energy consumption are reinforcing the shift toward advanced solar solutions. Moreover, ongoing declines in solar technology costs-driven by economies of scale and steady improvements in manufacturing-are making PV systems more financially viable. This affordability is opening up opportunities in regions that are rich in solar resources but have historically faced challenges in accessing conventional power infrastructure. The expansion of distributed energy generation further supports the demand for inverters capable of operating seamlessly across grid-connected and off-grid setups.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34.6 Billion |

| Forecast Value | $90 Billion |

| CAGR | 9.5% |

Modernization efforts within power grids are also amplifying the role of advanced inverters. With the evolution of intelligent energy networks, there is an increased need for inverters that can perform beyond basic power conversion. Features such as remote diagnostics, real-time monitoring, voltage regulation, and frequency support are becoming standard in next-generation devices. These functionalities enable better integration into smart grid frameworks and help utilities maintain grid stability amid fluctuating renewable power inputs. As digitalization gains traction across the energy sector, PV inverters equipped with data analytics and AI-driven energy management capabilities are proving vital for efficient power distribution and performance optimization.

Among the different product types, string inverters are experiencing heightened demand, with expectations of growing at a CAGR of 9.8% through 2034. Their popularity stems from their scalability, affordability, and ease of maintenance. These systems are widely adopted in both residential and commercial sectors, as their modular architecture facilitates quick fault identification and simplified system upgrades. Additionally, the increasing compatibility of string inverters with energy storage units has broadened their appeal across hybrid installations. Their efficient thermal management and compact designs further contribute to their rising market share, especially in space-constrained projects.

The PV inverter market is segmented by phase into single-phase and three-phase systems. In 2024, three-phase inverters accounted for 86% of the overall market. This dominance can be attributed to the rapid pace of industrialization and urban development in emerging economies, which demand higher-capacity and more versatile energy systems. Three-phase inverters offer operational efficiency and are better suited for large-scale deployments in commercial and utility-scale applications, where power requirements are substantial and consistent.

North America, as of 2024, represented 18.1% of the global PV inverter market. Within this region, the United States continues to be a key contributor, with market values rising from USD 4.8 billion in 2022 to USD 6.1 billion in 2024. The country's emphasis on decentralized energy generation, supported by robust federal and state-level incentives, has fostered an environment conducive to rooftop solar growth in both residential and commercial settings. At the same time, ongoing upgrades to the national grid infrastructure are driving the integration of smart inverters. With the rise of behind-the-meter storage solutions, particularly in states focused on energy resilience, the deployment of PV inverters is set to grow further.

Manufacturers are investing heavily in R&D to develop a broad portfolio of inverters tailored to specific customer needs across residential, commercial, and utility-scale sectors. From hybrid models to high-capacity inverters designed for industrial use, companies are rolling out innovations that improve performance, enhance energy yield, and align with global sustainability goals. There is also a noticeable trend toward embedding intelligent technologies into products, including digital interfaces, cloud connectivity, and predictive maintenance capabilities. These advancements not only improve user experience but also offer operators deeper insights into energy usage and system health.

To strengthen their global footprint, market participants are leveraging a combination of strategies. These include entering new geographic regions with high solar potential, forming alliances to enhance service offerings, and pursuing mergers to tap into emerging technologies. The increasing relevance of digital infrastructure and AI-based monitoring tools is leading stakeholders to incorporate smart features that add value beyond basic energy conversion. As the global solar landscape matures, these comprehensive strategies will help companies remain competitive while addressing the evolving energy demands of consumers, businesses, and utilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 String

- 5.3 Micro

- 5.4 Central

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 Standalone

- 7.3 On grid

Chapter 8 Market Size and Forecast, By Nominal Output Power, 2021 - 2034 (USD Billion & MW)

- 8.1 Key trends

- 8.2 ≤ 0.5 kW

- 8.3 0.5 - 3 kW

- 8.4 3 - 33 kW

- 8.5 33 - 110 kW

- 8.6 > 110 kW

Chapter 9 Market Size and Forecast, By Nominal Output Voltage, 2021 - 2034 (USD Billion & MW)

- 9.1 Key trends

- 9.2 ≤ 230 V

- 9.3 230 - 400 V

- 9.4 400 - 600 V

- 9.5 > 600 V

Chapter 10 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion & MW)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial & industrial

- 10.4 Utility

Chapter 11 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & MW)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 Italy

- 11.3.3 Poland

- 11.3.4 Netherlands

- 11.3.5 Austria

- 11.3.6 UK

- 11.3.7 France

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Australia

- 11.4.3 India

- 11.4.4 Japan

- 11.4.5 South Korea

- 11.5 Middle East & Africa

- 11.5.1 Israel

- 11.5.2 Saudi Arabia

- 11.5.3 UAE

- 11.5.4 South Africa

- 11.6 Latin America

- 11.6.1 Brazil

- 11.6.2 Mexico

- 11.6.3 Chile

Chapter 12 Company Profiles

- 12.1 Altenergy Power System

- 12.2 Canadian Solar

- 12.3 Darfon Electronics

- 12.4 Delta Electronics

- 12.5 Eaton

- 12.6 Enphase Energy

- 12.7 Fimer Group

- 12.8 Fronius International

- 12.9 General Electric

- 12.10 Ginlong Technologies

- 12.11 GoodWe

- 12.12 Growatt New Energy

- 12.13 Huawei Technologies

- 12.14 Panasonic Corporation

- 12.15 Schneider Electric

- 12.16 Siemens

- 12.17 Sineng Electric

- 12.18 SMA Solar Technology

- 12.19 SolarEdge Technologies

- 12.20 Sungrow

- 12.21 Tabuchi Electric

- 12.22 TMEIC