PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773219

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773219

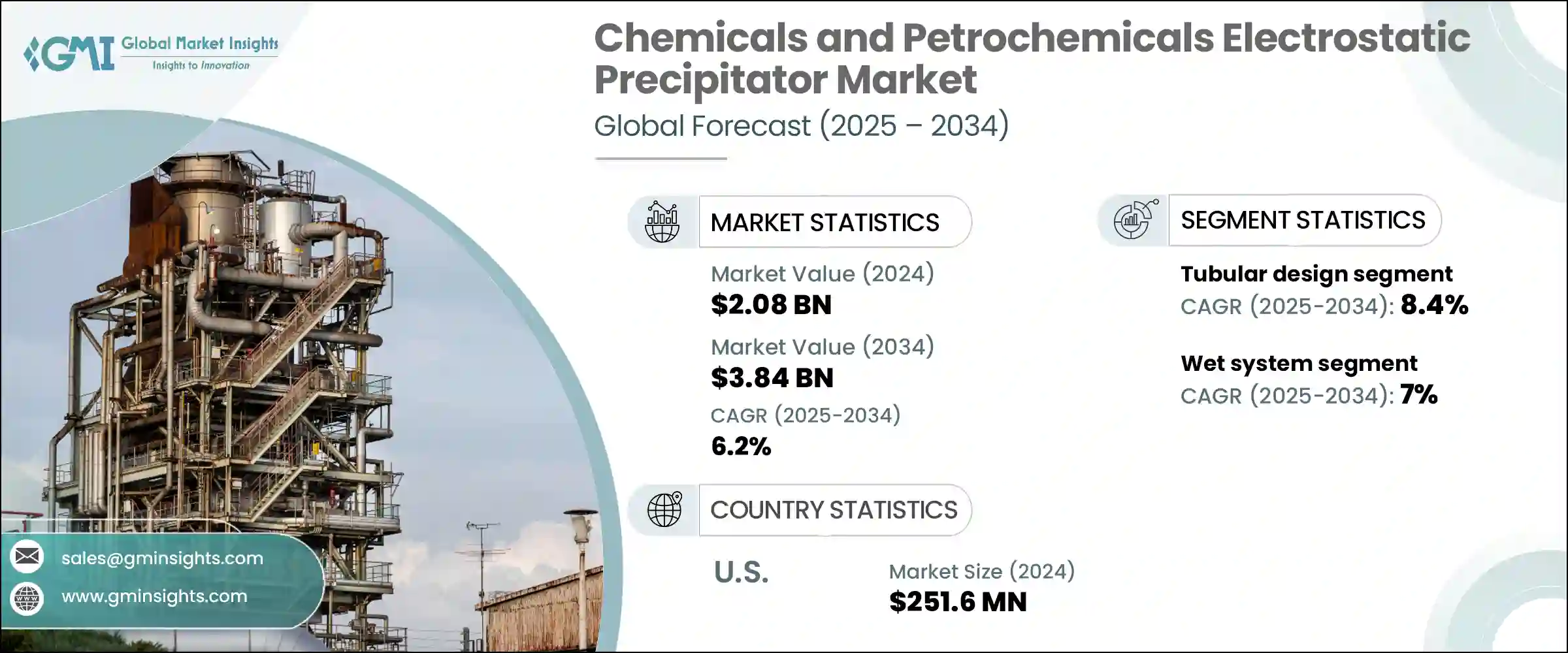

Chemicals and Petrochemicals Electrostatic Precipitator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

The Global Chemicals and Petrochemicals Electrostatic Precipitator Market was valued at USD 2.08 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 3.84 billion by 2034. Demand is accelerating due to the growing use of systems capable of capturing particulate matter while simultaneously recovering valuable by-products. These by-products can be reintegrated into the production cycle, boosting overall process efficiency and recycling efforts. The addition of petrochemical processing capacity alongside existing refinery operations continues to support the expansion of electrostatic precipitator deployments. Greater awareness of air quality, especially in high-emission industrial zones, along with workplace safety concerns, is pushing plant operators to invest in advanced emissions control systems. Increasing synthetic chemical output and the push for sustainable operational practices are further fueling the integration of electrostatic precipitators in large-capacity units.

Tighter environmental compliance rules, particularly across the chemicals sector, are also accelerating product adoption in both mature and developing economies. With regulations becoming more rigorous, particularly for hazardous pollutants, the use of cleaner production technologies will remain a top priority across global facilities. Industrial operators are increasingly prioritizing emission-reduction solutions that not only meet environmental compliance but also enhance energy efficiency and operational productivity. This growing emphasis is prompting a widespread shift toward integrated air pollution control systems that combine multiple functions such as desulfurization, particulate removal, and real-time emissions monitoring.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.08 Billion |

| Forecast Value | $3.84 Billion |

| CAGR | 6.2% |

The plate-type electrostatic precipitator segment is expected to reach USD 3.2 billion by 2034, driven by its high removal efficiency and suitability for handling dry gas streams in large processing plants. These systems are favored for their compatibility with continuous operations and ease of maintenance in high-throughput industrial environments. Ongoing upgrades to flue gas treatment systems across various chemical manufacturing sites will continue to drive the installation of plate-type ESPs.

Dry electrostatic precipitator systems segment accounted for 86.6% in 2024. This dominance is attributed to their cost-effective design, ability to manage flue gas temperatures ranging between 50°C and 450°C, and strong collection efficiency. As industries prioritize cleaner emissions, dry ESPs remain the preferred solution due to low maintenance needs and operational reliability. The growing use of digital controls and real-time monitoring technology in these systems is enhancing their appeal for large-scale industrial deployment.

Asia Pacific Chemicals and Petrochemicals Electrostatic Precipitator Market is expected to reach USD 1.8 billion by 2034. Factors driving growth include rapid industrial development, heightened public concern over air pollution, and stricter enforcement of emission standards across key countries. As investments in environmental compliance increase, countries across the region are prioritizing the installation of advanced ESP technologies in both existing and newly built chemical and petrochemical facilities.

Key players contributing to the competitive landscape of the Chemicals and Petrochemicals Electrostatic Precipitator Market include HIMENVIRO, Wood, Enviropol Engineers, Valmet, ELEX, Babcock & Wilcox, ANDRITZ GROUP, GEA Group, Alstom, FLSmidth, KC Cottrell India, PPC Austria Holding, Isgec Heavy Engineering, Thermax Group, and the Thermax Group. Leading companies in the chemicals and petrochemicals electrostatic precipitator market are strengthening their presence by investing in R&D focused on improving capture efficiency, energy optimization, and reducing maintenance costs. Many firms are forming strategic alliances with petrochemical and chemical manufacturers to secure long-term contracts. Businesses are also expanding their footprints in fast-growing regions like Asia Pacific through localized manufacturing and service support. Additionally, integrating digital monitoring systems and AI-driven diagnostics into precipitator units allows companies to offer predictive maintenance solutions, ensuring uninterrupted performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Design, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Plate

- 5.3 Tubular

Chapter 6 Market Size and Forecast, By System, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Dry

- 6.3 Wet

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Indonesia

- 7.4.6 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.5.4 Nigeria

- 7.5.5 Angola

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

- 7.6.4 Peru

Chapter 8 Company Profiles

- 8.1 ANDRITZ GROUP

- 8.2 Alstom

- 8.3 Babcock & Wilcox

- 8.4 Enviropol Engineers

- 8.5 ELEX

- 8.6 FLSmidth

- 8.7 GEA Group

- 8.8 HIMENVIRO

- 8.9 Isgec Heavy Engineering

- 8.10 KC Cottrell India

- 8.11 PPC Austria Holding

- 8.12 Thermax Group

- 8.13 Valmet

- 8.14 Wood