PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773228

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773228

North America On-premises Carbon Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

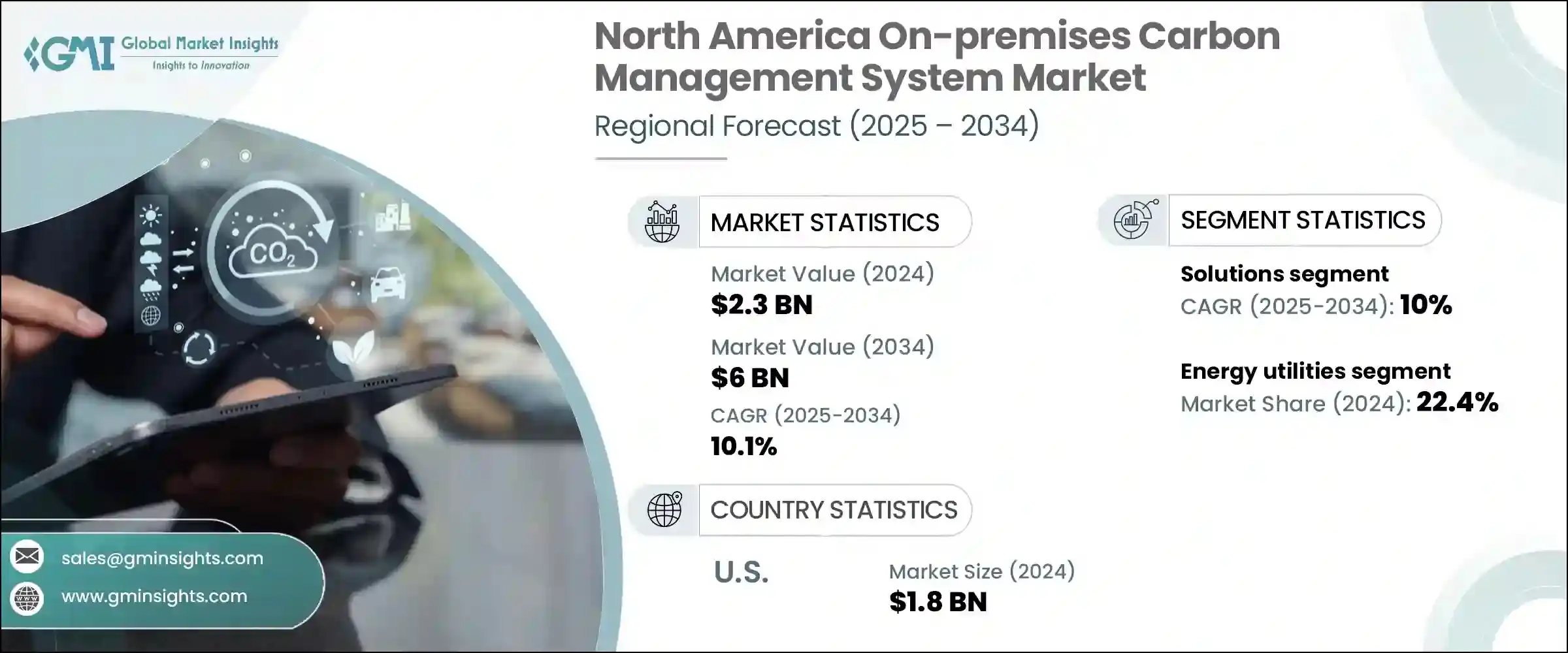

North America On-premises Carbon Management System Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 10.1% to reach USD 6 billion by 2034. This growth is largely propelled by the increasing demand from organizations aiming to internally manage and monitor their greenhouse gas (GHG) emissions amid stringent environmental regulations. Sectors like oil & gas, chemicals, cement, steel, and manufacturing, which face intense regulatory scrutiny, are prioritizing on-premises carbon management solutions to comply with evolving ESG mandates and governmental directives. The region's tightening environmental policies, including carbon taxes, emissions trading programs, and stricter reporting requirements, are compelling companies to adopt precise monitoring and reporting tools that provide real-time data and detailed emissions analysis.

These systems deliver granular insights with tailored reporting aligned to local regulatory needs, supporting lifecycle assessments and sustainability strategies. Equipped with artificial intelligence and machine learning, modern platforms detect emissions hotspots, optimize energy consumption, and predict future carbon trends. They aggregate information from IoT devices, smart meters, and industrial equipment, offering a comprehensive view of emissions across enterprise operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $6 Billion |

| CAGR | 10.1% |

By integrating data streams from disparate systems, these platforms enable companies to monitor, benchmark, and analyze emissions across facilities, processes, and value chains in near real-time. This centralized visibility allows for deeper insights into energy consumption patterns, equipment performance, and emissions anomalies. It also facilitates scenario modeling and the evaluation of emission reduction strategies, making it easier to align sustainability goals with operational decisions.

The services segment is expected to grow at a 10.2% CAGR through 2034 and is becoming an indispensable part of the on-premises carbon management ecosystem. As organizations increasingly rely on customized deployments and seamless system integration, service providers offer essential support across implementation, updates, maintenance, and system optimization. The need for real-time emissions tracking and predictive insights, powered by AI and advanced analytics, requires regular calibration, algorithm refinement, and responsive troubleshooting. These services ensure the long-term accuracy, reliability, and scalability of platforms while allowing companies to adapt to evolving compliance demands and sustainability goals.

The energy utilities segment captured a 22.4% share in 2024 and is leveraging carbon management tools to support its transition toward low-carbon operations. These enterprises are embedding digital technologies across the infrastructure to fine-tune load distribution, reduce waste, and extend asset lifespans. The adoption of AI-driven tools and IoT sensors allows real-time adjustments, enabling smarter grid management and more resilient service delivery. As utilities ramp up efforts to meet decarbonization mandates, carbon management systems are instrumental in ensuring transparency, performance tracking, and emissions reporting-all critical for gaining regulatory approvals and public trust.

U.S. On-premises Carbon Management System Market was valued at USD 1.8 billion in 2024. The surge is fueled by rising regulatory pressures, corporate sustainability goals, and heightened concerns over data privacy and cybersecurity. These systems allow extensive customization and seamless integration with internal IT infrastructures, making them ideal for large enterprises with complex operations. Federal initiatives promoting green infrastructure and industrial decarbonization, supported by funding programs and tax incentives, are further boosting demand for advanced emissions-tracking technologies.

Key players active in the North America On-premises Carbon Management System Market include IBM, Enablon, Schneider Electric, SAP, Accuvio, EnergyCap, Dakota Software, Envirosoft, Locus Technologies, Trinity Consultants, ESP, Carbon Footprint, NativeEnergy, Salesforce, Engie, Isometrix, Intelex. Companies in this market focus on strengthening their foothold through continuous innovation, emphasizing AI and machine learning enhancements to improve emissions accuracy and predictive capabilities.

They invest in scalable, modular platforms that can adapt to diverse industry requirements and regulatory changes, ensuring long-term relevance. Building strong partnerships with industry stakeholders and expanding service offerings, such as end-to-end implementation, training, and maintenance, helps secure client loyalty. Strategic acquisitions and collaborations accelerate technology development and geographic reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive Landscape, 2025

- 3.1 Introduction

- 3.2 Company market share analysis, 2024

- 3.3 Strategy dashboard

- 3.4 Strategic initiative

- 3.5 Company benchmarking

- 3.6 Innovation & technology landscape

Chapter 4 Market Size and Forecast, By Component, 2021 - 2034, (USD Billion)

- 4.1 Key trends

- 4.2 Solutions

- 4.3 Services

Chapter 5 Market Size and Forecast, By Industry, 2021 - 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Energy & utilities

- 5.3 Manufacturing

- 5.4 Residential & commercial building

- 5.5 Transportation & logistics

- 5.6 IT & telecom

- 5.7 Others

Chapter 6 Market Size and Forecast, By Country, 2021 - 2034, (USD Billion)

- 6.1 Key trends

- 6.2 U.S.

- 6.3 Canada

Chapter 7 Company Profiles

- 7.1 Accuvio

- 7.2 Carbon Footprint

- 7.3 Dakota Software

- 7.4 Enablon

- 7.5 EnergyCap

- 7.6 Engie

- 7.7 Enviance

- 7.8 Envirosoft

- 7.9 ESP

- 7.10 IBM

- 7.11 Intelex

- 7.12 Isometrix

- 7.13 Locus Technlogies

- 7.14 NativeEnergy

- 7.15 Salesforce

- 7.16 SAP

- 7.17 Schneider Electric

- 7.18 Trinity Consultants