PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773258

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773258

Asia Pacific Electric Vehicle On-Board Charger Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

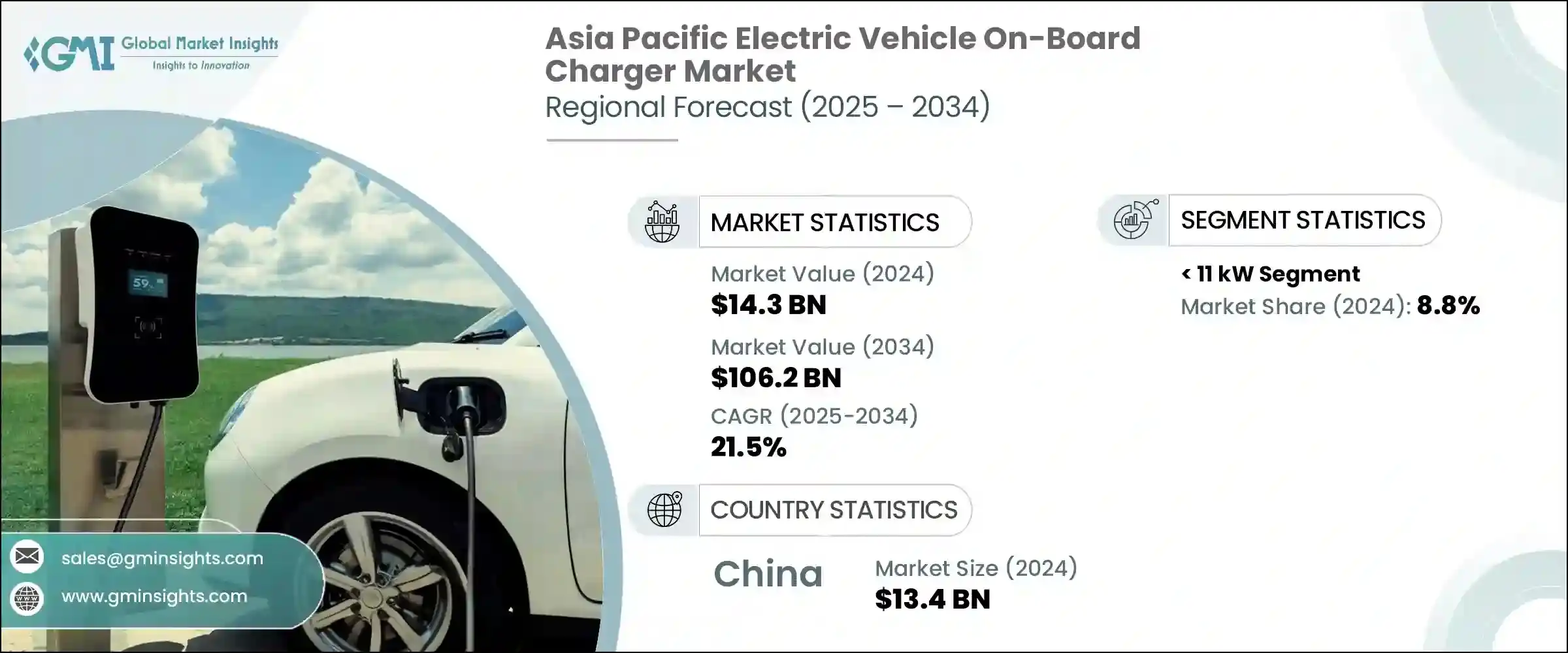

Asia Pacific Electric Vehicle On-Board Charger Market was valued at USD 14.3 billion in 2024 and is estimated to grow at a CAGR of 21.5% to reach USD 106.2 billion by 2034. The region's rapid transition to cleaner mobility solutions is being strongly influenced by policy incentives, technology adoption, and investment in EV infrastructure. The development of advanced charging networks is now a priority, as nations in this region aim to reduce carbon emissions and promote electric transportation. A key concern that continues to drive innovation in this sector is range anxiety-leading manufacturers to focus on faster and more flexible charging options to ensure seamless EV use, especially in areas with limited infrastructure.

Countries across Asia Pacific are aggressively working on deploying fast-charging solutions to support the growing EV base. Bidirectional charging technologies, such as Vehicle-to-Grid (V2G) and Vehicle-to-Home (V2H), are gaining momentum by enabling energy flow in both directions. These systems support grid flexibility, providing backup energy during peak demand. The presence of strong government policies and favorable regulations continues to push the adoption of more advanced, compact, and bidirectional onboard chargers. Electrification trends in countries such as China, India, South Korea, and Japan are accelerating the shift toward Battery Electric Vehicles (BEVs), increasing the demand for high-capacity OBC units capable of supporting higher voltage and faster charging cycles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.3 Billion |

| Forecast Value | $106.2 Billion |

| CAGR | 21.5% |

The BEV applications segment held a notable share in 2024. This evolution supports faster charging while maintaining system efficiency and reducing space and weight. Lightweight, compact designs are becoming essential for vehicle performance and cost control. The market is seeing robust development of bidirectional OBCs capable of allowing grid feedback, which contributes to the energy ecosystem and enhances overall vehicle functionality. These advancements are vital in reducing the environmental impact while supporting widespread EV adoption across both public and private transport systems.

The >11 kW to 22 kW segment from Asia Pacific Electric Vehicle On-Board Charger Market is witnessing accelerated demand across the region, supported by the need for quicker charging at home and public spaces. These systems offer reduced charging time and improved user experience, driving electric vehicle ownership among a wider user base.

China Electric Vehicle On-Board Charger Market generated USD 13.4 billion in 2024 with strong government backing, rapid EV deployment, and an integrated supply chain that enhances cost-efficiency and technological capability. Competitive advantages in local manufacturing and scale have further solidified China's dominance in the regional landscape.

Key companies active in the Asia Pacific Electric Vehicle On-Board Charger Market include: Delta Energy Systems, Ficosa International SA, Toyota Industries Corporation, STMicroelectronics, Eaton Corporation, Bell Power Solution, Valeo, Alfanar Group, Infineon Technologies AG, Aptiv, Kirloskar Electric Company, BRUSA Elektronik AG, Powell Industries, BorgWarner Inc., Current Ways Inc., and Delphi Technologies. Major companies in this sector are aggressively investing in R&D to develop lightweight, high-capacity, and bidirectional OBC systems that support faster charging and grid feedback. Strategic alliances with EV automakers are enabling joint development of vehicle-specific solutions to enhance performance and cost efficiency. Firms are also focusing on expanding regional production hubs to meet growing demand locally while cutting logistics costs. The adoption of silicon carbide and gallium nitride technologies is being prioritized to increase power density and thermal performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive Landscape, 2025

- 3.1 Introduction

- 3.2 Company market share analysis, 2024

- 3.3 Strategic dashboard

- 3.4 Strategic initiatives

- 3.5 Competitive benchmarking

- 3.6 Innovation & technology landscape

Chapter 4 Market Size and Forecast, By Propulsion, 2021 - 2034 (Units, USD Billion)

- 4.1 Key trends

- 4.2 BEV

- 4.3 PHEV

- 4.4 Others

Chapter 5 Market Size and Forecast, By Rating, 2021 - 2034 (Units, USD Billion)

- 5.1 Key trends

- 5.2 < 11 kW

- 5.3 > 11 kW to 22 kW

- 5.4 > 22 kW

Chapter 6 Market Size and Forecast, By Country, 2021 - 2034 (Units, USD Billion)

- 6.1 Key trends

- 6.2 China

- 6.3 Japan

- 6.4 India

- 6.5 South Korea

- 6.6 Australia

Chapter 7 Company Profiles

- 7.1 Alfanar Group

- 7.2 Aptiv

- 7.3 Bell Power Solution

- 7.4 BorgWarner Inc.

- 7.5 BRUSA Elektronik AG

- 7.6 Current Ways Inc.

- 7.7 Delphi Technologies

- 7.8 Delta Energy Systems

- 7.9 Eaton Corporation

- 7.10 Ficosa International SA

- 7.11 Infineon Technologies AG

- 7.12 Kirloskar Electric Company

- 7.13 Powell Industries

- 7.14 STMicroelectronics

- 7.15 Toyota Industries Corporation

- 7.16 Valeo