PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773335

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773335

New Energy Vehicle Stabilizer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

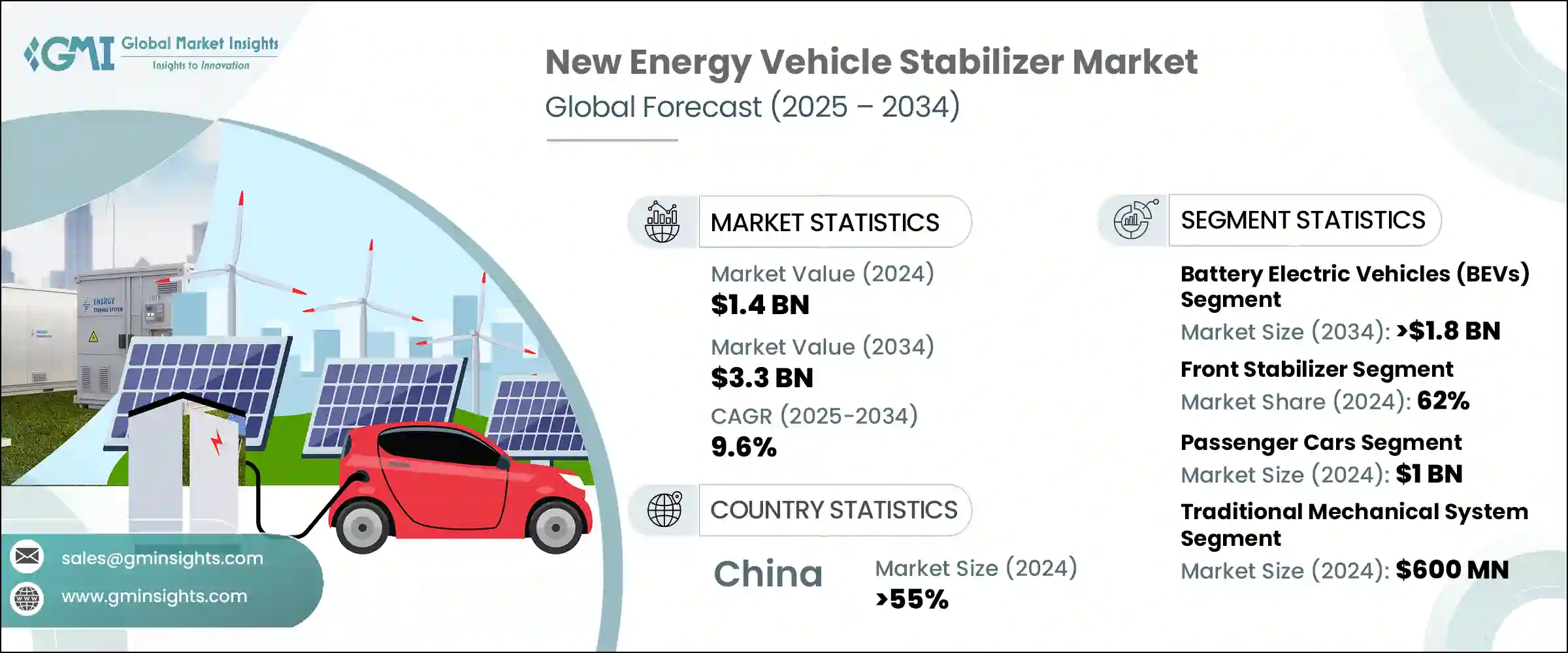

The Global New Energy Vehicle Stabilizer Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 9.6% to reach USD 3.3 billion by 2034. This growth is largely fueled by the increasing adoption of electric, hybrid, and hydrogen-powered vehicles across major global markets. As manufacturers shift to alternative drivetrains, there is a rising emphasis on vehicle dynamics and overall ride quality, which directly boosts the demand for advanced stabilizer technologies. Electromechanical and active stabilizers are becoming more widely adopted due to their ability to enhance suspension performance, reduce body roll, and provide smoother handling for both passengers and drivers. This reflects a broader trend in the EV sector to deliver high levels of safety and comfort.

Stabilizers-often called sway or anti-roll bars-play a crucial role in supporting the suspension systems of NEVs, especially given the altered weight distribution brought on by battery placement. Unlike conventional internal combustion engine (ICE) vehicles, NEVs tend to house battery packs on the vehicle floor, shifting the center of gravity and requiring reimagined stabilizer systems. These systems are designed to ensure optimal performance and cornering stability, particularly during high-speed maneuvers or rapid direction changes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $3.3 Billion |

| CAGR | 9.6% |

Battery Electric Vehicles (BEVs) commanded a 46% share in 2024, and the segment is anticipated to generate USD 1.8 billion by 2034. The strong foothold of BEVs in the stabilizer market is backed by surging production and consumer demand for all-electric platforms. This increase is due to supportive policy environments, expanded charging infrastructure, and significant investment from global OEMs like Hyundai, Volkswagen, Tesla, and BYD. Heavier battery weights in BEVs necessitate specially engineered suspension systems, increasing the reliance on advanced stabilizer components.

In 2024, the front stabilizer bars segment led the global new energy vehicle stabilizer market, accounting for 62% share, and is forecasted to grow at a CAGR of 8.2% through 2034. This dominance stems from their critical role in managing front-axle stability and maintaining vehicle balance. As electric vehicles frequently adopt front-wheel drive configurations and concentrate battery mass on the front axle, front stabilizers have become indispensable in ensuring precise handling and reduced body movement in real-time driving conditions.

Asia Pacific New Energy Vehicle Stabilizer Market held a 55% share and generated USD 300 million in 2024. The rapid acceleration of NEV manufacturing sustained regulatory support, and increasing domestic demand are key drivers of this growth. China has established itself as the largest NEV market worldwide, a position reinforced by aggressive national strategies and investment. Local brands like NIO, XPeng, BYD, and Geely, as well as global automakers such as Tesla and Volkswagen, have continued to expand their production footprints in the region to meet this surging demand.

Leading players operating in the New Energy Vehicle Stabilizer Market include Sogefi Group, Thyssenkrupp, DAEWON, ZF, Dongfeng, NHK International, SwayTec, Hendrickson, Kongsberg Automotive, and Mubea. Companies in the NEV stabilizer segment are aggressively pursuing innovation and integration with next-gen EV platforms. Most are investing in R&D to develop lighter, high-strength stabilizer components that match the evolving dynamics of electric drivetrains. Collaborations with EV manufacturers for early-stage design involvement allow for customized suspension systems. Firms are also incorporating adaptive and electromechanical technologies that work with onboard sensors and control units for real-time performance. Global expansion through localized production hubs and long-term supplier agreements with OEMs helps these players strengthen their market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Stabilizer

- 2.2.4 Technology

- 2.2.5 Application

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component manufacturers

- 3.1.1.3 Technology providers

- 3.1.1.4 Aftermarket suppliers

- 3.1.1.5 System integrators

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing government mandates and consumer demand for electric and hybrid vehicles

- 3.2.1.2 Demand for enhanced ride control and handling performance in NEVs

- 3.2.1.3 Shift from mechanical to intelligent, sensor-integrated stabilizers

- 3.2.1.4 Increased need for adaptive and disconnecting stabilizer systems

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Especially electromechanical and active systems

- 3.2.2.2 Packaging challenges due to space constraints

- 3.2.3 Market Opportunities

- 3.2.3.1 Growth in performance parts and customization in electric off-road vehicles

- 3.2.3.2 Opens door for over-the-air (OTA) stabilizer tuning and control solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

- 3.6 Technology & innovation landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 Middle East & Africa

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Sustainability analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New Product Launches

- 4.5.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Battery Electric Vehicles (BEVs)

- 5.3 Plug-in Hybrid Electric Vehicles (PHEVs)

- 5.4 Hybrid Electric Vehicles (HEVs)

- 5.5 Fuel Cell Electric Vehicles (FCEVs)

Chapter 6 Market Estimates & Forecast, By Stabilizer, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Front Stabilizer

- 6.3 Rear Stabilizer

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Hydraulic stabilizer system

- 7.3 Electromechanical stabilizer system

- 7.4 Electronically controlled stabilizer bar

- 7.5 Traditional mechanical system

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.1.1 Passenger Car

- 8.1.2 Sedan

- 8.1.3 Hatchback

- 8.1.4 SUV

- 8.1.5 MUV

- 8.2 Commercial Vehicle

- 8.2.1 Light Commercial Vehicle

- 8.2.2 Medium Commercial Vehicle

- 8.2.3 Heavy Commercial Vehicle

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 North America

- 10.1.1 U.S.

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Ukraine

- 10.2.7 Russia

- 10.2.8 Nordic

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 South Korea

- 10.3.6 Southeast Asia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.4.4 Chile

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 AAM

- 11.2 ADDCO

- 11.3 Chuo Spring

- 11.4 DAEWON

- 11.5 Dongfeng

- 11.6 JAMNA AUTO INDUSTRIES LIMITED

- 11.7 Sogefi Group

- 11.8 Kongsberg Automotive

- 11.9 Mubea

- 11.10 NHK International

- 11.11 Hendrickson

- 11.12 Sogefi

- 11.13 SwayTec

- 11.14 Tata

- 11.15 Thyssenkrupp

- 11.16 Tinsley Bridge

- 11.17 TMT(CSR)

- 11.18 Tower

- 11.19 Wanxiang

- 11.20 Yangzhou Dongsheng

- 11.21 ZF