PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773337

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773337

Organic Baby Food Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

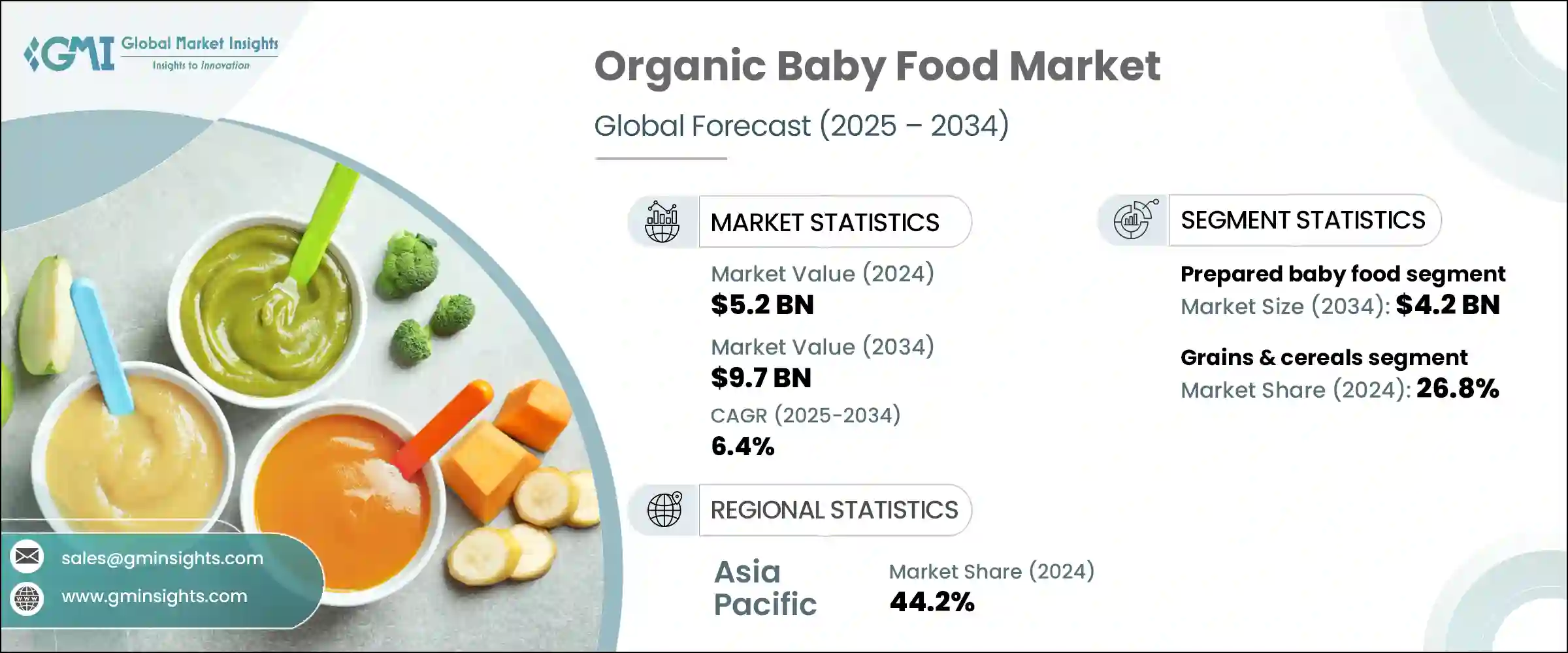

The Global Organic Baby Food Market was valued at USD 5.2 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 9.7 billion by 2034. The market continues to witness steady growth, largely due to shifting consumer habits, greater awareness about child nutrition, and evolving lifestyle dynamics. Modern-day parents, especially those from millennial and Gen Z demographics, are prioritizing transparency, clean-label ingredients, and chemical-free products. As more caregivers become conscious about the foods they give to their infants, the demand for organic alternatives has surged. Products free from GMOs, preservatives, artificial ingredients, and synthetic pesticides are gaining significant popularity as families focus on providing a healthier start in life.

Concerns over processed food and potential long-term health impacts have made organic baby food more desirable. Consumers are actively choosing options that are both safe and environmentally responsible. The increasing number of infants experiencing allergies and sensitivities has also played a role in this market trend, pushing demand for simpler ingredient profiles. Coupled with fast-paced urban living and changing family dynamics, there's a greater need for nutritious yet hassle-free feeding choices that cater to convenience without compromising quality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $9.7 Billion |

| CAGR | 6.4% |

Prepared organic baby food is emerging as the fastest-growing category and is forecasted to be valued at USD 4.2 billion by 2034, growing at 6.6% CAGR. This segment resonates well with today's busy caregivers who prefer ready-to-serve meals in convenient formats like pouches, jars, and purees. These products offer the perfect balance of nutrition and ease, especially for working parents looking to save time. With more mothers rejoining the workforce, demand for this category has climbed. Innovations in packaging, such as resealable containers and eco-conscious materials, have further boosted its appeal by offering portability, preserving freshness, and aligning with sustainability values.

The grains and cereals segment held the dominant share in 2024 at 26.8% and is expected to grow at a CAGR of 6.1% through 2034. This segment continues to lead due to its nutritional profile and versatility in meal formats like porridge, infant cereals, bars, and teething snacks. Foods made with oats, millet, quinoa, and rice are high in energy, easily digestible, and suitable for early development. Their flexibility and foundational role in baby diets make them a consistent favorite for caregivers looking to nourish their children with wholesome, natural ingredients.

Asia Pacific Organic Baby Food Market held a 44.2% share in 2024. Countries such as Indonesia, China, and India are seeing a rise in birth rates alongside expanding middle-class populations. Heightened awareness about the risks of chemical additives in baby nutrition is influencing buying patterns across urban and semi-urban areas. Governments across the region are also raising food safety standards and enforcing stricter organic certification norms, which boost consumer trust. Moreover, increased internet access and e-commerce adoption are making premium organic baby food products available in more remote regions, helping grow the customer base.

The Global Organic Baby Food Market remains consolidated, with major players including Hero Group, Danone S.A., The Hain Celestial Group, Abbott Laboratories, and Nestle S.A. To enhance their market position, leading companies in the organic baby food sector are focusing on expanding product portfolios through plant-based formulations, allergen-free variants, and fortified blends for specific developmental needs. Many are investing in sustainable farming partnerships and traceability technologies to meet clean-label expectations and enhance brand trust. Businesses are also capitalizing on the e-commerce boom to widen their distribution footprint, especially in emerging markets. Collaborations with pediatricians and nutritionists help drive product credibility, while innovative, eco-friendly packaging solutions support long-term sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Ingredients type trends

- 2.2.3 Age group

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising health consciousness among parents

- 3.2.1.2 Growing concerns over chemical residues in conventional food

- 3.2.1.3 Increasing incidence of allergies and food sensitivities

- 3.2.1.4 Rising number of working women

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Premium pricing of organic products

- 3.2.2.2 Limited shelf life due to absence of preservatives

- 3.2.2.3 Supply chain challenges for organic ingredients

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 E-commerce growth and direct-to-consumer models

- 3.2.3.3 Product innovation and diversification

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global organic certification standards

- 3.4.2 Regional Regulatory Variations

- 3.4.2.1 North America (USDA organic)

- 3.4.2.2 Europe (EU organic regulations)

- 3.4.2.3 Asia pacific regulatory framework

- 3.4.3 Labeling requirements and claims

- 3.4.4 Safety standards and testing protocols

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Consumer behavior analysis

- 3.13.1 Purchasing patterns and preferences

- 3.13.2 Willingness to pay premium for organic products

- 3.13.3 Demographic influences on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Prepared baby food

- 5.3 Dried baby food

- 5.4 Infant milk formula

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Ingredients Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Grains & cereals

- 6.3 Fruits

- 6.4 Vegetables

- 6.5 Dairy products

- 6.6 Meat & poultry

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Age Group, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Infants (0–6 months)

- 7.3 Babies (6–12 months)

- 7.4 Toddlers (12–24 months)

- 7.5 Children (24+ months)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Supermarkets & hypermarkets

- 8.3 Specialty stores

- 8.4 Convenience stores

- 8.5 Online retail

- 8.6 Pharmacies & drug stores

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Nestle S.A.

- 10.3 Danone S.A.

- 10.4 Hero Group

- 10.5 The Hain Celestial Group, Inc.

- 10.6 Kraft Heinz Company

- 10.7 Plum Organics (Campbell Soup Company)

- 10.8 Once Upon a Farm

- 10.9 HiPP GmbH & Co. Vertrieb KG

- 10.10 Amara Organic Foods

- 10.11 Babylife Organics

- 10.12 Little Spoon

- 10.13 Serenity Kids

- 10.14 Sprout Organic Foods, Inc.

- 10.15 Tiny Organics