PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773347

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773347

Commercial Vehicle Electronic Service Tools (EST) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

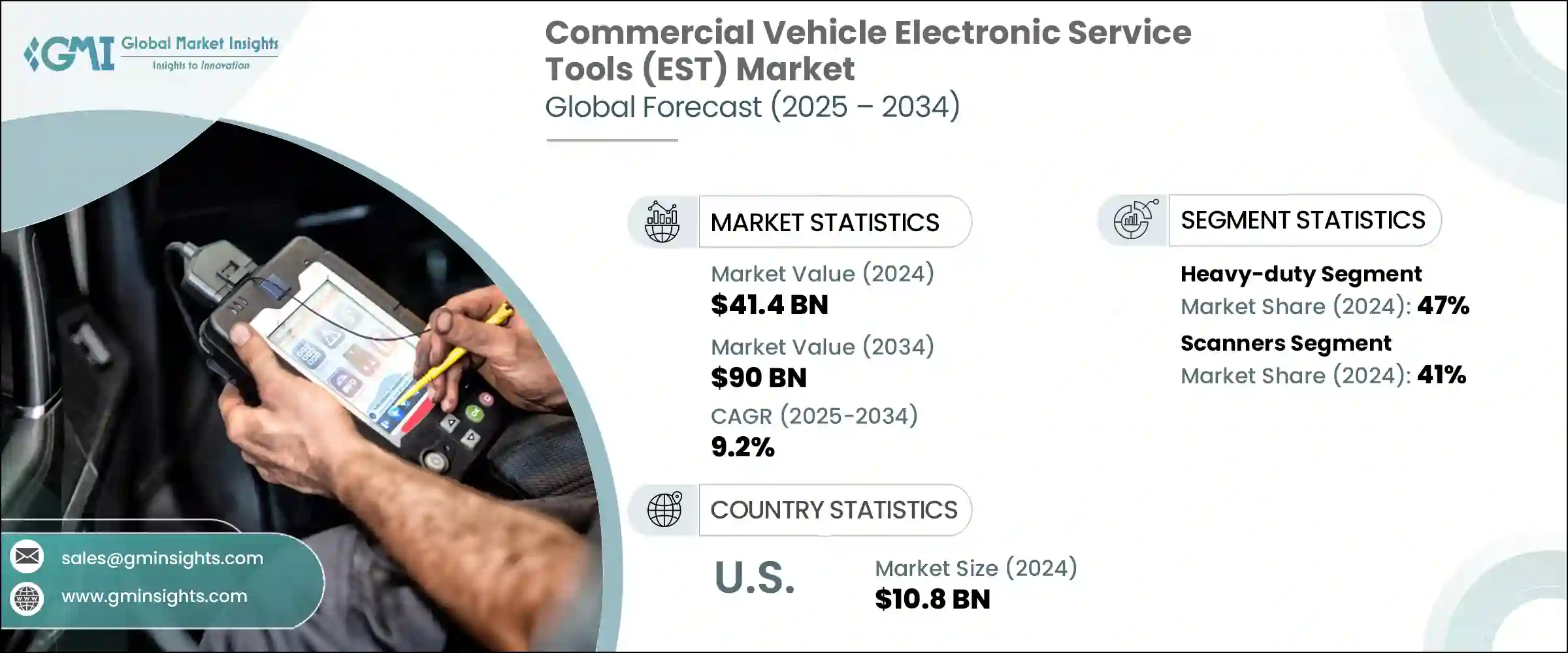

The Global Commercial Vehicle Electronic Service Tools Market was valued at USD 41.4 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 90 billion by 2034. The rapid integration of advanced electronics into commercial vehicles, including engine control units (ECUs), telematics systems, and driver-assistance technologies, has significantly increased the demand for high-tech diagnostic tools. With traditional mechanical servicing becoming inadequate, fleet operators and service centers are adopting advanced electronic tools to provide real-time diagnostics, software updates, and precise fault detection. These tools help reduce vehicle downtime, optimize fleet performance, and enhance maintenance efficiency. As the global commercial vehicle fleet grows, driven by the boom in e-commerce, logistics, and supply chain sectors, the need for regular diagnostics and maintenance is intensifying.

Fleet managers are increasingly relying on predictive maintenance solutions, powered by electronic service tools, to minimize downtime and improve resource allocation. This trend is especially critical as commercial vehicles experience increased wear and tear from extended operational hours, particularly in industries like logistics, construction, and long-haul trucking. The continuous operation of these vehicles puts added pressure on components, accelerating the need for frequent maintenance and timely diagnostics. With the growing demands on fleets, service providers and tool manufacturers are finding significant opportunities to introduce innovative solutions that can optimize maintenance schedules and enhance vehicle longevity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $41.4 Billion |

| Forecast Value | $90 Billion |

| CAGR | 9.2% |

In 2024, the heavy-duty vehicle segment held a 47% share. This growth is driven by the increasing use of heavy-duty vehicles in global logistics, where real-time data and remote diagnostics are vital for ensuring operational efficiency, regulatory compliance, and quick problem resolution. As the logistics industry becomes more reliant on advanced technologies to improve fleet management, the demand for specialized electronic service tools continues to surge. These tools help monitor key vehicle parameters, such as fuel consumption, engine performance, and driver behavior, thus enhancing fleet operations, minimizing downtime, and maintaining regulatory standards, especially in cross-border transportation.

The scanners segment held a 41% share in 2024 and is expected to grow at a CAGR of 11.1% through 2034. The continuous evolution of diagnostic scanners has made them more versatile and efficient in diagnosing complex vehicle systems. New advancements, such as wireless communication capabilities, touchscreen interfaces, and live data streaming, have made these tools indispensable in workshops and service centers. They now offer more functionalities, including ECU programming, system tests, and bi-directional controls, which enhance technician productivity and service accuracy, further driving their adoption.

United States Commercial Vehicle Electronic Service Tools (EST) Market held a dominant 83% share and generated USD 10.8 billion in 2024. The vast and varied commercial vehicle fleet in the U.S. serves as a constant driver for demand in this sector, particularly in industries like long-haul trucking, delivery, and construction. The country's well-established automotive aftermarket infrastructure, including a wide network of independent workshops, OEM-authorized service centers, and fleet maintenance facilities, provides a solid foundation for the growth of electronic service tools.

Key players in the Commercial Vehicle Electronic Service Tools Market include Bendix, Bosch, Continental AG, Cummins, Daimler Trucks, Knorr-Bremse, Navistar, PACCAR, Snap-on, and Volvo. Key strategies that companies are adopting to strengthen their position in the market include the continuous development of advanced diagnostic tools that integrate seamlessly with the latest vehicle technologies. Companies are also focusing on expanding their product offerings to cater to a wide range of vehicle types, from heavy-duty trucks to smaller municipal vehicles. Additionally, partnerships with OEMs and fleet operators are being pursued to ensure tool compatibility with new vehicle models, while investment in research and development is a priority to enhance tool capabilities, such as incorporating artificial intelligence and machine learning for predictive diagnostics. Furthermore, many companies are focusing on expanding their global presence, particularly in emerging markets, to capitalize on the growing fleet and logistics sectors.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Tool

- 2.2.4 Business Model

- 2.2.5 Connectivity

- 2.2.6 Application

- 2.2.7 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising commercial vehicle production

- 3.2.1.2 Growing adoption of telematics & fleet management

- 3.2.1.3 Rising demand for predictive and preventive maintenance

- 3.2.1.4 Integration of AI & data analytics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment cost

- 3.2.2.2 Cybersecurity risk

- 3.2.3 Market opportunities

- 3.2.3.1 Emission regulation compliance

- 3.2.3.2 Fleet digitalization initiatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Light duty

- 5.3 Medium-duty

- 5.4 Heavy-duty

Chapter 6 Market Estimates & Forecast, By Tool, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Scanners

- 6.3 Analyzers

- 6.4 System-specific tools

- 6.5 Telematics

Chapter 7 Market Estimates & Forecast, By Business Model, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Purchase

- 7.3 Subscription-based

- 7.4 Pay-per-use

Chapter 8 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Bluetooth

- 8.3 Wi-Fi

- 8.4 USB

- 8.5 Cellular

- 8.6 Cloud

Chapter 9 Market Estimates & Forecast, By Application, 2021- 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Fault detection & diagnostics

- 9.3 Predictive & preventive maintenance

- 9.4 Performance monitoring & calibration

- 9.5 Repair & maintenance services

- 9.6 Vehicle tracking & telematics service

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021- 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Online

- 10.3 Offline

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Nordics

- 11.3.7 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Autel Intelligent Technology

- 12.2 Bendix

- 12.3 Bosch

- 12.4 Cojali USA

- 12.5 Continental AG

- 12.6 Cummins

- 12.7 Daimler Trucks

- 12.8 Delphi Technologies

- 12.9 Denso

- 12.10 Knorr-Bremse

- 12.11 Meritor

- 12.12 Navistar

- 12.13 Noregon Systems

- 12.14 PACCAR

- 12.15 Snap-on

- 12.16 Tech Mahindra

- 12.17 TEXA

- 12.18 Valeo

- 12.19 Volvo Group

- 12.20 ZF Friedrichshafen