PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773353

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773353

Concrete Batch Plants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

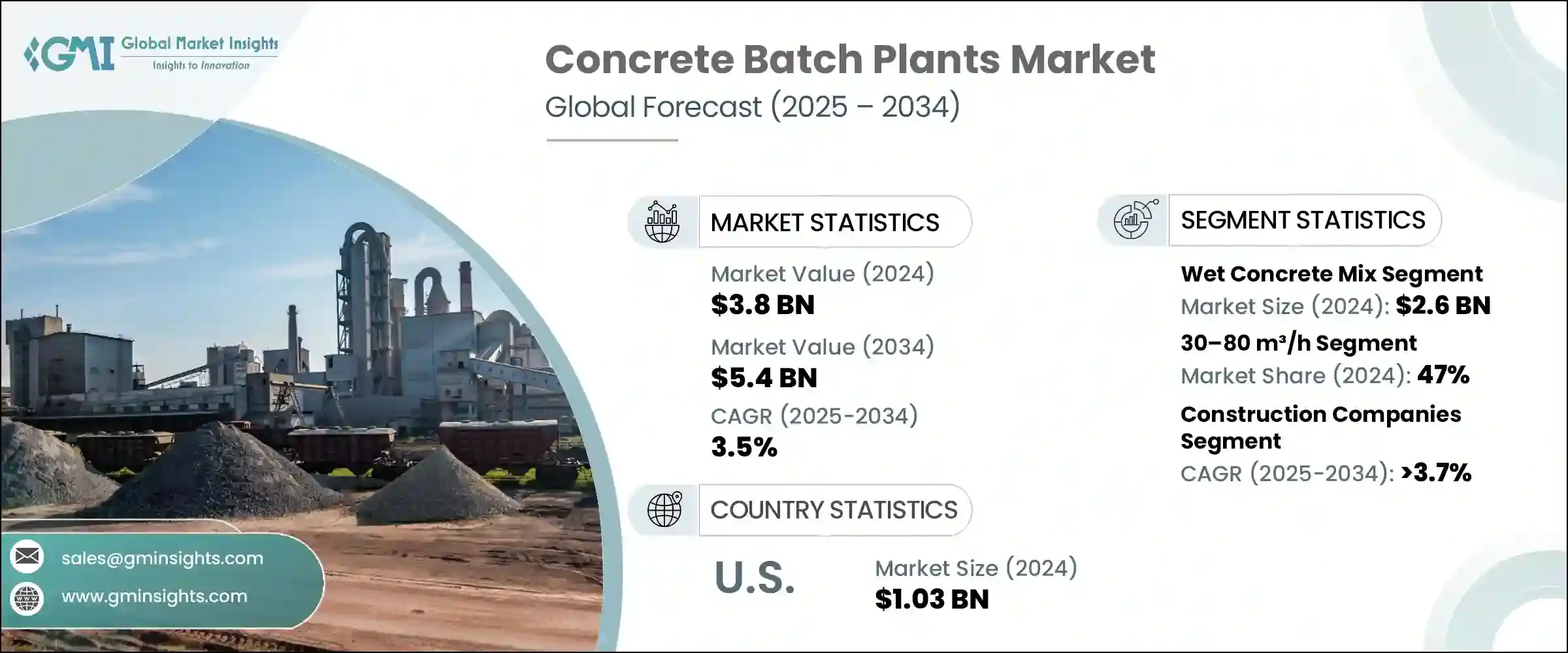

The Global Concrete Batch Plants Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 3.5% to reach USD 5.4 billion by 2034. This upward trend is supported by growing infrastructure development, rapid urban expansion, and the rising demand for efficient, high-quality concrete production methods. Governments and private entities across both developed and developing economies are continuing to invest in robust transportation systems, commercial hubs, housing developments, and energy-related infrastructure. These projects all rely heavily on consistent and high-performance concrete, which is fueling the need for advanced batch plants.

Mobile batching plants are gaining notable traction due to their on-site mixing capability, which reduces the reliance on transportation and speeds up project timelines. This demand spans across various sectors, including utilities, industrial development, and road construction. Evolving environmental policies and growing emphasis on sustainable construction are prompting contractors to consider electric-powered mobile plants over diesel-based alternatives, particularly in dense urban areas. Compact modular plants with portable features are increasingly being adopted for their ease of relocation and set-up flexibility. Furthermore, innovations like IoT integration, automation, and smart control panels are transforming plant operations, making real-time monitoring and minimal manual input possible.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 3.5% |

The wet concrete mix segment generated USD 2.6 billion in 2024 and is expected to grow at a CAGR of 3.7% from 2025 to 2034. Wet mix plants are gaining more preference as they allow all essential materials-including water-to be thoroughly mixed at the site before the concrete is loaded for delivery. This results in a more even mix and superior concrete quality, which appeals to construction professionals seeking consistency and reliability. Compared to dry batch plants that deliver pre-weighed materials for mixing in transit, wet mix systems offer greater control and uniformity, especially in larger projects requiring higher strength specifications. While dry mix solutions are useful for fast-moving, remote construction tasks, wet batching remains dominant for its better results and production precision.

Plants with a production capacity ranging from 30 to 80 m3/h segment accounted for 47% share in 2024 and are projected to register a CAGR of 3.9% during 2025-2034. These batch plants are ideally suited for medium-scale infrastructure developments and urban projects, balancing capacity with flexibility. Their moderate throughput enables contractors to deploy them for a wide range of applications such as commercial developments, municipal projects, and road paving operations. They strike a good balance between output efficiency and mobility, allowing users to adapt quickly to different project requirements.

Europe Concrete Batch Plants Market was valued at USD 800 million in 2024 and is anticipated to grow at a CAGR of 3.1% from 2025 to 2034. This regional growth is being shaped by regulatory pressure to cut construction emissions and the rising demand for sustainable building practices. Contractors throughout Europe are adopting mobile batch plants to reduce the environmental footprint of transporting concrete and to better align with eco-focused infrastructure initiatives. Western Europe sees steady demand supported by refurbishment and maintenance activities, while in Eastern Europe, the market is expanding rapidly due to public and private investment in infrastructure growth and emerging construction demands. Countries across the region are making sustainability central to development strategies, pushing the adoption of newer-generation concrete batching systems.

Key manufacturers leading the market include Sany, Elkon, Vince Hagan, Putzmeister, XCMG, Cemco, Meka, JEL Concrete Plants, SCHWING Stetter, Semix, Stephens Mfg, Ammann, AIMIX Group, Liebherr, and Astec. Top players in the concrete batch plants market are deploying several focused strategies to strengthen their competitive edge and enhance market share. Companies prioritize product innovation with a strong emphasis on automation and digital integration to deliver smart batching solutions with real-time control features. They are introducing energy-efficient models to align with sustainability trends and meet emission norms. Regional expansion through partnerships and localized manufacturing is helping firms improve market responsiveness and reduce logistics costs. Modular and portable plant designs are being emphasized to serve remote projects and fast-paced construction sites.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By type

- 2.2.3 By capacity

- 2.2.4 By mix type

- 2.2.5 By application

- 2.2.6 By end use

- 2.2.7 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code - 84743110)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Stationary batch plant

- 5.3 Mobile batch plant

Chapter 6 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Below 30 m³/h

- 6.3 30-80 m³/h

- 6.4 Above 80 m³/h

Chapter 7 Market Estimates & Forecast, By Mix Type, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Wet concrete mix

- 7.3 Dry concrete mix

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Residential construction

- 8.3 Commercial construction

- 8.3.1 Office buildings

- 8.3.2 Retail spaces

- 8.3.3 Hotels and resorts

- 8.3.4 Healthcare

- 8.3.5 Educational institutions

- 8.3.6 Others

- 8.4 Infrastructure projects

- 8.4.1 Roads and highways

- 8.4.2 Bridges and tunnels

- 8.4.3 Airports and seaports

- 8.4.4 Railways and Metros

- 8.4.5 Dam & reservoirs

- 8.4.6 Wind farms and solar farms

- 8.4.7 Warehouses

- 8.4.8 Others

- 8.5 Municipality & smart city projects

- 8.6 Industrial construction

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Construction companies

- 9.3 Government agencies

- 9.4 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AIMIX Group

- 12.2 Ammann

- 12.3 Astec

- 12.4 Cemco

- 12.5 Elkon

- 12.6 JEL Concrete Plants

- 12.7 Liebherr

- 12.8 Meka

- 12.9 Putzmeister

- 12.10 Sany

- 12.11 SCHWING Stetter

- 12.12 Semix

- 12.13 Stephens Mfg

- 12.14 Vince Hagan

- 12.15 XCMG