PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773367

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773367

Passenger Vehicle Diesel Engine Exhaust Valve Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

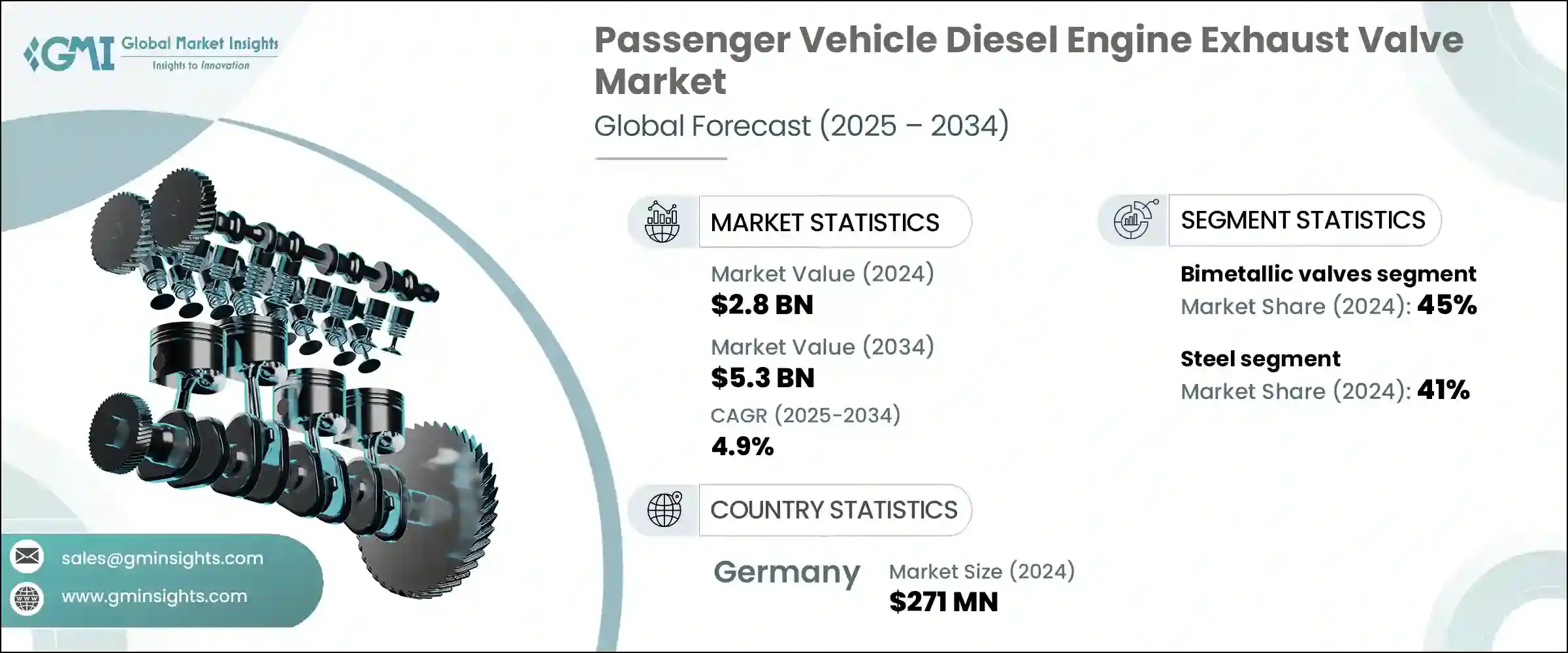

The Global Passenger Vehicle Diesel Engine Exhaust Valve Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 5.3 billion by 2034. This steady growth is largely fueled by the expansion of automotive aftermarket services, especially in regions where diesel passenger vehicles have been in use for many years. Instead of purchasing new cars, vehicle owners increasingly prefer maintaining and replacing key components like exhaust valves, ensuring ongoing demand in the aftermarket sector. The rise of online distribution channels and the widespread availability of local repair shops has further enhanced access to replacement parts, creating reliable revenue streams for valve manufacturers independent of original equipment manufacturer (OEM) contracts. This trend is particularly significant in markets with stagnant new vehicle sales but rising aftermarket maintenance activities.

Advancements in research and development are playing a critical role in enhancing exhaust valve performance. Innovations such as specialized surface coatings, bimetallic valve designs, and the use of heat-resistant steel alloys have extended valve durability, improved emissions compliance, and optimized overall engine efficiency. The precision afforded by CNC machining and digital inspection technologies has allowed manufacturers to fine-tune valve geometries to meet the demanding conditions of modern diesel engines, which operate under increased combustion pressures and tighter emissions standards. These technological improvements enable OEMs to continue integrating diesel engines into power-dense passenger vehicles while meeting regulatory requirements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 4.9% |

In 2024, bimetallic valves dominated the market by 45% share and are forecasted to grow at a CAGR of 5% through 2034. Their popularity stems from their exceptional blend of strength and thermal resistance, making them ideal for diesel engines operating under extreme heat and pressure. These valves typically feature a heat-resistant austenitic steel head combined with a martensitic or chrome steel stem, offering superior performance and longevity in demanding engine environments.

The steel valve segment accounted for 41% share in 2024 and is projected to grow at a CAGR of 4% between 2025 and 2034. Steel valves remain the most cost-effective option due to existing manufacturing infrastructure that favors traditional forging and machining processes over more expensive alternatives like titanium or nickel alloys. High-grade steel valves demonstrate remarkable resistance to harsh operating conditions, corrosion, and wear. The inclusion of chromium, molybdenum, and vanadium alloys enhances their durability, creep resistance, and fatigue life, particularly benefiting lean burn and turbocharged diesel engines without the need for costly materials.

Germany Passenger Vehicle Diesel Engine Exhaust Valve Market held a 25% share and generated USD 271 million in 2024. Germany's automotive sector benefits from a well-established production ecosystem and its continued commitment to diesel technology supports steady demand for exhaust valves. German manufacturers are poised to increase the output of premium diesel SUVs, multi-purpose vehicles, and sedans destined for export markets including Eastern Europe, Latin America, and Africa. While much of Europe shifts toward electric mobility, Germany maintains a strong focus on clean diesel compliance, aligning with Euro 6d standards and reinforcing its position in the diesel engine segment.

Key players competing in the Global Passenger Vehicle Diesel Engine Exhaust Valve Market include Mahle, Aisan, Fuji Oozx, Eaton, Rane, Nittan, Dengyun Auto Parts, SSV, Yangzhou Guanghui, and Tenneco. These companies collectively shape market dynamics through continuous product innovation and strategic collaborations. To strengthen their foothold in the passenger vehicle diesel engine exhaust valve market, companies prioritize innovation in materials and manufacturing processes to improve valve durability and emissions compliance. They invest heavily in R&D to develop advanced surface coatings and bimetallic designs that meet increasingly strict regulatory standards. Firms also focus on expanding aftermarket distribution networks by partnering with local service providers and enhancing e-commerce platforms, ensuring easier access to replacement parts worldwide. Strategic alliances with OEMs enable these manufacturers to secure long-term supply contracts while simultaneously targeting aftermarket growth in regions with aging diesel vehicle fleets.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Valve type

- 2.2.3 Vehicle

- 2.2.4 Material

- 2.2.5 Engine type

- 2.2.6 Sales channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for diesel-powered SUVs & sedans

- 3.2.1.2 High torque & fuel efficiency requirements

- 3.2.1.3 Increasing focus on engine durability

- 3.2.1.4 Rise in premium & multipurpose segments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Declining global demand for diesel passenger vehicles

- 3.2.2.2 Stringent emission regulations increasing compliance costs

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for heavy-duty diesel SUVs and MPVs

- 3.2.3.2 Stricter emission norms driving valve innovation

- 3.2.3.3 Aftermarket growth from valve replacements

- 3.2.3.4 Advancements in valve material and design

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Case studies

- 3.9 Use cases

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Valve Type, 2021 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Monometallic valves

- 5.3 Bimetallic valves

- 5.4 Hollow valves

- 5.5 Sodium-filled valves

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Hatchback

- 6.3 Sedan

- 6.4 SUVs

- 6.5 MPV (multi-purpose vehicle)

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Titanium

- 7.4 Nickel-based alloys

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Engine type, 2021 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 Turbocharged diesel engine

- 8.3 Naturally aspirated diesel engine

Chapter 9 Market Estimates & Forecast, By Sales channel, 2021 - 2034 (USD Million, Units)

- 9.1 Key trends

- 9.2 OEMs (Original equipment manufacturers)

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aisan

- 11.2 AnFu

- 11.3 Burg

- 11.4 Dengyun Auto-parts

- 11.5 Eaton

- 11.6 Ferrea

- 11.7 Fuji Oozx

- 11.8 JinQingLong

- 11.9 Mahle

- 11.10 Nittan

- 11.11 Rane

- 11.12 ShengChi

- 11.13 SSV

- 11.14 Tenneco (including Federal-Mogul)

- 11.15 Tongcheng

- 11.16 Tyen Machinery

- 11.17 Wode Valve

- 11.18 Worldwide Auto

- 11.19 Xin Yue

- 11.20 Yangzhou Guanghui