PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773373

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773373

North America Microinverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

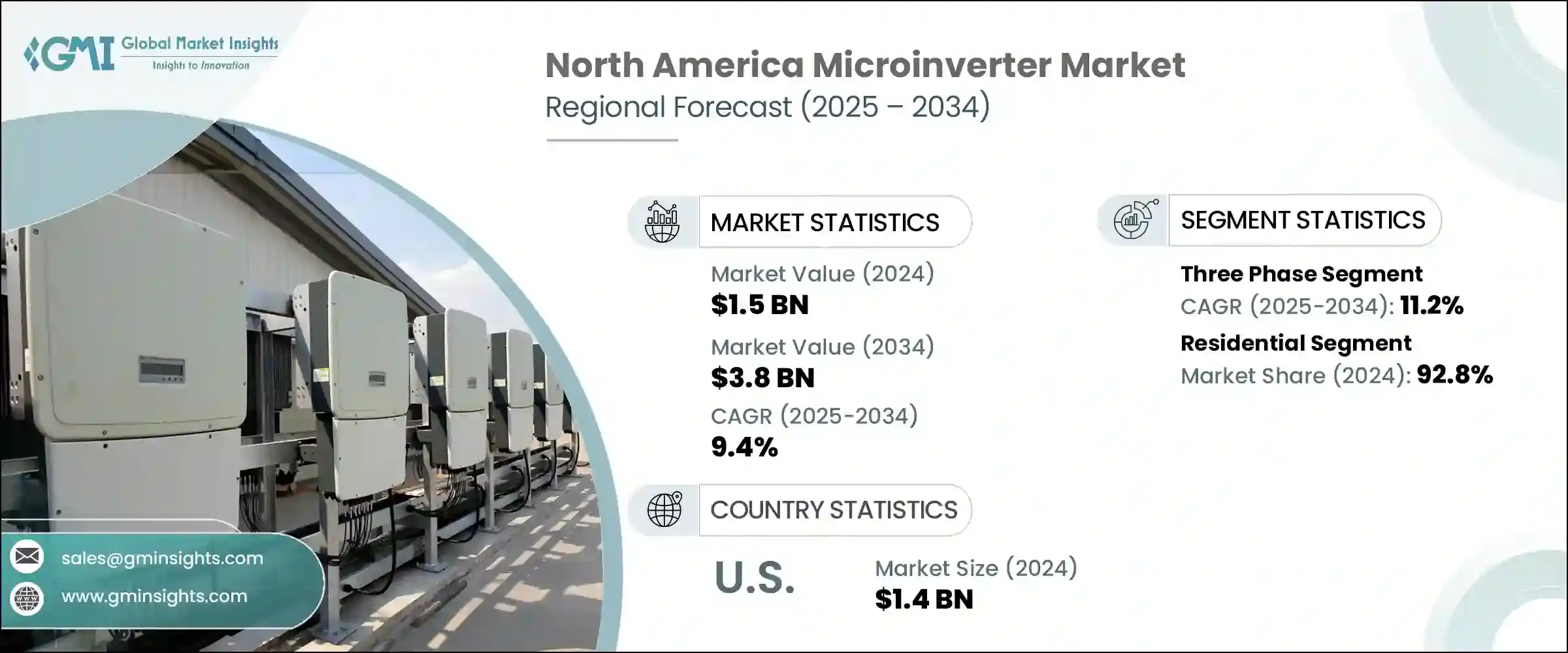

North America Microinverter Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 3.8 billion by 2034. Rising demand for real-time system performance tracking and safer solar power solutions is playing a key role in accelerating microinverter adoption across the region. These devices offer the benefit of module-level monitoring, allowing users to identify faults instantly, optimize energy production, and reduce system maintenance costs. Their value becomes even more evident in residential and small commercial installations that feature multiple roof angles or shaded environments, typical in dense urban and suburban areas. Microinverters are also gaining traction due to the growing adoption of solar-plus-storage setups, as their seamless integration with AC-coupled batteries offers added design flexibility. This is particularly important in regions frequently impacted by grid outages. A strong base of regional manufacturers is further contributing to improved availability, installation support, and consumer trust.

Rising regulatory focus on energy resilience and localized power generation is making microinverters an increasingly preferred technology, especially as they comply with evolving safety mandates and system optimization protocols tailored for rooftop solar setups. Their ability to meet rapid shutdown requirements, minimize single-point failures, and support grid-independent performance aligns with the priorities of both policymakers and end users. With a heightened emphasis on grid stability and home energy autonomy, microinverters offer a decentralized architecture that enables each panel to function independently, maximizing uptime even in partial shading or system disruptions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 9.4% |

The single-phase microinverter segment is projected to reach USD 3.4 billion by 2034, owing to its simplified installation process, enhanced safety features, and module-level performance optimization. These systems are well-suited for rooftop solar deployments with complex layouts or partial shading and are known for improving energy yield across variable conditions. Their decentralized architecture, which avoids single points of failure, offers increased system uptime and aligns well with safety mandates such as rapid shutdown compliance, making them especially attractive in the residential market.

In 2024, the residential installations segment held a 92.8% share. Homeowners are increasingly opting for inverter systems capable of managing energy output at the individual module level, which improves performance on rooftops that may not be ideally oriented or uniformly shaded. These systems also offer built-in safety mechanisms that meet or exceed local code requirements, while reducing labor costs due to easier and faster installation-further reinforcing their popularity in the residential segment.

U.S. Microinverter Market was valued at USD 1.4 billion in 2024. This growth was driven in part by mandatory compliance with rapid shutdown requirements, which has made module-level power electronics indispensable in ensuring both residential and commercial solar system safety. The country's strong move toward decentralized energy, paired with the rising appeal of plug-and-play solar technologies, is also influencing demand. Consumer preferences for high-efficiency, low-maintenance solar solutions are growing, and generous federal and state incentives-like the investment tax credit-are lowering the entry barrier for homeowners and businesses alike.

Prominent companies in the North America Microinverter Market include Enphase Energy, Sungrow, APSystems, Hoymiles, Growatt New Energy, SMA Solar Technology, Northern Electric Power Technology, Sparq System, Yotta Energy, Chilicon Power, Fimer Group, Deye Inverter Technology, NingBo Deye Inverter Technology, and Darfon Electronics. To expand their presence in the North America microinverter market, companies are focusing on several core strategies.

Many are enhancing R&D efforts to introduce next-gen models with better efficiency and smarter grid compatibility. Manufacturers are also prioritizing strategic alliances with solar module and battery storage providers to deliver bundled solutions. Several firms are expanding their installer networks and offering extensive training to improve product installation and service quality. Strong emphasis is placed on ensuring compliance with evolving safety and energy codes across U.S. states.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Industry Insights

- 2.1 Industry ecosystem

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive landscape, 2024

- 3.1 Introduction

- 3.2 Company market share

- 3.3 Strategic dashboard

- 3.4 Strategic initiative

- 3.5 Competitive benchmarking

- 3.6 Innovation & sustainability landscape

Chapter 4 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & MW)

- 4.1 Key trends

- 4.2 Single phase

- 4.3 Three phase

Chapter 5 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Stand alone

- 5.3 On grid

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

Chapter 7 Market Size and Forecast, By Country, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 U.S.

- 7.3 Canada

Chapter 8 Company Profiles

- 8.1 APSystems

- 8.2 Chilicon Power

- 8.3 Deye Inverter Technology

- 8.4 Darfon Electronics

- 8.5 Enphase Energy

- 8.6 Fimer Group

- 8.7 Growatt New Energy

- 8.8 Hoymiles

- 8.9 NingBo Deye Inverter Technology

- 8.10 Northern Electric Power Technology

- 8.11 SMA Solar Technology

- 8.12 Sparq System

- 8.13 Sungrow

- 8.14 Yotta Energy