PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773384

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773384

Bioplastic for Interior Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

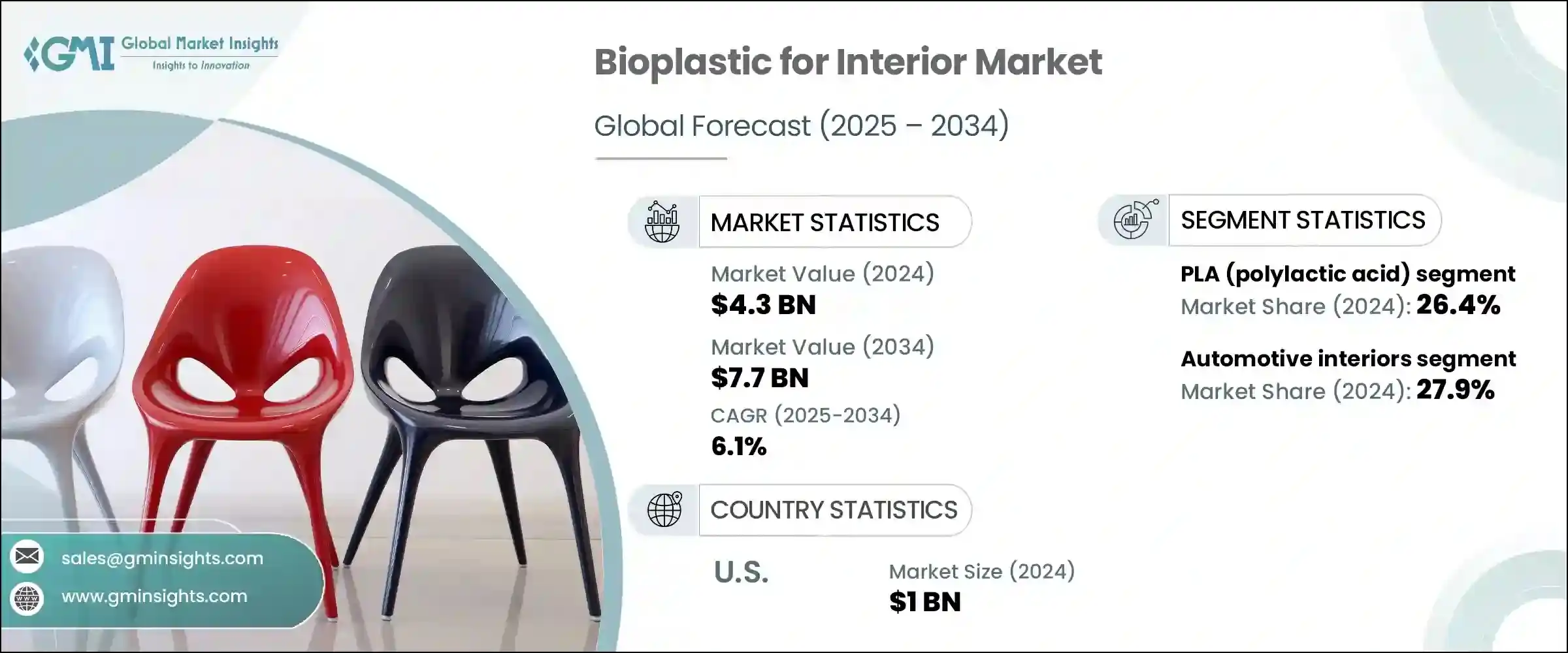

The Global Bioplastic for Interior Market was valued at USD 4.3 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 7.7 billion by 2034. Growing environmental consciousness among consumers and organizations is reshaping the interior materials landscape, encouraging the shift toward renewable, low-impact alternatives. Traditional plastics are increasingly being replaced by bioplastics, which are derived from natural sources such as sugarcane, corn, and cellulose. These materials not only support environmental goals but also deliver practical advantages like biodegradability and reduced carbon emissions, aligning with the broader push for sustainable living and production practices.

As people seek more eco-conscious design elements, the demand for green interiors is accelerating, reinforcing the role of bioplastics in this transition. The move away from petroleum-based plastics is no longer limited to niche applications; it is gaining traction across furniture, wall treatments, interior decorative elements, and flooring, among other uses. Stricter global waste management regulations and mounting concerns over plastic pollution are pressuring manufacturers to adopt sustainable alternatives, further fueling the growth of bioplastics in interior applications. Businesses are also realizing the commercial value of catering to environmentally driven preferences, leading to widespread adoption of bioplastic materials that offer performance without compromising sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.3 Billion |

| Forecast Value | $7.7 Billion |

| CAGR | 6.1% |

In 2024, polylactic acid (PLA) accounted for 26.4% of the total market share by polymer type. PLA continues to lead the segment due to its favorable environmental profile, renewability, and wide usability. Sourced from plant-based sugars, PLA offers a sustainable substitute for conventional plastic components. Its visual clarity and strong mechanical performance make it a preferred choice for a variety of interior applications, especially where transparency or a polished finish is important. As demand for environmentally responsible solutions grows, PLA stands out as a go-to polymer for manufacturers aiming to blend functionality with ecological benefits.

From an application standpoint, automotive interiors held the largest share in 2024, contributing 27.9% to the overall market. Automakers are actively replacing traditional plastic parts with bioplastics to meet both environmental regulations and consumer expectations. The ability of bioplastics to deliver weight savings plays a significant role in enhancing fuel efficiency while also supporting vehicle recyclability. These materials are used in numerous interior parts, including seat bases, dashboard structures, trim pieces, and panels. Their capacity for precise molding and compatibility with cleaner production techniques make them ideal for automotive applications, where performance and design flexibility are equally important.

On the basis of end users, the building construction segment led the market in 2024, capturing a dominant position. However, automotive OEMs emerged as the most active adopters of bioplastics in the interiors domain. These companies are heavily involved in integrating bio-based materials into vehicle interiors as part of broader environmental strategies. Incorporating bioplastics in structural and aesthetic parts not only reduces vehicle mass but also lowers lifecycle emissions. Many companies are forming long-term collaborations with material suppliers to enhance their bioplastic sourcing capabilities and ensure stable supply chains.

Furniture manufacturers ranked second in terms of bioplastic usage. They are incorporating bio-based materials into modular systems and sustainable home decor, meeting the evolving needs of environmentally conscious buyers. Interior design studios are customizing projects with bioplastics, particularly in high-end residential and commercial settings that adhere to green certification programs. The use of these materials is also rising in retail and showroom installations, where sustainable aesthetics contribute to brand positioning. Additionally, builders and commercial interior contractors are turning to bioplastics for items like cladding, panels, and partitions that comply with modern green building codes.

In 2024, the bioplastic for interior market in the United States was valued at USD 1 billion. Growth in the U.S. is being driven by a combination of consumer awareness and regulatory efforts to reduce environmental impact, especially in the automotive and construction sectors. Leading manufacturers are prioritizing bio-based materials in response to consumer demands for cleaner technologies and sustainable products. Enhanced material performance, driven by innovation in bio-polymers, is allowing smoother integration of bioplastics into large-scale production lines. As a result, U.S.-based producers are not only expanding their capabilities but also setting new benchmarks for sustainable manufacturing.

Globally, the bioplastic for interior market are shaped by a competitive environment where companies are focusing on proprietary materials, advanced processing technologies, and sustainable production models. Leading players are increasingly securing upstream raw material sources to stabilize costs and ensure availability. At the same time, efforts to improve product durability, achieve green certifications, and offer design flexibility are helping companies differentiate themselves. These strategies are enabling key stakeholders to stay ahead in a market that is quickly evolving to meet both regulatory demands and consumer expectations for environmentally friendly interiors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Polymer type

- 2.2.2 Application

- 2.2.3 End use

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By polymer type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Polymer Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 PLA (polylactic acid)

- 5.3 Starch-based bioplastics

- 5.4 Polyhydroxyalkanoates (PHA)

- 5.5 Cellulose-based bioplastics

- 5.6 Bio-PE (bio-polyethylene)

- 5.7 Bio-PET (bio-polyethylene terephthalate)

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Automotive interiors

- 6.3 Furniture & home interiors

- 6.4 Commercial & office interiors

- 6.5 Retail & hospitality interiors

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive OEM

- 7.3 Furniture manufacturers

- 7.4 Interior design firms

- 7.5 Retailers & showrooms

- 7.6 Contractors & Builders

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Arkema S.A.

- 9.2 BASF SE

- 9.3 Biome Bioplastics

- 9.4 Braskem S.A.

- 9.5 Cardia Bioplastics

- 9.6 Celanese Corporation

- 9.7 Covestro AG

- 9.8 DuPont de Nemours, Inc

- 9.9 Evonik Industries AG

- 9.10 FKuR Kunststoff GmbH

- 9.11 Mitsubishi Chemical Group

- 9.12 NatureWorks LLC

- 9.13 Novamont

- 9.14 TotalEnergies Corbion