PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835658

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835658

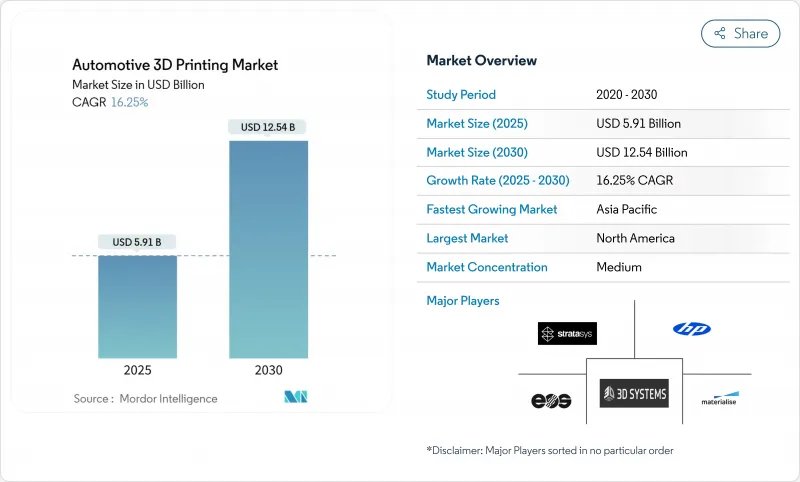

Automotive 3D Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive 3D printing market is valued at USD 5.91 billion in 2025 and is forecast to reach USD 12.54 billion by 2030, reflecting a 16.25% CAGR.

The shift from prototyping toward full-scale production is accelerating as breakthroughs in multi-material processing, digital supply-chain orchestration, and artificial-intelligence-driven quality control redefine manufacturing economics. Demand for lightweight components that meet stringent emissions rules, illustrated by BMW's 27% emissions reduction using wire-arc additive manufacturing, underpins growth. Hardware advances in fused deposition modeling (FDM) and selective laser sintering (SLS) improve throughput, while cost-effective iron-silicon powders open metal applications for electric-vehicle (EV) motor parts. Regulatory pressure, on-shoring strategies, and the availability of sustainable feedstocks align to expand the Automotive 3D printing market across established and emerging economies.

Global Automotive 3D Printing Market Trends and Insights

EV Lightweight-Parts Demand

Electric vehicle makers pursue weight optimization to extend their range and comply with emissions standards. General Motors integrates more than 130 printed parts in the Cadillac Celestiq, including the largest additively manufactured aluminum component in automotive production. Europe's Euro 7 norms accelerate adoption for brake-disc coatings and structural elements. Sand-based 3D printing shortens mold-development cycles, enabling casting designs that reduce mass while preserving tolerance targets. The need to offset battery weight intensifies competitive incentives to remove every gram across vehicle platforms.

Rapid Prototyping Cost-Cuts

Enterprises report up to 90% reductions in prototype lead times and sharp declines in single-part costs as additive manufacturing replaces machining for early-stage design iterations. Stereolithography's high dimensional accuracy supports low-cost investment casting alternatives, while AI-based build-parameter optimization elevates first-time-right success rates. Desktop SLS printers priced below USD 3,000 broaden access for small and midsize suppliers, compressing innovation cycles across Asia-Pacific manufacturing clusters.

High Cost of Metal Printers

Industrial SLS printers list between USD 12,000 and USD 33,000, while specialty metal powders average USD 300-600 per kg, limiting adoption among cost-sensitive suppliers. Helium-atomized powder production offers the most sustainable route, yet capital outlays remain steep. Lifecycle analyses show powder-bed fusion is economical for high-complexity components, but up-front capital still deters wide deployment. Lower-cost metal-filament processes mitigate entry barriers but add post-processing complexity, reducing the Automotive 3D printing market CAGR by 2.4 percentage points

Other drivers and restraints analyzed in the detailed report include:

- Custom Production Tooling

- Digital Spare-Parts Inventory

- Material-Qualification Gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

FDM accounted for 38.32% of the Automotive 3D printing market share in 2024, owing to low system costs and broad material selection. SLS is projected to grow at an 18.53% CAGR through 2030 as desktop powder-bed systems below USD 3,000 democratize high-performance nylon and composite printing. Advances in nanoscale photopolymerization have pushed stereolithography resolution to 100 nm at 100 µm per second, extending its use into microfluidic and optics applications. Digital Light Processing (DLP) increasingly supports jewelry and dental models, while electron-beam melting serves aerospace titanium parts. The Automotive 3D printing market size for SLS-based parts is forecast to expand sharply as EV manufacturers adopt durable nylon gears and under-hood components.

Hybrid manufacturing that blends additive and subtractive techniques is gaining ground. FDM toolpaths integrate continuous-fiber reinforcement, improving tensile strength without secondary operations. Holographic volumetric printing demonstrates up-to-20-fold speed gains by curing entire layers simultaneously, holding promise for high-volume automotive interiors. Continual improvements in process simulation software reduce trial iterations, ensuring FDM retains relevance even as the SLS installed base rises.

Hardware captured 57.32% of 2024 revenue, encompassing printers, post-processing stations, and scanners. However, software is expanding at 18.78% CAGR as machine-learning algorithms cut defect rates and orchestrate multi-factory fleets. Manufacturing operations platforms deployed at Baker Hughes trimmed monitoring time by 98% and scrap by 18%. Service bureaus flourish when automakers outsource specialty materials or small production runs that do not justify capital spending.

AI-driven build-parameter engines reduce engineering labor by 80%, contributing to a rising software share within the Automotive 3D printing market. Browser-based collaboration suites allow design iterations across continents, enabling simultaneous engineering and rapid release to production. As cloud connectivity scales, subscription revenue offers vendors a high-margin annuity, shifting the competitive balance from machines to digital ecosystems

The 3D Printing in Automotive Industry Market Report is Segmented by Technology Type (Selective Laser Sintering (SLS), Stereo Lithography (SLA), and More ), Component Type (Hardware, Software, and Service), Material Type (Metal, Polymer, and More), Application Type (Production, Prototyping, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America leads the Automotive 3D printing market with a 38.63% share in 2024, supported by the United States' dominant aerospace and EV supply chains. GE Aerospace's USD 1 billion investment in additive facilities signals long-term confidence in domestic productio. Reshoring initiatives combined with the Inflation Reduction Act incentivize localized manufacturing, accelerating printer installations across automotive tiers. Canada and Mexico contribute through lightweight truck components and aerospace casting molds, leveraging cross-border trade frameworks.

Asia-Pacific is the fastest-growing region at a 19.47% CAGR through 2030, propelled by China's manufacturing digitalization and India's emerging bioprinting startups. Chinese five-year plans earmark additive manufacturing as a strategic pillar, spurring installation growth across automotive hubs and battery factories. India's collaboration between EOS and Godrej accelerates aerospace applications, while public-private R&D centers foster skill development. Japan and South Korea push materials innovation, developing heat-resistant polymers tailored to hybrid-electric powertrains. Southeast Asian electronics clusters adopt 3D printing for tooling, aided by government tax incentives.

Europe holds a significant share, anchored by Germany where majority of manufacturers deploy additive processes. The region invests 30.6% of AM company turnover back into R&D, reinforcing leadership in metal-printer exports. France and Italy expand composite printing for supercars, while Scandinavia explores bio-based polymers for vehicle interiors. Regulatory alignment through ISO/ASTM standards supports cross-border qualification of printed parts, smoothing supply-chain flows. Emerging regions in South America and the Middle East pursue diversification; Saudi Arabia outfits SMEs with entry-level printers to decrease energy consumption in metal fabrication. Brazil pilots additive repair hubs for agricultural machinery, demonstrating the technology's reach beyond high-income economies.

- Stratasys Ltd

- 3D Systems Corporation

- EOS GmbH

- HP Inc.

- Materialise NV

- GE Additive (Arcam AB)

- Desktop Metal (ExOne)

- Ultimaker BV

- Voxeljet AG

- Carbon Inc.

- Hoganos AB

- EnvisionTEC GmbH

- SLM Solutions Group AG

- Renishaw plc

- BASF Forward AM

- Markforged Inc.

- Sindoh Co. Ltd

- XYZprinting Inc.

- Moog Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV lightweight-parts demand

- 4.2.2 Rapid prototyping cost-cuts

- 4.2.3 Custom production tooling

- 4.2.4 Digital spare-parts inventory

- 4.2.5 Multi-material AM integration

- 4.2.6 Supply-chain on-shoring push

- 4.3 Market Restraints

- 4.3.1 High cost of metal printers

- 4.3.2 Material-qualification gaps

- 4.3.3 Energy-intensive laser systems

- 4.3.4 IP-security concerns

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Technology Type

- 5.1.1 Selective Laser Sintering (SLS)

- 5.1.2 Stereolithography (SLA)

- 5.1.3 Digital Light Processing (DLP)

- 5.1.4 Electron Beam Melting (EBM)

- 5.1.5 Selective Laser Melting (SLM)

- 5.1.6 Fused Deposition Modeling (FDM)

- 5.2 By Component Type

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Service

- 5.3 By Material Type

- 5.3.1 Metal

- 5.3.2 Polymer

- 5.3.3 Ceramic

- 5.3.4 Composite

- 5.4 By Application Type

- 5.4.1 Production

- 5.4.2 Prototyping

- 5.4.3 Tooling and Fixtures

- 5.4.4 Spare-Parts / MRO

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Stratasys Ltd

- 6.4.2 3D Systems Corporation

- 6.4.3 EOS GmbH

- 6.4.4 HP Inc.

- 6.4.5 Materialise NV

- 6.4.6 GE Additive (Arcam AB)

- 6.4.7 Desktop Metal (ExOne)

- 6.4.8 Ultimaker BV

- 6.4.9 Voxeljet AG

- 6.4.10 Carbon Inc.

- 6.4.11 Hoganos AB

- 6.4.12 EnvisionTEC GmbH

- 6.4.13 SLM Solutions Group AG

- 6.4.14 Renishaw plc

- 6.4.15 BASF Forward AM

- 6.4.16 Markforged Inc.

- 6.4.17 Sindoh Co. Ltd

- 6.4.18 XYZprinting Inc.

- 6.4.19 Moog Inc.

7 Market Opportunities & Future Outlook