PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773398

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773398

Peptic Ulcers Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

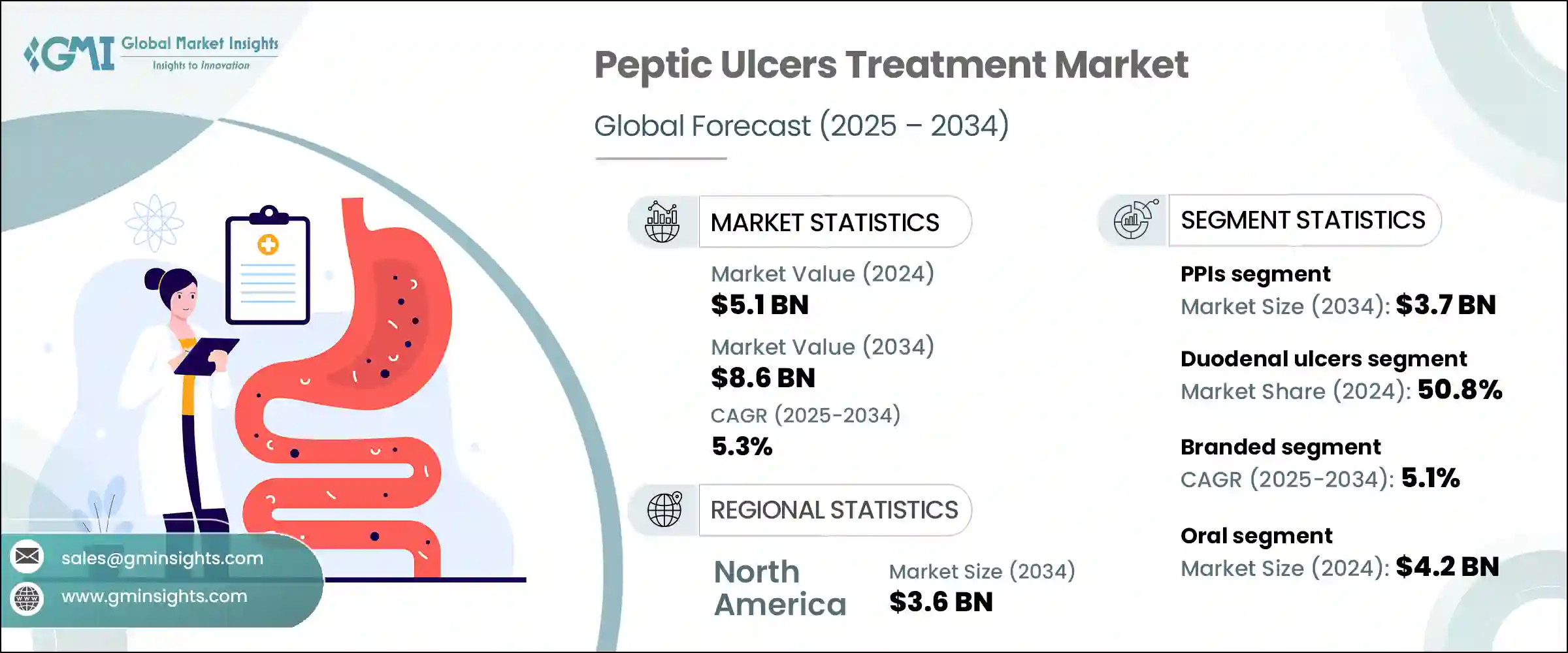

The Global Peptic Ulcers Treatment Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 8.6 billion by 2034. The market growth is largely driven by the rising incidence of gastrointestinal conditions among adults and the continued development of innovative pharmaceutical solutions. A key contributor to this demand is the widespread prevalence of Helicobacter pylori infections, which remain a dominant cause of peptic ulcers globally. As noted by global health bodies, this infection affects more than half the world's population, with particularly high rates in low- and middle-income regions. This alarming prevalence is expected to accelerate the demand for more effective treatment options to manage and eliminate the condition.

Another factor fueling market expansion is the increasing misuse of non-steroidal anti-inflammatory drugs, which often damage the stomach lining and lead to ulcer formation. Alongside this, advancements in diagnostics and the rising adoption of innovative treatment regimens-including dual and triple combination therapies-are improving patient recovery rates and minimizing ulcer recurrence. These factors, combined with rising awareness and enhanced healthcare accessibility in both developed and emerging countries, are expected to sustain steady demand for peptic ulcer treatment solutions in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8.6 Billion |

| CAGR | 5.3% |

The proton pump inhibitors (PPIs) segment generated USD 2.3 billion in 2024 and is forecasted to hit USD 3.7 billion by 2034, registering a CAGR of 5.1%. PPIs have become the cornerstone of ulcer therapy due to their effectiveness in reducing gastric acid levels, accelerating healing, and relieving pain. Their dependable efficacy and minimal side effects have made them widely preferred in treatment regimens. Their contribution to multi-drug therapy approaches for H. pylori eradication further cements their dominant market position. High healing success rates have been consistently reported in clinical settings, particularly when PPIs are administered over a treatment window of four to eight weeks.

The duodenal ulcers segment held a 50.8% share in 2024 and is set to experience significant growth throughout the forecast period. These ulcers typically form in the upper part of the small intestine and are primarily triggered by bacterial infection and long-term use of NSAIDs. They are prevalent across a broad population and frequently present with distinct symptoms that allow for quicker diagnosis and more immediate intervention, supporting higher treatment rates.

North America Peptic Ulcers Treatment Market generated USD 2.1 billion in 2024 and is expected to reach USD 3.6 billion by 2034, growing at a CAGR of 5.5%. This regional dominance can be attributed to the high burden of NSAID-related complications and H. pylori cases. A well-established healthcare framework, better access to advanced medications, and increasing awareness regarding gastrointestinal care and preventive health all contribute to the region's strong market position. Additionally, the active presence of leading pharmaceutical companies continues to support growth in this region.

Major players in the Global Peptic Ulcers Treatment Industry include Takeda, GlaxoSmithKline, Cadila Healthcare, Aurobindo Pharma, Ranbaxy Laboratories, Pfizer, Dr. Reddy's Laboratories, Strides Pharma, Phathom Pharmaceuticals, Granules India, AstraZeneca, Sun Pharma, Eisai, and Azurity Pharmaceuticals. To solidify their market positions, key players in the peptic ulcer treatment space are focusing on diverse strategic initiatives. Many are investing heavily in R&D to develop new therapies with higher efficacy and lower side effects. Formulation improvements, especially around combination drug regimens, are aimed at increasing treatment adherence and minimizing recurrence.

Companies are also expanding their manufacturing capabilities and strengthening their global supply chains to ensure wider access to treatment. Additionally, firms are entering strategic partnerships and engaging in mergers and acquisitions to broaden their portfolios and geographical presence. Targeted awareness campaigns and physician education programs further enhance product visibility and brand credibility, especially in emerging healthcare markets where diagnostic and treatment rates are steadily climbing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Drug type

- 2.2.3 Ulcer type

- 2.2.4 Medication type

- 2.2.5 Route of administration

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of Helicobacter pylori Infections

- 3.2.1.2 Growing geriatric population

- 3.2.1.3 Expanding R&D fundings and activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects of long-term PPI use

- 3.2.3 Market opportunities

- 3.2.3.1 Novel therapies & drug delivery innovations

- 3.2.3.2 Expansion of online pharmacies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Regulatory landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Proton pump inhibitors (PPIs)

- 5.3 H2-receptor antagonists

- 5.4 Antacids

- 5.5 Antibiotics

- 5.6 Cytoprotective agents

- 5.7 Other drug types

Chapter 6 Market Estimates and Forecast, By Ulcer Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Gastric ulcers

- 6.3 Duodenal ulcers

- 6.4 Esophageal ulcers

Chapter 7 Market Estimates and Forecast, By Medication Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generics

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral Parenteral

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital pharmacies

- 9.3 Retail pharmacies

- 9.4 Online pharmacies

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AstraZeneca

- 11.2 Aurobindo Pharma

- 11.3 Azurity Pharmaceuticals

- 11.4 Cadila Healthcare

- 11.5 Dr. Reddy’s Laboratories

- 11.6 Eisai

- 11.7 GlaxoSmithKline

- 11.8 Granules India

- 11.9 Pfizer

- 11.10 Phathom Pharmaceuticals

- 11.11 Ranbaxy Laboratories

- 11.12 Strides Pharma

- 11.13 Sun Pharma

- 11.14 Takeda