PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773442

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773442

Diabetic Foot Ulcer Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

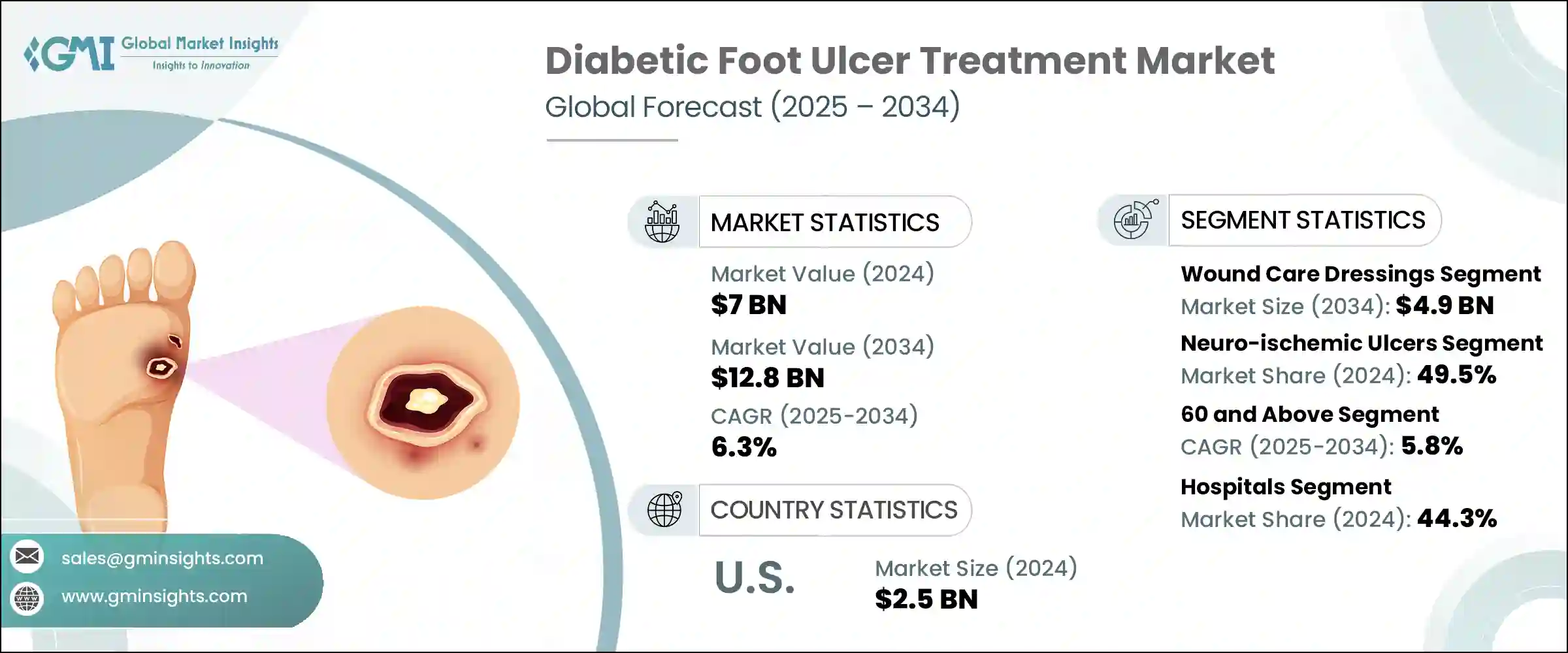

The Global Diabetic Foot Ulcer Treatment Market was valued at USD 7 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 12.8 billion by 2034. This growth is being fueled by a combination of rising chronic wound cases, an aging global population, and increasing healthcare expenditure. Innovations in advanced wound care, including engineered skin substitutes, regenerative tissue products, and state-of-the-art wound therapy devices, are drastically improving treatment outcomes and shortening healing times. Government support and reimbursement schemes targeting diabetes-related limb loss are pushing the adoption of advanced care. Furthermore, expanding patient awareness around early diagnosis, particularly in lower-income regions, is propelling demand for treatment. These dynamics are expected to strongly support the global rise in diabetic foot ulcer interventions in the years ahead.

Diabetic foot ulcer treatment focuses on clinically managing open wounds or sores that form on the feet due to complications of diabetes, including nerve damage, reduced circulation, and prolonged pressure. Treatment methods include medical-grade antibiotics, wound-cleaning procedures like debridement, biologic-based therapies, and newer advanced healing technologies. The core objective is to promote wound closure, avoid serious complications such as infections or amputations, and improve overall recovery outcomes. Rapid progress in therapies such as bioengineered grafts, pressure therapy systems, and intelligent dressings like hydrogels and antimicrobials has helped elevate success rates in managing these complex wounds.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7 Billion |

| Forecast Value | $12.8 Billion |

| CAGR | 6.3% |

The wound care dressings segment in the diabetic foot ulcer treatment market generated USD 2.7 billion in 2024 and is projected to reach USD 4.9 billion by 2034, growing at a CAGR of 6.1%. This segment includes several dressing types, such as foam, hydrocolloids, alginates, hydrogels, and antimicrobial-based solutions. Rising consumer and clinical awareness of the benefits of specialized dressing materials has increased their utilization. Additionally, an uptick in product approvals and strong research-backed innovation in smart wound care materials-designed to create optimal healing environments while preventing infections-has contributed to their growing dominance in the market.

The neuro-ischemic ulcer segment captured the highest share of 49.5% in 2024. This ulcer type is frequently seen in patients with diabetes who suffer from combined nerve damage and poor blood circulation. Due to the complex nature of these ulcers, they are highly prone to delayed healing and complications, requiring more personalized and aggressive interventions. As diabetes becomes more prevalent globally, more patients are at risk of neuro-ischemia, reinforcing the demand for effective, targeted treatments and securing this segment's strong foothold in the market.

North America Diabetic Foot Ulcer Treatment Market with USD 2.8 billion in 2024 and is forecasted to reach USD 5.2 billion by 2034, growing at a CAGR of 6.5%. This regional leadership is supported by the region's high incidence of diabetes, a mature healthcare system, and the presence of several key players including Organogenesis, Smith & Nephew, and 3M Healthcare. Additionally, extensive insurance coverage, steady clinical trial funding, and a well-established provider network are sustaining strong treatment adoption across hospital and outpatient settings.

Notable companies operating within the Global Diabetic Foot Ulcer Treatment Market include Coloplast, Cardinal Health, LifeNet Health, Convatec, Organogenesis, Pfizer, StimLabs, Zimmer Biomet, Johnson & Johnson's Ethicon division, Baxter, 3M Healthcare, Smith & Nephew, B. Braun, Medline, MIMEDX, BioTissue, Molnlycke Health Care, Integra LifeSciences, AHA Hyperbarics, and Ipca Laboratories. To expand their market presence, companies in the diabetic foot ulcer treatment segment are employing several focused strategies. Many are channeling investments into R&D to develop next-generation wound healing products, including biologics and regenerative therapies. Strategic mergers and collaborations with specialty clinics and hospitals have enhanced product reach and clinician familiarity. Businesses are also increasing efforts to secure faster regulatory approvals across multiple regions. Moreover, firms are amplifying awareness campaigns, particularly in underpenetrated markets, while expanding manufacturing capabilities to meet growing demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Ulcer type

- 2.2.4 Age group

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes

- 3.2.1.2 Growing advancement in wound care technologies

- 3.2.1.3 Expanding government and NGO initiatives towards preventive measures

- 3.2.1.4 Growing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding homecare-based wound management

- 3.2.3.2 Growing partnerships, research and development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Diabetes epidemology

- 3.6 Pipeline analysis by medications

- 3.7 Regulatory landscape

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Mergers and acquisitions

- 4.5.2 Partnerships and collaborations

- 4.5.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wound care dressings

- 5.2.1 Alginate dressing

- 5.2.2 Foam dressings

- 5.2.3 Hydrocolloid dressings

- 5.2.4 Hydrogel dressings

- 5.2.5 Film dressings

- 5.2.6 Antimicrobial dressings

- 5.2.7 Other wound care dressings

- 5.3 Biologics

- 5.3.1 Skin substitutes

- 5.3.2 Growth factor

- 5.3.3 Tissue engineered products

- 5.3.4 Platelet-derived therapies

- 5.4 Wound therapy devices

- 5.4.1 Negative pressure wound therapy

- 5.4.2 Hyperbaric oxygen therapy

- 5.4.3 Pressure relief devices

- 5.4.4 Other wound therapy devices

- 5.5 Antibiotic medications

- 5.6 Other treatment types

Chapter 6 Market Estimates and Forecast, By Ulcer Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Neuropathic ulcers

- 6.3 Ischemic ulcers

- 6.4 Neuro-ischemic ulcers

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 18 - 39

- 7.3 40 - 59

- 7.4 60 and above

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers (ASCs)

- 8.4 Long-term care facilities

- 8.5 Specialty clinics

- 8.6 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3M Healthcare

- 10.2 AHA Hyperbarics

- 10.3 B. Braun

- 10.4 Baxter

- 10.5 BioTissue

- 10.6 Cardinal Health

- 10.7 Coloplast

- 10.8 Convatec

- 10.9 Ethicon (Johnson and Johnson)

- 10.10 Integra LifeSciences

- 10.11 Ipca Laboratories

- 10.12 LifeNet Health

- 10.13 Medline

- 10.14 MIMEDX

- 10.15 Molnlycke Health Care

- 10.16 Organogenesis

- 10.17 Pfizer

- 10.18 Smith & Nephew

- 10.19 StimLabs

- 10.20 Zimmer Biomet