PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773444

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773444

Storage and Handling Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

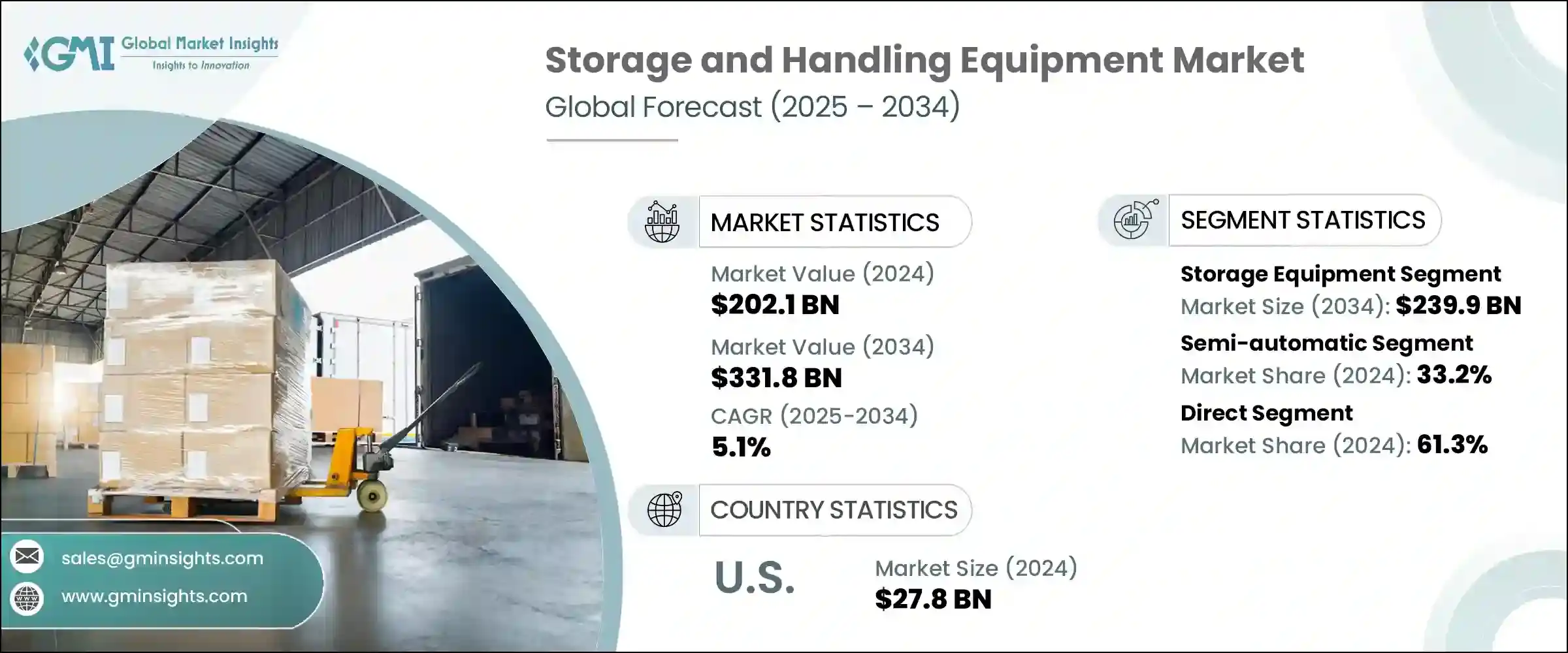

The Global Storage and Handling Equipment Market was valued at USD 202.1 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 331.8 billion by 2034. This momentum is driven by explosive growth in e-commerce-especially in North America, Western Europe, and emerging Southeast Asia-requiring fulfillment centers to invest in advanced solutions like high-density racks, robotic conveyors, and modular mezzanines. IoT, RFID, and telemetry systems are now nearly standard, enabling real-time inventory tracking and synchronized logistics. With warehouse operations expected to run around the clock, especially in retail, e-commerce, and automotive sectors, modern storage and handling systems-combined with automation-are transforming the warehouse model.

The integration of robotics, automated storage and retrieval systems (AS/RS), conveyor systems, guided forklifts, and autonomous mobile robots (AMRs) is revolutionizing warehouse operations. These technologies enable businesses to efficiently handle increasing order demands without proportionally increasing labor expenses. By automating repetitive tasks and optimizing material flow, companies improve accuracy, speed, and throughput. Additionally, these innovations help reduce human error, enhance safety, and maximize space utilization within facilities. As a result, businesses can maintain high service levels and scalability, even during peak periods, while keeping operational costs in check. This shift toward automation is transforming warehousing into a smarter, more responsive component of the supply chain.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $202.1 Billion |

| Forecast Value | $331.8 Billion |

| CAGR | 5.1% |

Storage equipment alone accounted for USD 140.2 billion in 2024 and is projected to reach USD 239.9 billion by 2034. Units like pallet racks, mezzanine platforms, and modular shelving are crucial for maximizing space utilization. With pallet racking holding more than half of this segment, demand is surging across industries from e-commerce to pharmaceuticals and food distribution, driven by the need for customizable solutions.

The semi-automatic segment captured a 33.2% share in 2024 and is expected to grow at 6.5% through 2034. Semi-automated solutions-such as guided forklifts, belt conveyors, and adjustable racks-hit the sweet spot by improving efficiency without the full investment of complete automation. Industry data indicates these systems are implemented in approximately 40% of mid-sized warehouses globally.

U.S. Storage and Handling Equipment Market was valued at USD 27.8 billion in 2024 and is anticipated to grow at a CAGR of 6.2% through 2034. The country's extensive e-commerce infrastructure, dense distribution networks, and thriving industrial base-driven by logistics giants and retailers-continue to fuel investment in semi-automated conveyors, high-density racks, and next-gen robotics. Growth remains steady in both warehouse modernization and food-and-beverage logistics.

Key players in the Storage and Handling Equipment Market include Interroll Group, Dematic, Toyota Material Handling, Honeywell Intelligrated, Bastian Solutions, Hyster-Yale Materials Handling, Daifuku Co., Ltd., SSI Schafer, Jungheinrich AG, Swisslog, Flexcon Container, Mecalux, BEUMER Group, Raymond Corporation, and Godrej Storage Solutions. Leading firms are focusing on modular and scalable systems that allow fast adaptation to varying inventory and seasonal peaks, targeting growth in e-commerce and retail sectors. They are integrating advanced technologies like IoT, AI-driven analytics, and robotics-especially AS/RS and AMRs-to enhance operational efficiency and reduce labor dependency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Automation

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code- 8428)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Equipment type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Storage equipment

- 5.2.1 Pallet racking systems

- 5.2.1.1 Selective racking (most common)

- 5.2.1.2 Double deep racking

- 5.2.1.3 Drive-in/drive-through racking

- 5.2.1.4 Push back racking

- 5.2.1.5 Others

- 5.2.2 Shelving systems

- 5.2.2.1 Static shelving

- 5.2.2.2 Mobile shelving

- 5.2.2.3 Others

- 5.2.3 Specialty storage

- 5.2.3.1 Cantilever racks (for long items)

- 5.2.3.2 Multi-tier racking

- 5.2.3.3 Mezzanine flooring

- 5.2.3.4 Modular storage systems

- 5.2.3.5 Others

- 5.2.1 Pallet racking systems

- 5.3 Handling equipment

- 5.3.1 Transport equipment

- 5.3.1.1 Forklifts (electric, gas, diesel)

- 5.3.1.2 Pallet jacks

- 5.3.1.3 Hand trucks

- 5.3.1.4 Conveyor systems

- 5.3.1.5 Others

- 5.3.2 Lifting equipment

- 5.3.2.1 Cranes

- 5.3.2.2 Hoists

- 5.3.2.3 Lift tables

- 5.3.2.4 Scissor lifts

- 5.3.2.5 Others

- 5.3.3 Continuous handling equipment

- 5.3.3.1 Belt conveyors

- 5.3.3.2 Roller conveyors

- 5.3.3.3 Chain conveyors

- 5.3.3.4 Pneumatic systems

- 5.3.1 Transport equipment

Chapter 6 Market Estimates & Forecast, By Automation, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automated

- 6.4 Fully automated

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manufacturing

- 7.3 Automotive

- 7.4 Electronics

- 7.5 Food and beverage

- 7.6 Pharmaceuticals

- 7.7 Chemicals

- 7.8 Textiles

- 7.9 Distribution and logistics

- 7.10 Retail

- 7.11 E-commerce

- 7.12 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 UAE

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Bastian Solutions

- 10.2 BEUMER Group

- 10.3 Daifuku Co., Ltd.

- 10.4 Dematic

- 10.5 Flexcon Container

- 10.6 Godrej Storage Solutions

- 10.7 Honeywell Intelligrated

- 10.8 Hyster-Yale Materials Handling, Inc.

- 10.9 Interroll Group

- 10.10 Jungheinrich AG

- 10.11 Mecalux

- 10.12 Raymond Corporation

- 10.13 SSI Schafer

- 10.14 Swisslog

- 10.15 Toyota Material Handling