PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773455

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773455

AGM VRLA Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

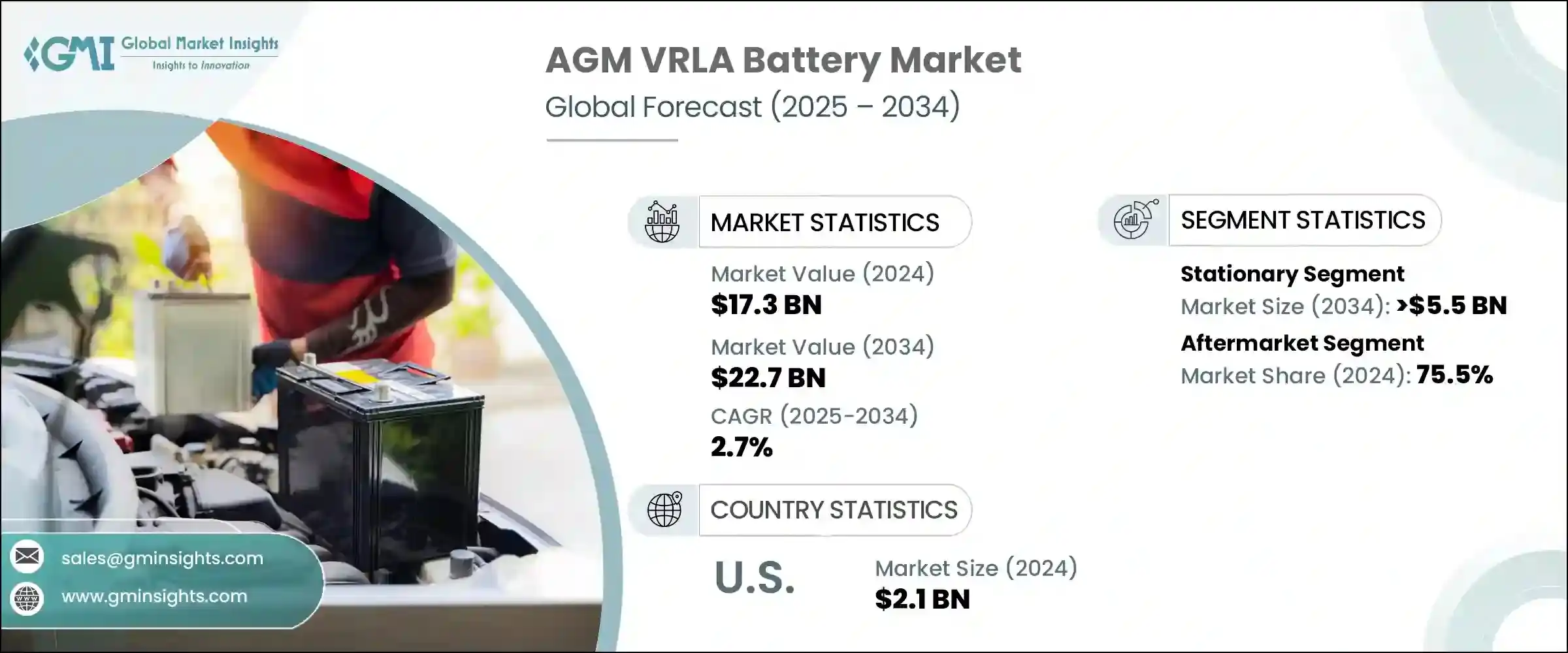

The Global AGM VRLA Battery Market was valued at USD 17.3 billion in 2024 and is estimated to grow at a CAGR of 2.7% to reach USD 22.7 billion by 2034. The demand for absorbent glass mat valve-regulated lead-acid (AGM VRLA) batteries continues to expand as industries emphasize reliable, low-maintenance, and durable energy storage solutions. Technological progress in battery plate architecture and enhanced glass mat compression techniques is driving performance improvements, especially in deep-discharge applications across sectors such as renewable energy, telecom, and electric mobility.

With optimized fiberglass mats offering higher porosity and acid absorption, these systems reduce stratification, improve charge cycles, and extend battery life-critical attributes for modern off-grid and grid-support applications. The cost-efficiency of AGM VRLA batteries also makes them ideal for solar-powered systems and rural electrification programs, especially in regions where lithium alternatives are either too expensive or not yet viable. The global push for energy access and decarbonization in developing economies is shaping the future trajectory of this market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.3 Billion |

| Forecast Value | $22.7 Billion |

| CAGR | 2.7% |

The growing integration of AGM VRLA batteries in hybrid energy setups-often in tandem with lithium-ion packs for load balancing-continues to enhance their relevance. These systems are gaining traction due to their compatibility with intelligent battery management systems (BMS), which offer precise health diagnostics, improved runtime estimates, and lifecycle tracking. As demand for decentralized power rises, microgrids and distributed renewable systems increasingly adopt AGM VRLA batteries to ensure stability and cost control.

The stationary segment of the AGM VRLA battery market is anticipated to reach USD 5.5 billion by 2034, largely fueled by demand for continuous power supply across mission-critical facilities. These batteries are widely favored in data centers, hospital systems, telecom infrastructure, and emergency control units due to their sealed, leak-proof design and the fact that they require virtually no routine maintenance. Their compact form factor and high energy density allow for effective deployment in urban infrastructure and isolated installations where uptime is non-negotiable. As global internet usage grows and digital infrastructure expands, the need for dependable, always-on power backups is scaling rapidly, making stationary AGM VRLA systems a preferred choice for system integrators and utility planners alike.

The OEM segment in the AGM VRLA Battery Market will grow at a CAGR of 2.9% through 2034. Original equipment manufacturers in the automotive sector are increasingly integrating AGM VRLA batteries into their vehicle platforms, particularly in hybrid and electric forklift categories. These batteries offer better cycling stability and vibration resistance, which is ideal for commercial and off-highway electric mobility solutions. Rising electrification trends in the transport and logistics industries, along with increased demand for sustainable warehousing solutions, are accelerating the adoption of these batteries. Forklift manufacturers are leveraging AGM VRLA technology to deliver high-efficiency, low-maintenance electric solutions for indoor operations.

United States AGM VRLA Battery Market generated USD 2.1 billion in 2024, reflecting steady investment in backup power infrastructure. Federal initiatives focused on modernizing transportation and communication networks are propelling the deployment of AGM VRLA units in support of redundancy systems, especially in mission-critical sectors. The adoption of stringent standards for uptime and reliability in healthcare, data management, and telecommunications continues to bolster demand. Additionally, the enforcement of regulations requiring backup energy storage in emergency response and critical operations further stimulates product uptake. With ongoing infrastructure overhauls and expanding reliance on distributed energy systems, the U.S. market will remain a key revenue contributor through the forecast period.

Major players influencing this market space include EnerSys, HOPPECKE Batterien, Clarios, GS Yuasa International, EXIDE INDUSTRIES, JYC BATTERY MANUFACTURER, Microtex Energy, MUST ENERGY, NorthBatt, Okaya Power, Caterpillar, Ritar International Group, Shenzhen EverExceed Industrial, Mutlu Battery, C&D Technologies, Champion Power Tech, and Shandong Sacred Sun Power Sources. Companies in the AGM VRLA battery market are pursuing innovation-focused strategies to maintain their competitive positioning.

They are actively enhancing plate and separator technologies to improve charge efficiency and cycle life, particularly for high-demand applications like telecom and solar storage. Many manufacturers are investing in smart battery management systems to deliver remote diagnostics, predictive maintenance alerts, and real-time performance tracking. Sustainability is also a central focus-firms are adopting eco-friendly materials and recycling processes to reduce environmental impact and comply with evolving regulations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Stationary

- 5.2.1 Telecommunications

- 5.2.2 UPS

- 5.2.3 Control & switchgear

- 5.2.4 Others

- 5.3 Motive

- 5.4 SLI

- 5.4.1 Automobiles

- 5.4.2 Motorcycles

Chapter 6 Market Size and Forecast, By Sales Channel, 2021 - 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 OEM

- 6.3 Aftermarket

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Russia

- 7.3.5 Italy

- 7.3.6 Spain

- 7.3.7 Austria

- 7.3.8 Netherlands

- 7.3.9 Sweden

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Philippines

- 7.4.10 Vietnam

- 7.4.11 Singapore

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Iran

- 7.5.4 Egypt

- 7.5.5 Turkey

- 7.5.6 Morocco

- 7.5.7 South Africa

- 7.5.8 Nigeria

- 7.5.9 Algeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Mexico

- 7.6.4 Chile

Chapter 8 Company Profiles

- 8.1 C&D Technologies

- 8.2 Caterpillar

- 8.3 Champion Power Tech

- 8.4 Clarios

- 8.5 EnerSys

- 8.6 EXIDE INDUSTRIES

- 8.7 GS Yuasa International

- 8.8 HOPPECKE Batterien

- 8.9 JYC BATTERY MANUFACTURER

- 8.10 leoch International Technology

- 8.11 Microtex Energy

- 8.12 MUST ENERGY

- 8.13 Mutlu Battery

- 8.14 NorthBatt

- 8.15 Okaya Power

- 8.16 Ritar International Group

- 8.17 Shandong Sacred Sun Power Sources

- 8.18 Shenzhen EverExceed Industrial