PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773463

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773463

Food Intolerance Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

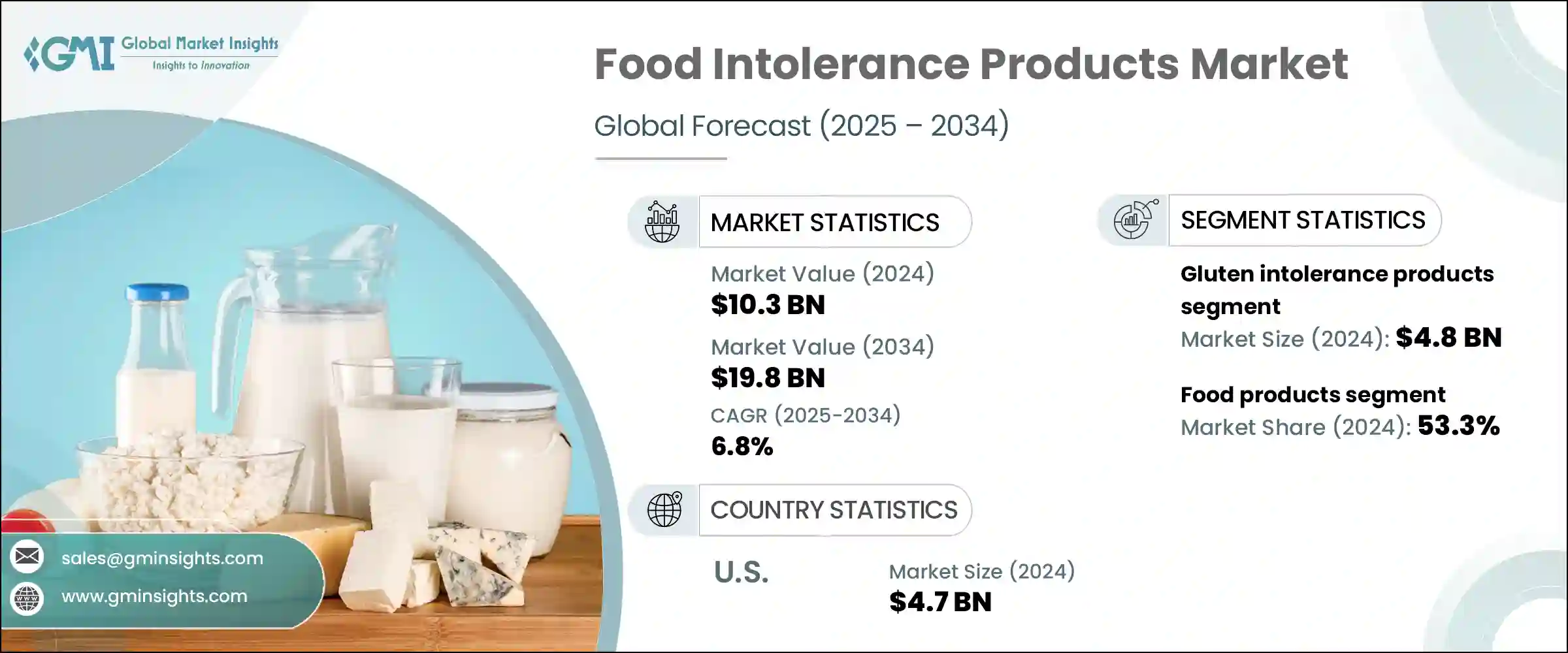

The Global Food Intolerance Products Market was valued at USD 10.3 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 19.8 billion by 2034. This market has been experiencing consistent growth, fueled by increased consumer awareness of food sensitivities and a broader demand for personalized nutrition. As diagnostic tools improve and dietary preferences evolve, more consumers are turning to products tailored to specific intolerances, such as gluten, lactose, and FODMAP-related issues. The shift toward clean-label, allergen-free, and functional food is becoming a defining factor, especially as health-conscious shoppers look for items that not only avoid triggering ingredients but also align with wellness trends. These products have now become a vital part of the larger healthy eating category.

Most of the market's value still comes from tangible food items such as cereals, dairy substitutes, snack products, and baked goods, which enjoy strong demand from both retail and food service sectors. At the same time, although still a smaller segment, supplements and digestive support aids continue to gain attention from consumers managing more complex food sensitivities. These segments are witnessing increased product launches focused on improving digestion and offering relief for individuals with lesser-known or multi-faceted intolerances.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.3 Billion |

| Forecast Value | $19.8 Billion |

| CAGR | 6.8% |

In 2024, the gluten intolerance products segment was valued at USD 4.8 billion and is forecasted to grow at a CAGR of 6.6% between 2025 and 2034. This segment dominates because of the growing awareness and diagnosis of gluten-related disorders and the lifestyle adoption of gluten-free diets. There's been a wave of innovation in this space, particularly around improving taste, texture, and nutritional content in gluten-free snacks, bakery items, and ready-to-eat meals, driving long-term consumer interest and brand loyalty.

The food products segment in the food intolerance products market generated USD 5.4 billion in 2024 and is expected to maintain a 7% CAGR through 2034, accounting for a 53.3% share. This segment continues to thrive due to rising food sensitivity awareness and the increasing prevalence of dietary conditions like celiac disease and lactose intolerance. Brands are aggressively expanding their lines with allergen-conscious offerings, such as plant-based dairy alternatives, gluten-free snacks, and baked goods formulated without common irritants. The gap between demand and available options is gradually narrowing as companies step up to develop foods that meet both health needs and taste preferences.

United States Food Intolerance Products Market was valued at USD 4.7 billion in 2024 and is set to grow at a CAGR of 6.9% from 2025 to 2034. This significant growth is propelled by heightened consumer education, health-focused eating habits, and an increasing number of individuals identifying food sensitivities. American consumers are becoming more selective in their dietary choices, encouraging companies to invest in product diversification and innovation. As a result, producers must cater to specific nutritional demands, which has led to a broader offering of targeted food intolerance products throughout the country.

The leading companies operating in the Food Intolerance Products Industry include Lifeway Foods, Inc., McNeil Consumer Healthcare Lactaid, General Mills, Inc., Danone S.A., and Nestle S.A. These brands are actively engaged in expanding their footprint in this dynamic market. To solidify their presence, key players in the food intolerance space are using a mix of targeted strategies. They are expanding their product portfolios to cater to emerging intolerances, investing in R&D to improve the taste and texture of allergen-free foods, and forming collaborations with dieticians and healthcare professionals to enhance credibility. Companies are also adopting clean-label practices and leveraging digital platforms to engage with health-conscious audiences. Many are acquiring niche brands and launching specialized product lines to cater to evolving consumer demands, while also increasing their presence in e-commerce and retail shelves to maximize reach and visibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical success factors

- 2.7 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of food intolerances & allergies

- 3.2.1.2 Growing awareness & diagnosis rates

- 3.2.1.3 Increasing demand for free-from products

- 3.2.1.4 Expanding product availability & variety

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Premium pricing of specialty products

- 3.2.2.2 Formulation & taste challenges

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia pacific

- 3.4.4 Latin America

- 3.4.5 Middle east & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Price trends

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Intolerance Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Lactose intolerance products

- 5.3 Gluten intolerance products

- 5.4 Fodmap intolerance products

- 5.5 Histamine intolerance products

- 5.6 Sulfite intolerance products

- 5.7 Other intolerance products

Chapter 6 Market Estimates & Forecast, By Product Category, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food products

- 6.2.1 Bakery & cereal products

- 6.2.1.1 Bread & baked goods

- 6.2.1.2 Breakfast cereals & granola

- 6.2.1.3 Cookies & crackers

- 6.2.1.4 Other bakery products

- 6.2.2 Dairy alternatives

- 6.2.2.1 Milk alternatives

- 6.2.2.2 Cheese alternatives

- 6.2.2.3 Yogurt alternatives

- 6.2.2.4 Ice cream & dessert alternatives

- 6.2.2.5 Other dairy alternatives

- 6.2.3 Snacks & convenience foods

- 6.2.3.1 Chips & savory snacks

- 6.2.3.2 Nutrition & protein bars

- 6.2.3.3 Ready meals & prepared foods

- 6.2.3.4 Other snack products

- 6.2.4 Condiments, dressings & sauces

- 6.2.4.1 Confectionery & desserts

- 6.2.4.2 Baby food & infant formulas

- 6.2.4.3 Other food products

- 6.2.1 Bakery & cereal products

- 6.3 Beverages

- 6.3.1 Plant-based milk

- 6.3.2 Fruit & vegetable juices

- 6.3.3 Functional beverages

- 6.3.4 Other beverages

- 6.4 Supplements & digestive aids

- 6.4.1 Digestive enzymes

- 6.4.2 Probiotics & prebiotics

- 6.4.3 Other supplements

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Supermarkets & hypermarkets

- 7.3 Specialty stores & health food stores

- 7.4 Convenience stores

- 7.5 Online retail

- 7.5.1 E-commerce platforms

- 7.5.2 Direct-to-consumer websites

- 7.5.3 Subscription services

- 7.6 Pharmacies & drugstores

- 7.7 Foodservice & HoReCa

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.3.7 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Alpro

- 9.2 Amy's Kitchen, Inc.

- 9.3 Conagra Brands, Inc.

- 9.4 Daiya Foods Inc.

- 9.5 Danone S.A.

- 9.6 Dr. Schar AG/SPA

- 9.7 Enjoy Life Foods (Mondelez International)

- 9.8 Follow Your Heart

- 9.9 Fody Food Co.

- 9.10 General Mills, Inc.

- 9.11 Glutino (The Glutino Food Group)

- 9.12 Kellogg Company

- 9.13 Lactaid (McNeil Nutritionals, LLC)

- 9.14 Mondelez International, Inc.

- 9.15 Nestle S.A.

- 9.16 Oatly Group AB

- 9.17 The Hain Celestial Group, Inc.

- 9.18 The Kraft Heinz Company

- 9.19 The Lactalis Group

- 9.20 Udis Gluten Free (Boulder Brands, Inc.)