PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773465

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773465

Veterinary Neurodegenerative Disease Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

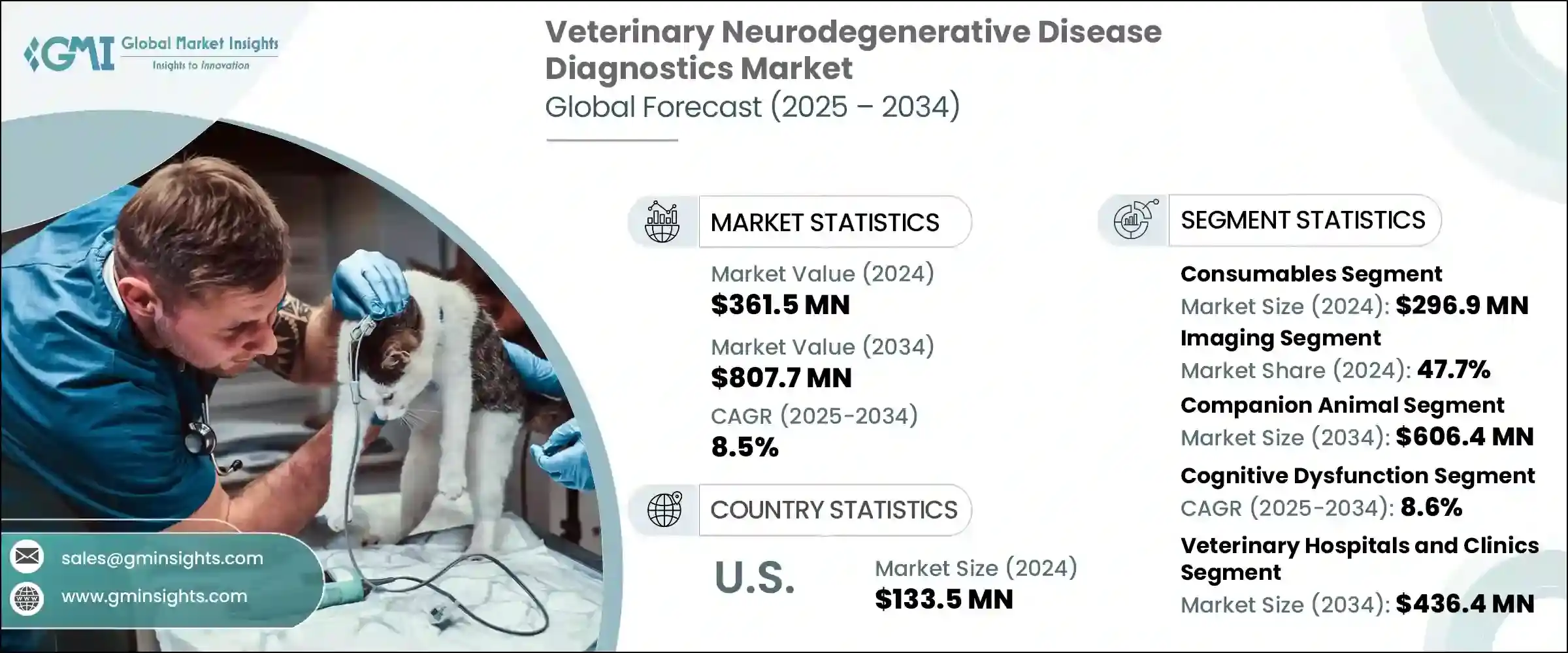

The Global Veterinary Neurodegenerative Disease Diagnostics Market was valued at USD 361.5 million in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 807.7 million by 2034. This growth, occurring at a CAGR of 8.5% from 2025 to 2034, is being driven by several key factors. The rise in neurological disorders among animals, coupled with a surge in pet ownership and spending on animal healthcare, is pushing demand for accurate and accessible diagnostic tools. With both companion and livestock animal populations increasing rapidly across the globe, the need for advanced veterinary diagnostics has become more pressing than ever. Technological advancements in veterinary neurology are also playing a crucial role in reshaping diagnostic approaches. Innovations in imaging, biomarker testing, and the development of highly sensitive diagnostic kits have significantly improved the precision of disease detection.

Emerging economies in Asia-Pacific, Latin America, and parts of Africa are witnessing a notable boost in the establishment of veterinary clinics and mobile care units. These facilities are increasingly equipped with cutting-edge neurological diagnostic tools such as CT and MRI, helping improve diagnostic accuracy and treatment outcomes. Supportive government policies focused on animal health and disease prevention are also encouraging public-private investments. Major corporations in the veterinary healthcare space are expanding their service networks and entering into strategic partnerships with reference laboratories, enhancing the availability of diagnostics in underserved regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $361.5 Million |

| Forecast Value | $807.7 Million |

| CAGR | 8.5% |

Veterinary neurodegenerative disease diagnostics comprise a wide array of instruments and consumables, including assays, reagents, kits, and other supporting components. These are used to develop and apply diagnostic solutions that help in the identification and monitoring of neurological conditions in animals. The market, segmented by product type into consumables and instruments, saw the consumables category leading with a valuation of USD 296.9 million in 2024. Consumables are used in every diagnostic procedure and thus need constant replenishment. This repetitive use ensures a steady revenue stream and strengthens the demand for these products. Their single-use nature, ease of integration into veterinary workflows, and standardized formats offer convenience, consistency, and reliability-key factors that contribute to their widespread adoption in clinics and labs.

On the basis of test type, the market is categorized into imaging, biomarker diagnostic tests, and other methods. Imaging held the dominant market share of 47.7% in 2024. It plays a vital role in identifying neurological abnormalities by providing visual insights into structural issues associated with diseases like spinal degeneration or brain dysfunction. The increasing integration of CT and MRI technologies in veterinary settings has improved the availability and effectiveness of these diagnostic methods, contributing to the dominance of imaging in the overall market.

By animal type, the market is segmented into companion animals and livestock animals. The companion animal segment led the market in 2024 and is projected to reach USD 606.4 million by 2034. This segment benefits from rising pet ownership, increasing awareness of animal neurological conditions, and the growing tendency among pet owners to invest in specialized diagnostics. As age-related neurological disorders become more recognized in pets, the need for precise and early detection continues to grow, prompting further use of advanced diagnostic solutions.

When analyzed by indication, cognitive dysfunction segment is expected to register a CAGR of 8.6% through 2034, driven by the rising occurrence of age-related neurological decline in animals. This condition, particularly in older dogs, is gaining greater awareness among pet owners and veterinary professionals alike. Ongoing research and the development of new diagnostic tests are enabling the identification of cognitive issues with improved speed and accuracy, helping to meet growing demand.

In terms of end use, the market is segmented into veterinary hospitals and clinics, diagnostic laboratories, and other end users. Veterinary hospitals and clinics emerged as the leading segment in 2024 and are anticipated to reach USD 436.4 million by 2034. These institutions are typically well-resourced, with advanced diagnostic tools and skilled professionals capable of processing a high volume of samples efficiently. Their ability to deliver accurate and timely diagnoses makes them the go-to choice for many pet owners. Investments in imaging systems and neurodiagnostic infrastructure further solidify their dominance in this space.

Geographically, North America led the global market with a share of 40.6% in 2024. The United States alone reached a market value of USD 133.5 million in 2024, continuing its upward trend from previous years. The region benefits from strong veterinary infrastructure, high rates of pet ownership, and growing awareness regarding pet health. The presence of advanced animal healthcare services and increasing adoption of pet insurance policies are also important factors fueling regional growth. Additionally, the expanding network of veterinary facilities in both urban and rural areas contributes to broader market penetration.

The competitive landscape in the veterinary neurodegenerative disease diagnostics market features a mix of global giants and regional specialists. Leading companies such as IDEXX Laboratories, Merck Animal Health, Virbac, and Zoetis collectively hold approximately 45%-50% of the market. Their dominance is attributed to broad product portfolios, global reach, and consistent investment in technological innovation. These players are focusing on strategic initiatives like acquisitions, new product development, and geographic expansion to strengthen their positions. Meanwhile, regional and local providers are intensifying competition by offering affordable diagnostic solutions and adopting growth strategies such as mergers and collaborations to expand their market presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Test type

- 2.2.4 Animal type

- 2.2.5 Indication

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of neurological disorders in animals

- 3.2.1.2 Improved understanding of animal neurobiology

- 3.2.1.3 Technological advancements in molecular and imaging diagnostics

- 3.2.1.4 Growing pet ownership and pet healthcare spending

- 3.2.1.5 Expansion of companion animal insurance coverage

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited availability of validated biomarkers

- 3.2.2.2 Shortage of veterinary neurologists and trained professionals

- 3.2.3 Opportunities

- 3.2.3.1 Rapid veterinary infrastructure development

- 3.2.3.2 Integration of AI and digital platforms in diagnostics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Imaging

- 6.2.1 MRI (magnetic resonance imaging)

- 6.2.2 CT (computed tomography)

- 6.2.3 Other imaging tests

- 6.3 Biomarker diagnostic tests

- 6.3.1 CSF (cerebrospinal fluid) biomarkers

- 6.3.2 Blood-based biomarkers

- 6.3.3 Other biomarker diagnostic tests

- 6.4 Other test types

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Companion animals

- 7.2.1 Dogs

- 7.2.2 Cats

- 7.2.3 Horses

- 7.2.4 Other companion animals

- 7.3 Livestock animals

- 7.3.1 Cattle

- 7.3.2 Sheep and goats

- 7.3.3 Other livestock animals

Chapter 8 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cognitive dysfunction

- 8.3 Cerebellar abiotrophy

- 8.4 Spongiform encephalopathies

- 8.5 Other indications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals and clinics

- 9.3 Diagnostic laboratories

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Antech Diagnostics

- 11.2 Avacta Animal Health Limited

- 11.3 ACUVET BIOTECH

- 11.4 Carestream Health

- 11.5 IDEXX Laboratories

- 11.6 Life Diagnostics

- 11.7 Neurologica Corporation

- 11.8 Merck Animal Health

- 11.9 MI:RNA Diagnostics

- 11.10 Mercodia AB

- 11.11 Neogen Corporation

- 11.12 Randox Laboratories

- 11.13 Siemens Healthineers

- 11.14 Virbac

- 11.15 Zoetis