PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773480

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773480

Europe Automotive Brake Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

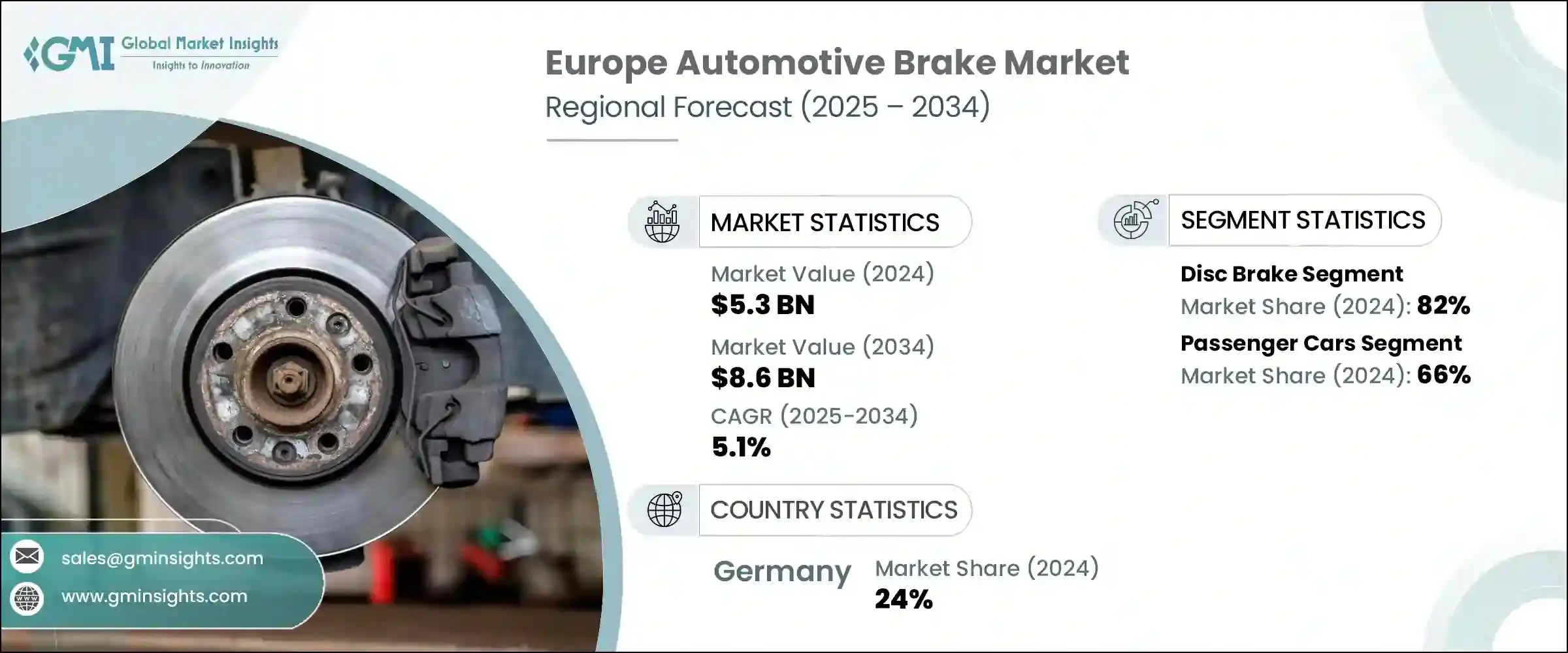

Europe Automotive Brake Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 8.6 billion by 2034. This growth is driven by stringent safety regulations and technological advancements, as regulatory bodies in Europe mandate the integration of advanced braking systems such as ABS, ESC, and EBD across multiple vehicle categories. Increasing emphasis on pedestrian safety and collision mitigation has accelerated innovation in braking technology. Automakers invest heavily in R&D to ensure compliance with safety norms to meet consumer expectations. Additionally, the broader transition to eco-conscious mobility solutions is reshaping demand patterns, as hybrid and electric vehicles-requiring efficient, regenerative braking systems-become more widespread.

Government support in the form of subsidies, tax incentives, and improvements to EV infrastructure continues to boost adoption. The regional industry observes OEMs and suppliers collaborating closely to engineer braking systems tailored for electric powertrains, signaling growth momentum. With demand rising across key countries, the need for lightweight, high-performance braking technologies that align with fuel efficiency and environmental goals is steadily increasing, making the market more competitive and innovation-focused.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $8.6 Billion |

| CAGR | 5.1% |

The shift toward hybrid and electric mobility is prompting a significant redesign of traditional braking systems. Manufacturers are developing quiet, lightweight, and high-efficiency solutions specifically for electric drivetrains. Suppliers are working hand in hand with OEMs to build systems compatible with modern powertrains, which is helping drive increased adoption across Europe. Major growth in EV sales is pushing this transformation forward as the demand for advanced, electric-specific braking systems continues to grow.

Disc brakes segment held a dominant position in 2024, comprising 82% share, and is projected to grow at 5% CAGR throughout 2034. The growing preference for high-performance and electric vehicles has led to increased use of advanced materials like carbon composites, ceramics, and aluminum alloys in brake discs. These materials enhance thermal performance, reduce component wear, and contribute to overall vehicle weight reduction-critical factors for both performance and efficiency. Carbon-ceramic disc brakes, though more expensive, are gaining popularity due to their exceptional heat tolerance and longevity, aligning with the push for sustainability and performance optimization in the region. The wide adoption of advanced safety features, including ESC and ABS, has accelerated the integration of disc brakes into mainstream passenger and premium vehicles due to their efficient heat dissipation and reliability.

The passenger cars segment held 66% share and will grow at a CAGR of 5% through 2034. European automakers are increasingly transitioning from hydraulic braking systems to brake-by-wire technology, especially in electric and hybrid vehicles. These digital systems improve responsiveness while reducing vehicle weight and enabling the use of software for performance tuning. Integrated diagnostics, wear tracking, and thermal monitoring are becoming standard in new models, enabling predictive maintenance and reducing safety risks. Automakers are incorporating these smart systems into connected vehicle networks, improving reliability and offering seamless user experience while enhancing safety.

Germany Automotive Brake Market held a 24% share and generated USD 1.3 billion in 2024. The country is home to several of the world's top vehicle manufacturers and component suppliers, which fuels the demand for advanced braking solutions. Continuous investment in cutting-edge technologies like regenerative braking, electromechanical boosters, and composite disc materials contributes to its leadership position. High production volumes and engineering complexity further drive demand for superior braking systems. Leading global brake system innovators are based in Germany, playing a key role in the development of future-ready solutions including brake-by-wire and electro-hydraulic platforms.

Key companies operating within the Europe Automotive Brake Industry include Valeo, Brembo, Robert Bosch, ZF Friedrichshafen, Hitachi Astemo, Continental, Aisin, Akebono Brake Industry, Textar, and Knorr-Bremse. Companies in Europe automotive brake industry are adopting a range of strategic approaches to fortify their market position. Investments in advanced material science-such as lightweight composites and ceramics-are helping enhance braking efficiency and system durability. Collaborations between OEMs and Tier 1 suppliers are intensifying to create customized braking systems tailored for electric and hybrid vehicles. Businesses ramp up R&D to develop brake-by-wire and regenerative braking technologies that align with sustainability goals. Market players are expanding production capabilities across Europe and entering long-term partnerships to secure their supply chains.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Brake

- 2.2.3 Component

- 2.2.4 Technology

- 2.2.5 Vehicle

- 2.2.6 Propulsion

- 2.2.7 Sales channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent safety regulations and standards

- 3.2.1.2 Rising demand for electric and hybrid vehicles

- 3.2.1.3 Technological advancements in brake components

- 3.2.1.4 Growth in automotive aftermarket and maintenance demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced brake technologies

- 3.2.2.2 Supply chain disruptions & material shortages

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of electric and hybrid vehicles

- 3.2.3.2 Adoption of advanced driver assistance systems

- 3.2.3.3 Stringent safety and emission regulations

- 3.2.3.4 Aftermarket growth updates

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Brake, 2021 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Disc brakes

- 5.3 Drum brakes

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Brake calipers

- 6.3 Brake pads/shoes

- 6.4 Brake rotors/ discs

- 6.5 Brake drums

- 6.6 Master cylinder

- 6.7 Brake lines & hoses

- 6.8 Brake boosters

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Hydraulic braking system

- 7.3 Electromechanical braking system

- 7.4 Pneumatic braking system

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 Passenger vehicles

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light Commercial Vehicles (LCV)

- 8.3.2 Medium Commercial Vehicles (MCV)

- 8.3.3 Heavy Commercial Vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Propulsion, 2021 - 2034 (USD Million, Units)

- 9.1 Key trends

- 9.2 ICE

- 9.3 Electric

- 9.3.1 PHEV

- 9.3.2 HEV

- 9.3.3 FCEV

- 9.3.4 BEV

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 OEMs

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 ADVICS

- 12.2 Aisin

- 12.3 Akebono Brake Industry

- 12.4 Brembo

- 12.5 Continental

- 12.6 FTE Automotive

- 12.7 Haldex

- 12.8 Hitachi Astemo

- 12.9 Knorr-Bremse

- 12.10 Mando

- 12.11 Metelli Group

- 12.12 Nissin Kogyo

- 12.13 PAGID

- 12.14 Robert Bosch

- 12.15 Sangsin Brake

- 12.16 Tenneco

- 12.17 Textar

- 12.18 TRW Automotive

- 12.19 Valeo

- 12.20 ZF Friedrichshafen