PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782082

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782082

Medicinal and Aromatic Plant Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

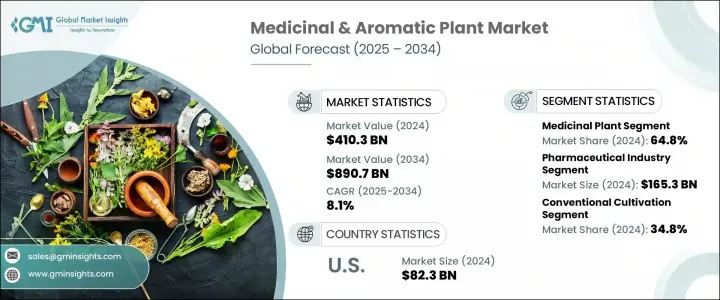

The Global Medicinal and Aromatic Plant Market was valued at USD 410.3 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 890.7 billion by 2034. This strong upward trend is powered by growing consumer interest in natural, plant-based wellness products. More people are seeking holistic and organic solutions for both preventive and therapeutic purposes. The demand for herbal supplements, essential oils, and botanically derived personal care items continues to rise globally. These plants are essential in multiple industries, offering healing benefits in alternative medicine, mental wellness, and skincare. Their role in promoting overall health and emotional balance is widely recognized, pushing manufacturers and consumers alike to explore their full potential.

Medicinal and aromatic plants are widely used across the pharmaceutical, food and beverage, and cosmetics sectors. In pharma, they act as vital inputs for creating both traditional and modern medicinal formulations. They are also incorporated into flavor systems and nutritional ingredients across the F&B industry. On the cosmetic front, their natural aromatic compounds help develop skincare and wellness products. Advances in extraction technologies, organic cultivation practices, and eco-conscious harvesting have further supported market expansion. The demand remains strongly influenced by consumer preference for clean-label, green, and plant-based alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $410.3 Billion |

| Forecast Value | $890.7 Billion |

| CAGR | 8.1% |

In 2024, the medicinal plants segment captured 64.8% share and is forecast to grow at a CAGR of 8% through 2034. Their rising importance stems from their continued use in a range of health systems, from traditional therapies to contemporary supplements and pharmaceuticals. These plants are extensively employed to address inflammation, infections, and chronic illnesses, drawing steady interest from manufacturers and consumers across global markets.

The pharmaceutical sector generated a market value of USD 165.3 billion in 2024 and is anticipated to grow at a faster CAGR of 8.4% over the next decade. As the healthcare sector rapidly evolves to meet growing needs for treatment options, medicinal plants are increasingly integrated into new drug formulations, herbal therapies, and preventative treatments. The sector's focus on continuous R&D further propels the demand for botanical inputs.

U.S. Medicinal and Aromatic Plant Market accounted for the largest share, valued at USD 82.3 billion in 2024, with expected growth at a CAGR of 6.3% through 2034. Strong agricultural and distribution infrastructure enables reliable supply chains and high-quality output across the medicinal and aromatic plant sector. Consumer preference for herbal, non-synthetic remedies is high, supported by a trusted regulatory environment that assures quality and safety.

Prominent companies shaping the competitive landscape of this market include Forest Essential, Emami Limited, doTERRA International, Givaudan SA, and Dabur India Limited. To secure a competitive edge, companies in the medicinal and aromatic plant market are focusing on vertical integration and investment in organic farming practices. Many are expanding production facilities, partnering with local growers, and enhancing processing capabilities to ensure consistent quality and traceability. They are also leveraging technological advancements in extraction and purification to deliver high-potency plant-based ingredients. Building trust through clean labeling, sustainable sourcing, and transparency in supply chains remains central. Additionally, companies are targeting international markets through customized product lines and strategic collaborations to grow global reach and reinforce their foothold.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Plant type

- 2.2.3 Product form

- 2.2.4 Application

- 2.2.5 Cultivation method

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for natural and organic products

- 3.2.1.2 Increasing healthcare awareness and preventive medicine

- 3.2.1.3 Rising adoption in pharmaceutical industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain vulnerabilities

- 3.2.2.2 Climate change impact on cultivation

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By plant type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Plant Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trend

- 5.2 Medicinal Plants

- 5.2.1 Adaptogenic Plants

- 5.2.1.1 Ashwagandha (Withania somnifera)

- 5.2.1.2 Ginseng (Panax species)

- 5.2.1.3 Rhodiola (Rhodiola rosea)

- 5.2.2 Anti-inflammatory Plants

- 5.2.2.1 Turmeric (Curcuma longa)

- 5.2.2.2 Ginger (Zingiber officinale)

- 5.2.2.3 Boswellia (Boswellia serrata)

- 5.2.3 Digestive Health Plants

- 5.2.3.1 Aloe Vera (Aloe barbadensis)

- 5.2.3.2 Peppermint (Mentha piperita)

- 5.2.3.3 Chamomile (Matricaria chamomilla)

- 5.2.4 Respiratory Health Plants

- 5.2.4.1 Eucalyptus (Eucalyptus globulus)

- 5.2.4.2 Thyme (Thymus vulgaris)

- 5.2.4.3 Licorice (Glycyrrhiza glabra)

- 5.2.5 Cardiovascular Health Plants

- 5.2.6 Immune Support Plants

- 5.2.7 Cognitive Health Plants

- 5.2.1 Adaptogenic Plants

- 5.3 Aromatic Plants

- 5.3.1 Essential Oil Plants

- 5.3.1.1 Lavender (Lavandula angustifolia)

- 5.3.1.2 Tea Tree (Melaleuca alternifolia)

- 5.3.1.3 Rosemary (Rosmarinus officinalis)

- 5.3.1.4 Oregano (Origanum vulgare)

- 5.3.2 Fragrance Plants

- 5.3.2.1 Rose (Rosa species)

- 5.3.2.2 Jasmine (Jasminum species)

- 5.3.2.3 Sandalwood (Santalum album)

- 5.3.3 Culinary Herbs

- 5.3.3.1 Basil (Ocimum basilicum)

- 5.3.3.2 Sage (Salvia officinalis)

- 5.3.3.3 Cinnamon (Cinnamomum species)

- 5.3.1 Essential Oil Plants

Chapter 6 Market Estimates & Forecast, By Product Form, 2021-2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Raw materials

- 6.2.1 Fresh plants and herbs

- 6.2.2 Dried plants and powders

- 6.2.3 Plant parts (roots, leaves, flowers, seeds)

- 6.3 Extracts and concentrates

- 6.3.1 Standardized extracts

- 6.3.2 Liquid extracts and tinctures

- 6.3.3 Concentrated powders

- 6.3.4 Oleoresins and resins

- 6.4 Essential oils

- 6.4.1 Pure essential oils

- 6.4.2 Blended essential oils

- 6.4.3 Organic essential oils

- 6.4.4 Therapeutic grade oils

- 6.5 Finished products

- 6.5.1 Capsules and tablets

- 6.5.2 Liquid formulations

- 6.5.3 Topical applications

- 6.5.4 Functional food products

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Tons)

- 7.1 Key trend

- 7.2 Pharmaceutical industry

- 7.2.1 Drug development and manufacturing

- 7.2.2 Nutraceuticals and dietary supplements

- 7.2.3 Traditional medicine formulations

- 7.2.4 Clinical research and development

- 7.3 Cosmetics and personal care

- 7.3.1 Skincare products

- 7.3.2 Hair care products

- 7.3.3 Fragrance and perfumery

- 7.3.4 Natural and organic cosmetics

- 7.4 Food and beverage industry

- 7.4.1 Functional foods and beverages

- 7.4.2 Natural flavoring agents

- 7.4.3 Food preservation and additives

- 7.4.4 Herbal teas and infusions

- 7.5 Aromatherapy and wellness

- 7.5.1 Essential oil therapy

- 7.5.2 Spa and wellness centers

- 7.5.3 Home aromatherapy products

- 7.5.4 Therapeutic applications

- 7.6 Agriculture and veterinary

- 7.6.1 Biopesticides and plant protection

- 7.6.2 Animal health and nutrition

- 7.6.3 Organic farming applications

- 7.6.4 Soil health and enhancement

Chapter 8 Market Estimates & Forecast, By Cultivation Method, 2021-2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Conventional cultivation

- 8.2.1 Traditional farming methods

- 8.2.2 Commercial plantation systems

- 8.2.3 Integrated farming approaches

- 8.3 Organic cultivation

- 8.3.1 Certified organic production

- 8.3.2 Biodynamic farming

- 8.3.3 Natural farming methods

- 8.4 Wild harvesting

- 8.4.1 Sustainable wild collection

- 8.4.2 Forest-based harvesting

- 8.4.3 Community-based collection

- 8.5 Controlled environment agriculture

- 8.5.1 Greenhouse cultivation

- 8.5.2 Hydroponic systems

- 8.5.3 Vertical farming applications

- 8.5.4 Tissue culture and micropropagation

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Dabur India Limited

- 10.2 doTERRA International

- 10.3 Emami Limited

- 10.4 Forest Essentials

- 10.5 Givaudan SA

- 10.6 Himalaya Drug Company

- 10.7 Kama Ayurveda

- 10.8 Khadi Natural

- 10.9 Patanjali Ayurved Limited

- 10.10 Shahnaz Husain

- 10.11 Symrise AG

- 10.12 Tongrentang

- 10.13 Young Living Essential Oils