PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782147

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782147

North America Power Generation Carbon Capture and Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

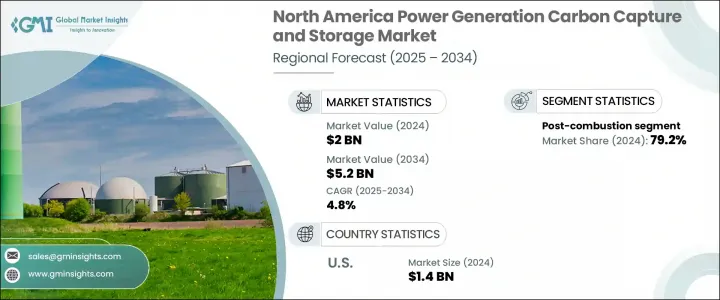

North America Power Generation Carbon Capture and Storage Market was valued at USD 2 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 5.2 billion by 2034. The market is evolving rapidly as regional efforts are intensifying to reduce carbon emissions and shift toward a more sustainable energy future. Despite the growing push for renewables, fossil fuel-based power generation continues to form a major part of the energy portfolio, making CCS an essential technology for decarbonization. The power sector now plays a central role in implementing carbon mitigation frameworks that focus on enhancing sustainability while ensuring energy stability.

Significant funding initiatives have supported large-scale CCS deployment, enabling the construction and operation of capture infrastructure at major energy and industrial sites. CCS is increasingly viewed as a dual-purpose solution-not only aiding in emissions reduction but also safeguarding energy security and economic competitiveness. Progress in integrating CCS with next-gen gas and coal technologies has significantly improved capture rates and operational efficiency. Projects involving combined cycle gas turbines and advanced coal plants are benefiting from these advancements, helping drive down energy penalties and system costs, which, in turn, are supporting adoption across both new builds and retrofit installations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 4.8% |

In 2024, the post-combustion capture segment held a 79.2% share in the North America Power Generation Carbon Capture and Storage Market. This technology continues to be widely adopted due to its versatility and ease of implementation in existing fossil-based facilities. By extracting carbon dioxide from exhaust gases after fuel combustion, post-combustion systems are ideal for use in natural gas and coal power plants that remain active throughout the region. Utilities are embracing this technology due to its cost-effectiveness, retrofitting capability, and compatibility with established infrastructure. Regulatory momentum and government-backed financial mechanisms are also encouraging power generators to incorporate this solution into their emission reduction strategies.

U.S. Power Generation Carbon Capture and Storage Market was valued at USD 1.4 billion in 2024. This growth is being propelled by robust regulatory oversight, strong policy support, and a wave of technological progress across carbon capture applications. National initiatives offering tax credits and infrastructure funding have spurred large-scale investments in CCS systems for coal and gas-fired plants, strengthening the market's foundation and accelerating industry participation.

Key companies at the forefront of the North America Power Generation Carbon Capture and Storage Market include NRG Energy, Shell, Chevron, Linde, and ExxonMobil. These organizations are actively shaping the competitive landscape through targeted investments and partnerships. To solidify their position in the North America power generation CCS market, leading players are focusing on expanding their carbon management portfolios through advanced capture technologies and large-scale demonstration projects.

Collaborations with power producers and industrial operators are helping streamline integration into existing infrastructure. Companies are leveraging policy-driven incentives and securing government grants to offset initial capital costs, making deployment more financially viable. Additionally, many are investing in regional CCS hubs and transportation networks to create scalable, shared infrastructure that lowers costs and increases efficiency. Ongoing R&D efforts are focused on enhancing capture rates, minimizing energy losses, and developing modular systems for flexible deployment across diverse power facilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive Landscape, 2025

- 3.1 Introduction

- 3.2 Company market share analysis, 2024

- 3.3 Strategy dashboard

- 3.4 Strategic initiative

- 3.5 Company benchmarking

- 3.6 Innovation & technology landscape

Chapter 4 Market Size and Forecast, By Technology, 2021 - 2034, (USD Billion and MTPA)

- 4.1 Key trends

- 4.2 Pre-combustion

- 4.3 Post-combustion

- 4.4 Oxy-fuel combustion

Chapter 5 Market Size and Forecast, By Country, 2021 - 2034, (USD Billion and MTPA)

- 5.1 Key trends

- 5.2 U.S.

- 5.3 Canada

Chapter 6 Company Profiles

- 6.1 Aker Solutions

- 6.2 Baker Hughes

- 6.3 CarbonFree

- 6.4 Dakota Gasification Company

- 6.5 Equinor

- 6.6 ExxonMobil

- 6.7 Fluor

- 6.8 GE Vernova

- 6.9 Global Thermostat

- 6.10 Halliburton

- 6.11 Linde

- 6.12 NRG Energy

- 6.13 Shell