PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782158

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782158

Men's Underwear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

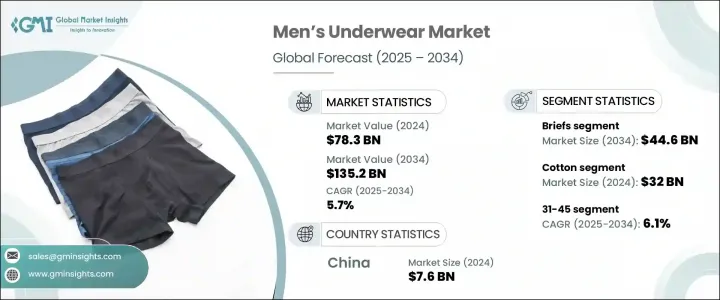

The Global Men's Underwear Market was valued at USD 78.3 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 135.2 billion by 2034. This market is gaining traction due to growing interest in modern, stylish, and performance-driven apparel that delivers both comfort and aesthetic appeal. As fashion trends continue to influence male consumers, there's a noticeable shift toward trendy, functional underwear featuring sleek cuts, athletic styling, and bold patterns. Consumer preference is increasingly shaped by branding strategies and influencer-backed promotions, which help elevate the visibility and appeal of labels and collections.

Product innovation is playing a key role in boosting market growth, especially in the realm of advanced textiles. High-performance fabrics that offer moisture management, odor resistance, and flexibility are becoming essential elements in men's underwear. Rising health awareness is also prompting demand for materials that offer benefits beyond comfort, including antimicrobial protection and breathability. As men become more hygiene-conscious, these added features are seen as vital. The popularity of smart fabric technologies and enhanced fit designs is further pushing market boundaries and expanding consumer choice across all price segments and style preferences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $78.3 Billion |

| Forecast Value | $135.2 Billion |

| CAGR | 5.7% |

The briefs segment is expected to generate USD 44.6 billion by 2034, growing steadily due to its appeal among men who value support and secure fit. Briefs continue to serve as a staple for those who prioritize practicality in both work and active lifestyles. This segment benefits from advances in material technology, such as blends featuring spandex, modal, and breathable cotton, which help improve stretch, comfort, and moisture regulation for extended wear.

The cotton segment was valued at USD 32 billion in 2024 and is projected to grow at a CAGR of 6% from 2025 to 2034. Cotton's softness and breathability keep it a preferred fabric for everyday use. Polyester's resilience makes it ideal for those seeking durability, while modal adds luxury through its silky feel. Nylon offers excellent stretch retention, making it great for high-performance wear. Bamboo, recognized for its sustainability and minimal environmental impact, is seeing wider adoption. Blended materials, especially those with spandex or elastane, enhance functionality by improving fit, movement, and shape retention, meeting both comfort and performance needs.

China Men's Underwear Market was valued at USD 7.6 billion in 2024 and is expected to grow at a CAGR of 6.5% through 2034. The region's robust expansion is driven by rising income levels, greater interest in fashion-forward styles, and a shift toward higher-end and branded products. Younger consumers are steering the market by embracing style, innovation, and elevated comfort. Digital platforms and mobile commerce are playing a crucial role, as more shoppers turn to online outlets to discover and purchase premium and performance-based underwear. Domestic and international labels are enhancing product variety, offering designs that span boxer briefs, trunks, and more tailored fits to cater to changing preferences.

Top companies shaping this space include Hanesbrands, Saxx Underwear, Adidas, Giorgio Armani, Hugo Boss, Tommy Hilfiger, Ralph Lauren, Puma, Mack Weldon, Jockey International, Under Armour, Nike, Berkshire Hathaway, Bonobos, and Calvin Klein. To maintain a competitive edge in the men's underwear market, leading companies are focusing on innovation, sustainability, and branding. Many are investing in smart textiles with enhanced features such as temperature regulation, odor control, and ergonomic design for all-day wear. Firms are also launching sustainable lines made from organic cotton, bamboo, and recycled fibers to attract environmentally aware consumers.

Strategic collaborations with fashion influencers and athletes are boosting brand recognition and driving consumer engagement. E-commerce development and omnichannel retail strategies help these companies capture wider audiences. Personalization options, size inclusivity, and subscription-based models are also being adopted to improve customer loyalty and increase repeat purchases. These efforts together help reinforce market leadership and long-term brand strength.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Age group

- 2.2.5 Price range

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Market Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behaviour

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Briefs

- 5.3 Boxers

- 5.4 Boxer briefs

- 5.5 Trunks

- 5.6 Hipsters

- 5.7 Thongs

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Cotton

- 6.3 Polyester

- 6.4 Modal

- 6.5 Nylon

- 6.6 Bamboo

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Age Group, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 15 - 30

- 7.3 31 - 45

- 7.4 46 - 60

- 7.5 Above 60

Chapter 8 Market Estimates & Forecast, By Price Range, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company website

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Mega retail stores

- 9.3.3 Others (individual stores, departmental stores, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Adidas

- 11.2 Berkshire Hathaway

- 11.3 Bonobos

- 11.4 Calvin Klein

- 11.5 Giorgio Armani

- 11.6 Hanesbrands

- 11.7 Hugo Boss

- 11.8 Jockey International

- 11.9 Mack Weldon

- 11.10 Nike

- 11.11 Puma

- 11.12 Ralph Lauren

- 11.13 Saxx Underwear

- 11.14 Tommy Hilfiger

- 11.15 Under Armour