PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797693

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797693

E-Commerce Heat-Resistant Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

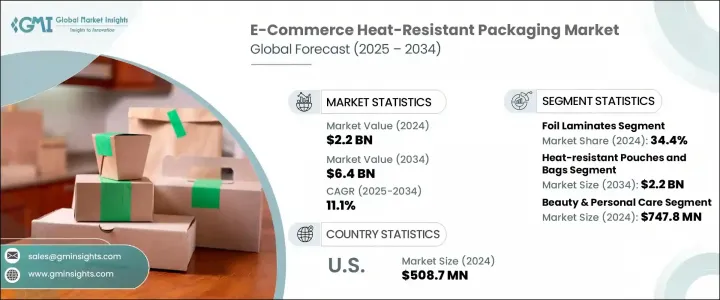

The Global E-Commerce Heat-Resistant Packaging Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 11.1% to reach USD 6.4 billion by 2034. Market expansion is primarily driven by the ongoing growth of e-commerce and the increasing need for thermal protection in the pharmaceutical industry. With the surge in online purchases and international deliveries, the demand for packaging that can maintain product integrity under varied temperature conditions has significantly increased. Consumers are seeking reliability and sustainability, especially when it comes to the safe delivery of food, personal care items, and temperature-sensitive electronics. Packaging solutions must now not only provide thermal insulation but also be environmentally friendly, aligning with modern customer expectations. Rising healthcare delivery to homes and the growing digital presence of pharmaceutical suppliers have added momentum to the demand for insulated packaging.

Regulatory compliance and temperature control for critical products like biologics and insulin are also pushing manufacturers to adopt advanced thermal packaging technologies for secure delivery during transport. These sensitive pharmaceuticals require strict adherence to temperature ranges throughout the logistics chain, often between 2°C to 8°C, to preserve efficacy and avoid degradation. As global regulatory bodies tighten guidelines around pharmaceutical cold chain integrity, manufacturers are under increasing pressure to implement packaging solutions that offer precise, validated temperature performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 11.1% |

The foil laminates segment held the largest share in 2024, accounting for 34.4%. These materials are becoming a staple in the packaging industry due to their excellent insulation capabilities and minimal weight. Their application across temperature-sensitive sectors is growing, especially for international shipments. New developments in multi-layer foil technology are improving thermal retention and resistance, offering better protection during extended transit periods and under fluctuating climate conditions.

The food & beverage segment is projected to grow at a CAGR of 12.3% through 2034. Shifting lifestyles in metropolitan areas, rising demand for fresh meals, and the globalization of cuisine have all intensified the requirement for robust heat-resistant packaging. The rising adoption of fast and same-day delivery services has made consistent temperature control across the supply chain a top priority for businesses in this sector.

U.S. E-Commerce Heat-Resistant Packaging Market generated USD 508.7 million in 2024. Its dominance stems from the successful execution of sustainable logistics strategies and advanced cold chain systems. Various industries-including manufacturing, food and beverage, and pharmaceuticals-are embracing recyclable insulation foams and eco-conscious packaging to meet environmental goals. The country's strong focus on energy-efficient packaging options continues to shape its leadership position in this sector.

Leading companies in the E-Commerce Heat-Resistant Packaging Market include LD Packaging, DS Smith, Insulated Products Corporation, Novolex, Amcor, Aspect Solutions, Nordic Cold Chain Solutions, and DBS Packaging. Companies in this sector are actively investing in R&D to develop materials that combine thermal efficiency with environmental sustainability. Brands are introducing recyclable and reusable insulation products to align with consumer preferences for eco-friendly solutions. Many are also forming strategic partnerships with e-commerce and logistics providers to create tailored packaging solutions for last-mile delivery under extreme weather conditions. Expanding production capabilities and global distribution networks is another major focus, allowing firms to address regional demand more effectively. Additionally, businesses are emphasizing design innovation-offering customizable, lightweight, and multi-layer packaging that meets temperature control regulations while ensuring cost efficiency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Material type trends

- 2.2.2 Product type trends

- 2.2.3 End use trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in e-commerce sector

- 3.2.1.2 Rising demand for sustainable and biodegradable packaging materials

- 3.2.1.3 Stringent regulations for cold chain compliance in last-mile delivery

- 3.2.1.4 Expansion of pharmaceutical sector requiring thermal protection

- 3.2.1.5 Growth of online food delivery and meal kit services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced thermal packaging materials

- 3.2.2.2 Limited recyclability and environmental concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Partnerships between E-commerce platforms and packaging innovators

- 3.2.3.2 Integration of smart sensors for real-time temperature monitoring

- 3.2.3.3 Increased adoption in niche segments like premium confectionery and organic skincare

- 3.2.3.4 Development of customizable, brand-differentiated insulated packaging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Sustainability Measures

- 3.10.1 Sustainable Materials Assessment

- 3.10.2 Carbon Footprint Analysis

- 3.10.3 Circular Economy Implementation

- 3.10.4 Sustainability Certifications and Standards

- 3.10.5 Sustainability ROI Analysis

- 3.11 Global consumer sentiment analysis

- 3.12 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Foil laminates

- 5.3 High-temperature resistant plastics

- 5.4 Insulated paper-based materials

- 5.5 Thermal insulating foams

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Heat-resistant pouches and bags

- 6.3 Insulated boxes and containers

- 6.4 Protective liners and inserts

- 6.5 Thermal mailers and envelopes

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Beauty & personal care

- 7.3 Food & beverages

- 7.4 Electronics & electrical

- 7.5 Healthcare & pharmaceuticals

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Aspect Solutions Ltd.

- 9.3 Cryopak

- 9.4 DBS Packaging

- 9.5 DS Smith

- 9.6 Insulated Products Corporation.

- 9.7 LD PACKAGING CO .,LTD

- 9.8 Nordic Cold Chain Solutions

- 9.9 Novolex

- 9.10 Perstorp

- 9.11 Puropak (Foshan) Co., Ltd.

- 9.12 Sealed Air

- 9.13 Sonoco ThermoSafe

- 9.14 Taghleef Industries

- 9.15 Thermal Packaging Solutions Ltd.

- 9.16 ZTJ Packaging Co., Ltd.