PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797729

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797729

GaN-powered Chargers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

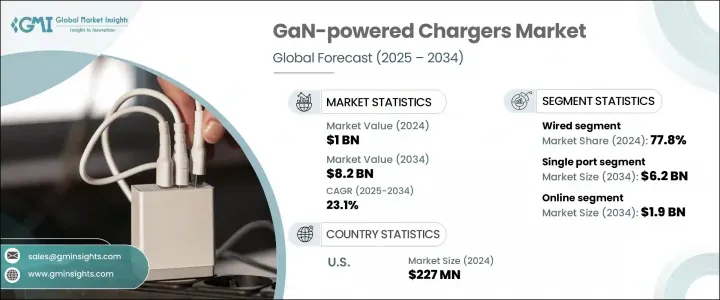

The Global GaN-powered Chargers Market was valued at USD 1 billion in 2024 and is estimated to grow at a CAGR of 23.1% to reach USD 8.2 billion by 2034. This rapid growth is being fueled by the increasing integration of smart devices across households and industries, along with growing demand from sectors such as electric vehicles and automated industrial systems. As global digital connectivity deepens, more consumers and businesses are relying on power-hungry electronics, which in turn accelerates the need for compact, energy-efficient, and high-speed charging options.

GaN-based chargers are gaining popularity for their compact designs, faster power delivery, and improved thermal efficiency. These features align with current technological demands for devices that are smaller, charge faster, and waste less power. As electrification efforts expand globally, especially in transportation and manufacturing, the shift toward GaN-powered systems is becoming more apparent.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $8.2 Billion |

| CAGR | 23.1% |

Their ability to offer compact architecture while delivering efficient energy conversion is making them a preferred choice in evolving EV infrastructure and smart industrial settings. As industries and transportation systems increasingly transition toward electrification, the demand for high-performance charging solutions that minimize energy loss and occupy less space is surging. GaN-powered chargers are ideally suited for this shift, as they enable faster charging cycles, reduce thermal buildup, and integrate seamlessly into next-generation designs that prioritize space optimization and energy savings.

The wired segment held a 77.8% share in 2024. This segment is favored for its efficiency, compatibility with various fast-charging protocols, and high reliability, particularly in work-centric and hybrid environments. Users continue to rely on wired charging for its speed and consistency, especially in professional and travel scenarios. The dominance of wired solutions is also supported by the broad acceptance of universal charging protocols like USB-C PD. Manufacturers are advised to prioritize innovations in wired GaN charger design, especially by integrating multi-protocol support to meet the demands of both high-performance and cost-conscious buyers.

The single-port GaN charger segment is expected to reach USD 6.2 billion by 2034, supported by its strong appeal among individuals seeking simplicity and portability. These chargers are especially popular with students, commuters, and minimalist users who require quick, on-the-go charging. Their compact size and compatibility with flagship electronic devices make them a practical choice for everyday needs. Moreover, the growing uptake of the USB-C Power Delivery standard continues to support market growth by simplifying power transfer while optimizing size. Manufacturers are actively launching pocket-sized GaN models in the 30W to 65W power range, targeting users looking for space-saving and efficient charging options.

North America GaN-powered Chargers Market held 24.9% share and is forecast to grow at a CAGR of 24% from 2025 to 2034. This upward trend is primarily driven by growing consumer expectations for high-performance chargers and the increasing adoption of energy-conscious electronic solutions. The region's embrace of compact, thermally efficient, and high-speed charging devices is pushing GaN technology forward. Consumer preferences are shifting away from bulky, slow-charging products to sleeker, more advanced solutions that align with sustainable practices and performance needs.

Major industry players shaping the GaN-powered charger market include Baseus Technology, RAVPower, Anker Innovations, Belkin International, and Aukey International. These companies are actively investing in research, innovation, and product diversification to solidify their positions within the competitive landscape. To strengthen their market presence, leading companies are focusing on a range of strategic initiatives. A key tactic involves continuous innovation, especially in developing compact, high-wattage GaN chargers with multi-protocol support that cater to the evolving needs of both consumer and industrial segments. Strategic partnerships and OEM collaborations are being leveraged to expand global distribution and penetrate emerging markets. Additionally, firms are investing in vertical integration to improve supply chain efficiency and reduce production costs. Some brands are prioritizing the creation of environmentally friendly and thermally efficient designs, aligning with global energy standards and sustainable technology trends. These proactive strategies are helping market leaders secure long-term growth and a resilient competitive advantage.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Product type trends

- 2.2.3 Number of ports trends

- 2.2.4 Power output trends

- 2.2.5 Port type trends

- 2.2.6 Device compatibility trends

- 2.2.7 Sales channel trends

- 2.2.8 End use trends

- 2.2.9 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Proliferation of smart devices and consumer electronics

- 3.2.1.2 Increased adoption in electric vehicles and industrial applications

- 3.2.1.3 Rising adoption of USB-C and PD charging standards

- 3.2.1 Growth drivers

3.2.1.4. Expansion of 5G infrastructure and IoT ecosystems

- 3.2.1.5 Surge in remote work and mobile device usage

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs associated with GaN components and manufacturing

- 3.2.2.2 Compatibility limitations with legacy devices

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for compact, high-efficiency chargers

- 3.2.3.2 Growth in electric mobility and portable EV accessories

- 3.2.3.3 Integration of GaN n in industrial and medical electronics

- 3.2.3.4 Development of universal multi-port charging stations

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Wired

- 5.3 Wireless

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Wall chargers

- 6.3 Desktop chargers

- 6.4 Travel adapters

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Number of Ports, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Single port

- 7.3 Multi port

Chapter 8 Market Estimates and Forecast, By Power Output, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 Up to 30w

- 8.3 31w to 65w

- 8.4 66w to 100w

- 8.5 101w to 200w

- 8.6 Above 200w

Chapter 9 Market Estimates and Forecast, By Port Type, 2021 - 2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 USB type-C

- 9.3 USB type-A

- 9.4 Mixed port

Chapter 10 Market Estimates and Forecast, By Device Compatibility, 2021 - 2034 (USD Million & Thousand Units)

- 10.1 Key trends

- 10.2 Smartphones

- 10.3 Tablets

- 10.4 Laptops

- 10.5 Smartwatches & wearables

- 10.6 Portable game consoles

- 10.7 Cameras & drones

- 10.8 Others

Chapter 11 Market Estimates and Forecast, By Sales Channel, 2021 - 2034 (USD Million & Thousand Units)

- 11.1 Key trends

- 11.2 Online

- 11.3 Offline

Chapter 12 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million & Thousand Units)

- 12.1 Key trends

- 12.2 Individual consumers

- 12.3 Enterprises & corporates

- 12.4 Government & defense

- 12.5 Others

Chapter 13 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Thousand Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.3.6 Netherlands

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 MEA

- 13.6.1 South Africa

- 13.6.2 Saudi Arabia

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 Global Key Players

- 14.1.1 Anker Innovations

- 14.1.2 Aukey International

- 14.1.3 Baseus Technology

- 14.1.4 Belkin International

- 14.1.5 RAVPower

- 14.2 Regional Key Players

- 14.2.1 North America

- 14.2.1.1 Apple

- 14.2.1.2 Energizer

- 14.2.1.3 Spigen

- 14.2.1.4 Satechi

- 14.2.2 Europe

- 14.2.2.1 Philips

- 14.2.2.2 VOLTME

- 14.2.2.3 Hama GmbH & Co KG

- 14.2.3 APAC

- 14.2.3.1 Samsung Electronics

- 14.2.3.2 Xiaomi

- 14.2.3.3 UGREEN Group

- 14.2.3.4 Pisen Electronics

- 14.2.3.5 Momax Technology

- 14.2.3.6 Zonsan Electronics

- 14.2.1 North America

- 14.3 Niche Players / Disruptors

- 14.3.1 DSD Tech

- 14.3.2 iWalk Electronics

- 14.3.3 OmniCharge

- 14.3.4 Zendure