PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797784

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797784

High-Voltage BCD Power IC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

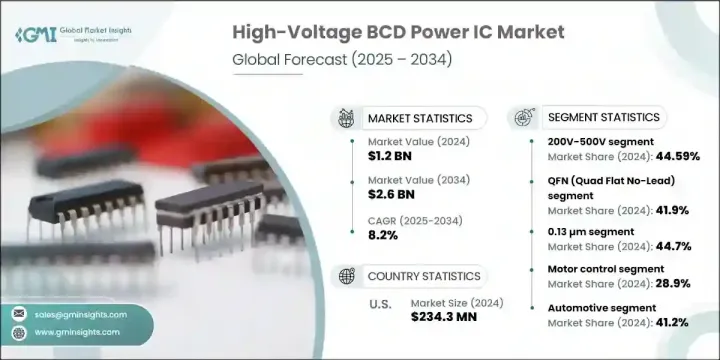

The Global High-Voltage BCD Power IC Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 2.6 billion by 2034. This growth is largely fueled by the increasing demand for compact and energy-efficient power management systems. Industries are moving toward BCD-based power ICs that integrate high-voltage DMOS, analog Bipolar, and CMOS logic components onto a single chip. This configuration offers notable space savings, reduces the number of components, and improves energy efficiency. These integrated solutions are particularly essential for use in electric and hybrid vehicles, telecom infrastructure, and industrial automation, as they improve power control precision, thermal performance, and operational sustainability while lowering the carbon footprint.

The development of intelligent, feature-rich power ICs is transforming applications across key sectors. Advanced BCD devices now include features such as programmable settings, fault monitoring, soft-switching, and thermal safeguards. These capabilities make them ideal for automotive ECUs, medical devices, robotics, and IoT systems by lowering maintenance needs, simplifying system architecture, and improving reliability. Their integration with SoCs and digital control systems continues to gain momentum across end-use markets. Automotive and industrial OEMs are driving adoption to enhance safety, efficiency, and real-time system response.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 8.2% |

In 2024, the 200V-500V voltage segment led the market with USD 535.1 million. These ICs are widely used in EV power modules, industrial controllers, and telecom equipment. Their appeal lies in their ability to deliver a balance of high performance, integration ease, and cost-effectiveness, making them suitable across a wide array of high-voltage applications. This segment is gaining traction due to its relevance in the growing electrification movement, factory modernization, and smart infrastructure deployments worldwide.

The 0.13 µm process node segment accounted for USD 535.89 million in 2024. It remains dominant due to its robustness, lower production costs, and ability to support integration of analog, digital, and high-voltage DMOS technologies on a single chip. This node has become a standard for mission-critical applications in automotive systems, industrial drives, and durable consumer electronics due to its reliability under extreme operating conditions and compliance with power density demands.

U.S. High-Voltage BCD Power IC Market generated USD 234.3 million in 2024 and is expected to register a CAGR of 7.9% through 2034. The country benefits from a robust base in semiconductor production, expanding EV infrastructure, and increasing automation in industrial sectors. Additional growth drivers include the rollout of next-generation telecom services, investment in defense systems, and a push toward clean energy adoption. Public funding under federal initiatives and incentives supporting domestic chip manufacturing is further strengthening the U.S. market presence.

Notable players in the Global High-Voltage BCD Power IC Market include Vishay Intertechnology, Power Integrations, Renesas Electronics, Maxim Integrated, ON Semiconductor (onsemi), Dialog Semiconductor, STMicroelectronics, Rohm Semiconductor, Diodes Incorporated, Texas Instruments, Alpha & Omega Semiconductor (AOS), Microchip Technology, Infineon Technologies, Analog Devices (ADI), Presto Engineering, NXP Semiconductors, GlobalFoundries, TSMC, UMC, and Magnachip Semiconductor. To strengthen market positioning, leading players are heavily investing in R&D for next-generation BCD architectures that support higher voltage ranges, enhanced thermal handling, and digital integration. Several companies are expanding their foundry partnerships to secure access to scalable and cost-effective fabrication capabilities. A strong emphasis is placed on automotive-grade qualification, enabling compliance with stringent safety and reliability standards. Firms are also focusing on modular chip designs that cater to application-specific power profiles.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing electrification in automotive & industrial sectors

- 3.2.1.2 Rising demand for energy-efficient and compact designs

- 3.2.1.3 Expansion of 5G infrastructure and data centers

- 3.2.1.4 Government incentives for EV charging and power infrastructure

- 3.2.1.5 Advances in smart power IC features (SoC integration, diagnostics, protection)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complexity and cost of advanced BCD process development

- 3.2.2.2 Thermal management and power dissipation issues at high voltages

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Sustainability measures

- 3.10.1 Sustainable materials assessment

- 3.10.2 Carbon footprint analysis

- 3.10.3 Circular economy implementation

- 3.10.4 Sustainability certifications and standards

- 3.10.5 Sustainability ROI analysis

- 3.11 Global consumer sentiment analysis

- 3.12 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Voltage Rating Type, 2021 - 2034 (USD Billion and Units)

- 5.1 Key trends

- 5.2 60V - 100V

- 5.3 100V - 200V

- 5.4 200V-500V

- 5.5 Above 500V

Chapter 6 Market Estimates and Forecast, By Process Node, 2021 - 2034 (USD Billion and Units)

- 6.1 Key trends

- 6.2 0.35 µm

- 6.3 0.18 µm

- 6.4 0.13 µm

- 6.5 Below 90 nm

Chapter 7 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Billion and Units)

- 7.1 Key trends

- 7.2 QFN (Quad Flat No-Lead)

- 7.3 WLCSP (Wafer-Level Chip-Scale Package)

- 7.4 BGA (Ball Grid Array)

- 7.5 Die/Chip-on-Board (for integrated modules)

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion and Units)

- 8.1 Key trends

- 8.2 Automotive (EV/HEV powertrain, ADAS, lighting)

- 8.3 Consumer Electronics (power adapters, battery management, fast chargers)

- 8.4 Industrial (motor drives, automation equipment, robotics)

- 8.5 Telecommunications (5G infrastructure, power amplifiers)

- 8.6 Medical Devices (portable diagnostic and therapeutic devices)

- 8.7 Aerospace & Defense (radar systems, communication equipment)

- 8.8 Data Centers & Cloud Infrastructure (server power supplies, DC-DC converters)

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion and Units)

- 9.1 Key trends

- 9.2 Power Management

- 9.3 Motor Control

- 9.4 Battery Management Systems (BMS)

- 9.5 LED Lighting Drivers

- 9.6 Voltage Regulation and Conversion

- 9.7 Signal Conditioning & Protection

- 9.8 Audio Amplifiers

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion and Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 STMicroelectronics

- 11.2 Texas Instruments

- 11.3 Infineon Technologies

- 11.4 Infineon Technologies

- 11.5 NXP Semiconductors

- 11.6 Renesas Electronics

- 11.7 Rohm Semiconductor

- 11.8 Analog Devices (ADI)

- 11.9 Diodes Incorporated

- 11.10 Microchip Technology

- 11.11 TSMC

- 11.12 GlobalFoundries

- 11.13 UMC

- 11.14 Vishay Intertechnology

- 11.15 Dialog Semiconductor

- 11.16 Maxim Integrated

- 11.17 Power Integrations

- 11.18 Alpha & Omega Semiconductor (AOS)

- 11.19 Magnachip Semiconductor

- 11.20 Presto Engineering