PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797785

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797785

Micro-LED Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

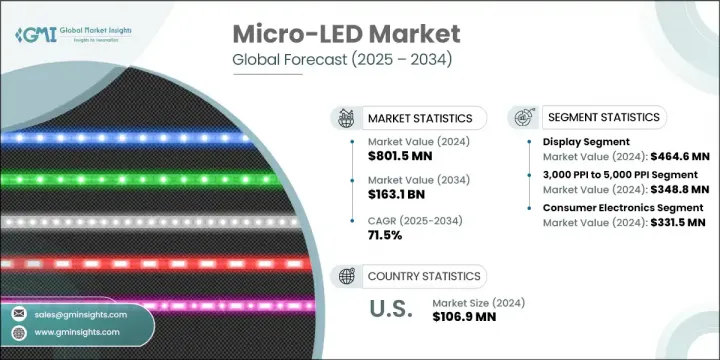

The Global Micro-LED Market was valued at USD 801.5 million in 2024 and is estimated to grow at a CAGR of 71.5% to reach USD 163.1 billion by 2034. This robust expansion is driven by rising demand for energy-efficient, high-performance display technologies across various applications. A major catalyst behind this growth is the widespread adoption of micro-LEDs in automotive systems, where digital dashboards, AR heads-up displays, and high-resolution infotainment panels are becoming standard. In addition, the increasing consumer preference for next-generation televisions, advanced digital signage, and premium visual experiences is boosting micro-LED adoption in the consumer electronics and advertising sectors.

With superior brightness, energy efficiency, and durability, micro-LED displays emerge as the go-to alternative over traditional OLED and LCD technologies. The market is also witnessing a strong shift toward flexible and transparent displays designed with modular architecture and ultra-thin materials, aligning with new applications such as wearable electronics, smart windows, and retail-based signage. As production costs continue to decline, broader commercialization is anticipated, particularly in premium segments where quality and longevity display are of paramount importance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $801.5 Million |

| Forecast Value | $163.1 Billion |

| CAGR | 71.5% |

In 2024, the display segment in the micro-LED market generated USD 464.6 million. Demand continues to surge due to the need for ultra-high-definition and power-efficient displays in personal electronic devices. Micro-LED panels outperform OLED and LCD alternatives by offering enhanced brightness, broader color range, higher contrast, and significantly longer lifespan. This makes them especially appealing for integration in AR/VR devices and next-gen smartwatches. Growing research and development efforts by global tech giants are further accelerating adoption and pushing innovation across consumer electronics.

The 3,000 PPI to 5,000 PPI segment generated USD 348.8 million in 2024. This pixel range strikes a strong balance between display clarity and power efficiency, making it highly attractive for premium electronics and immersive reality applications. Leading display research groups have identified this resolution as increasingly critical in delivering lifelike experiences in mixed reality environments. Continued investment in micro-display R&D-especially targeting defense-grade optics and high-performance wearables-is reinforcing momentum across diverse high-end markets.

United States Micro-LED Market generated USD 106.9 million in 2024. This dominance is supported by strategic national policies promoting advanced semiconductor manufacturing, such as large-scale federal funding programs dedicated to microelectronics and display innovation. These investments are helping reshape domestic production capabilities while reinforcing the supply chain for next-generation display technologies. The US continues to be a global innovation leader, with a strong corporate focus on deploying micro-LED solutions across smartphones, wearables, AR/VR devices, and other smart systems.

The Global Micro-LED Market is dynamic and highly fragmented, featuring a competitive landscape of established players and emerging innovators. Key participants include BOE Technology, Sony Corporation, LG Display Co., Ltd., Samsung Electronics, and Epistar Corporation. To strengthen their market position, leading micro-LED companies are heavily investing in research and development to enhance display performance, energy efficiency, and production scalability. Strategic collaborations with material suppliers and semiconductor manufacturers are helping streamline micro-LED integration across diverse applications. Companies are also pursuing acquisitions to gain access to innovative manufacturing techniques and intellectual property. Several players are focusing on internal fabrication capabilities to reduce reliance on external suppliers, which improves supply chain control. Customization and modular product offerings are being developed to cater to varying industry demands, from automotive to wearables.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Technology trends

- 2.2.2 Pixel density trends

- 2.2.3 Application trends

- 2.2.4 End use industry trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry ecosystem analysis

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth in wearable technology

- 3.3.1.2 Superior display performance

- 3.3.1.3 Increasing demand for energy-efficient displays

- 3.3.1.4 Rapid adoption in automotive applications

- 3.3.1.5 Demand for high-end televisions and digital signage

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 High manufacturing costs and yield issues

- 3.3.2.2 Competition from OLED and mini LED

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Emerging business models

- 3.10 Compliance requirements

- 3.11 Sustainability measures

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 RGB full-color

- 5.3 Monochrome

Chapter 6 Market Estimates and Forecast, By Pixel Density, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Less than 3,000ppi

- 6.3 3,000ppi to 5000ppi

- 6.4 Greater than 5000ppi

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Displays

- 7.2.1 AR/VR headsets

- 7.2.2 Smartwatches

- 7.2.3 Smartphones

- 7.2.4 Tablets & laptops

- 7.2.5 Televisions & monitors

- 7.2.6 Digital signage & video walls

- 7.2.7 Others

- 7.3 Lighting

- 7.3.1 General lighting

- 7.3.2 Automotive lighting

- 7.3.3 Others

Chapter 8 Market Estimates and Forecast, By Industry, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Aerospace & defense

- 8.5 Healthcare

- 8.6 Retail & hospitality

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Samsung Electronics

- 10.1.2 Sony Corporation

- 10.1.3 LG Display Co., Ltd.

- 10.1.4 BOE Technology

- 10.1.5 AU Optronics (AUO)

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 X-Celeprint

- 10.2.1.2 Nanosys

- 10.2.1.3 Kopin Corp

- 10.2.1.4 eLux Inc

- 10.2.1.5 VueReal

- 10.2.2 Europe

- 10.2.2.1 Aledia SA

- 10.2.2.2 Plessey Semiconductors

- 10.2.2.3 MICLEDI Microdisplays

- 10.2.3 Asia-Pacific

- 10.2.3.1 Epistar Corporation

- 10.2.3.2 PlayNitride

- 10.2.3.3 Jade Bird Display (JBD)

- 10.2.3.4 Konka Global

- 10.2.1 North America

- 10.3 Disruptors / Niche Players

- 10.3.1 Absen

- 10.3.2 Leyard

- 10.3.3 TCL CSOT