PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797790

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797790

Mammography Workstation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

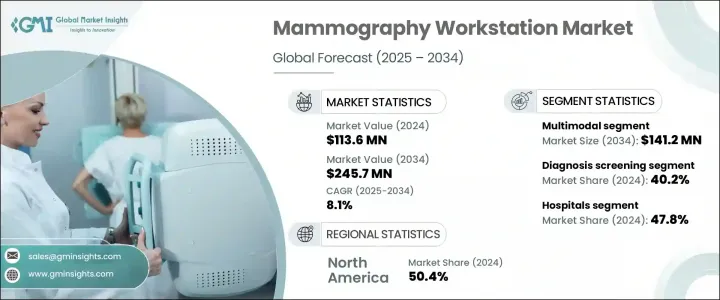

The Global Mammography Workstation Market was valued at USD 113.6 million in 2024 and is estimated to grow at a CAGR of 8.10% to reach USD 245.7 million by 2034. This expansion is largely fueled by the increasing incidence of breast cancer and the rapid shift from analog to digital mammography systems. The integration of advanced imaging technologies, such as artificial intelligence-enabled CAD tools and 3D tomosynthesis, is significantly improving diagnostic workflows and accuracy. Public and private investments in healthcare infrastructure are increasing worldwide, and government-backed screening initiatives are expanding, particularly in underserved and developing markets. These trends are collectively contributing to the global growth of this specialized segment.

A mammography workstation functions as a core imaging platform in breast diagnostics, built to assist radiologists with reviewing, analyzing, and interpreting digital mammography scans. With the aging population continuing to rise globally, the demand for efficient diagnostic tools like mammography workstations is growing as early detection becomes increasingly important. These systems now form an essential part of modern imaging centers, offering radiologists the advanced functionality needed for faster and more precise interpretation of breast imaging studies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $113.6 Million |

| Forecast Value | $245.7 Million |

| CAGR | 8.1% |

In 2024, the multimodal workstation segment was valued at USD 66.2 million and is estimated to reach USD 141.2 million by 2034. The popularity of this segment is due to its compatibility with multiple imaging modalities and enhanced diagnostic capabilities. Hospitals and diagnostic centers are increasingly seeking integrated platforms that support streamlined workflows, artificial intelligence integration, and all-in-one diagnostic environments-factors that are helping drive the multimodal workstation segment forward at a strong pace.

The diagnosis screening segment held a 40.2% share in 2024. These systems are developed to meet the demands of high-volume clinical settings and come equipped with features like AI-enhanced image analysis, automated lesion detection, and quick compatibility with screening protocols. Designed for efficiency, these workstations reduce manual workload and accelerate diagnostic turnaround, which is critical in public healthcare programs and high-throughput hospital environments. Their ability to handle a large volume of patient images while maintaining accuracy has made them essential tools in national screening efforts and routine diagnostics.

North America Mammography Workstation Market held a 50.4% share in 2024. This leadership is attributed to a well-established healthcare system and a strong inclination toward adopting innovative diagnostic technologies. Rising breast cancer rates in both the U.S. and Canada, coupled with significant investments in diagnostic infrastructure, continue to push the region's growth. The ongoing development of high-end diagnostic tools in North America also contributes to maintaining its dominant market position.

Major players shaping the Global Mammography Workstation Market include Konica Minolta Business Solutions India, Hologic, Siemens Healthineers, Philips Healthcare, Carestream Health, Sectra, Analogic, Agfa-Gevaert Group, GE Healthcare, Aycan Medical Systems, Medecom, Metaltronica, EIZO, and Fujifilm. These companies continue to influence technological evolution and global reach within the sector. Leading companies in the mammography workstation market are pursuing aggressive innovation strategies by integrating artificial intelligence, 3D imaging, and deep learning algorithms into their platforms to enhance diagnostic precision. Firms like Siemens Healthineers, GE Healthcare, and Hologic are investing heavily in R&D to launch feature-rich, multimodal systems tailored for both public and private health sectors. Expanding their footprint through partnerships with hospitals and diagnostic chains helps increase product adoption. Many players are also localizing production and distribution networks to improve accessibility and reduce lead times.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Modality trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of breast cancer globally

- 3.2.1.2 Increase in awareness of early detection

- 3.2.1.3 Expanding elderly population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced workstation systems

- 3.2.2.2 Limited access in low-income and rural regions

- 3.2.3 Market opportunities

- 3.2.3.1 Ongoing technology improvements

- 3.2.3.2 Surge in government screening programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Modality, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Multimodal

- 5.3 Standalone

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diagnosis screening

- 6.3 Advance imaging

- 6.4 Clinical review

- 6.5 Hair samples

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Agfa-Gevaert Group

- 9.2 Analogic

- 9.3 aycan Medical Systems

- 9.4 Carestream Health

- 9.5 EIZO

- 9.6 Fujifilm

- 9.7 GE Healthcare

- 9.8 Hologic

- 9.9 Konica Minolta Business Solutions India

- 9.10 Medecom

- 9.11 Metaltronica

- 9.12 Phillips Healthcare

- 9.13 Sectra

- 9.14 Siemens Healthineers