PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797837

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797837

Composite Insulators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

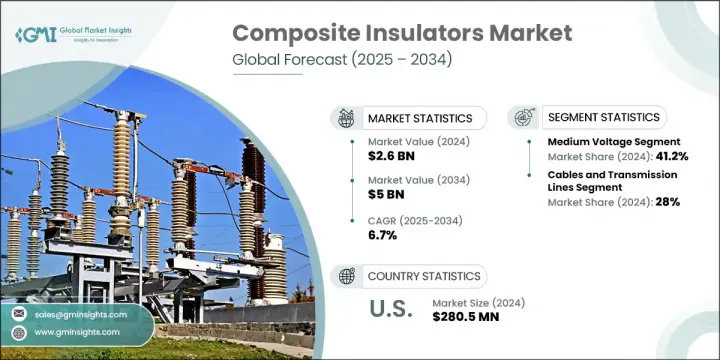

The Global Composite Insulators Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 5 billion by 2034. The expanding need for high-voltage insulation, advances in material innovation, and rising attention to grid reliability and energy efficiency are fueling market growth. Industry players are making significant R&D investments to develop insulators that provide improved thermal stability, longer service life, and resistance to environmental extremes. The accelerating integration of distributed energy technologies, such as wind and solar, alongside the advancement of smart grid infrastructures, continues to generate new market opportunities. Composite insulators are increasingly favored in areas with high pollution levels and extreme mechanical loads due to their low maintenance and operational reliability over long periods.

Government-backed initiatives to modernize aging grids and bridge power infrastructure gaps are also pushing the industry forward. Grid expansion and long-distance transmission development, especially in emerging economies, are reinforcing market potential. In regions like the Middle East and Africa, power system upgrades, new plant constructions, and infrastructure investments are stimulating high demand. These insulators are being embraced for their efficient operation in harsh weather and their ability to support advanced, sustainable energy networks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $5 Billion |

| CAGR | 6.7% |

The medium voltage segment held the largest market share of 41.2% in 2024 and is forecast to grow at a CAGR of 6% through 2034. The segment's growth is supported by its increasing role in regional interconnectivity and the critical need to deliver dependable energy across urban and remote regions. Manufacturers are enhancing the mechanical strength and electrical reliability of medium voltage insulators to optimize their durability and functionality across various installation environments.

The cables and transmission lines segment accounted for a 28% share in 2024 and is projected to grow at a CAGR of 5.5% through 2034. The drive to develop stable and efficient energy transmission systems, paired with continuous grid expansions, is reinforcing the demand for composite insulators in this segment. These units offer superior benefits over traditional options, including lower current leakage, enhanced insulation properties, and better operational outcomes under load stress. Electrification initiatives targeting remote access and underserved areas are also strengthening adoption across new transmission corridors.

United States Composite Insulators Market held a 72% share in 2024, generating USD 280.5 million. Growth in this region is being shaped by significant investments in grid modernization and renewable integration. Public and private stakeholders are increasingly allocating capital to update the nation's infrastructure, aiming to ensure consistent energy delivery while accommodating renewable energy sources.

Major companies driving the Global Composite Insulators Market include Siemens Energy, PFISTERER, Hubbell, Hitachi Energy, and TE Connectivity, among others. Leading manufacturers are implementing a multi-pronged approach to boost their market position. They are focusing heavily on R&D to develop advanced, lightweight composite materials that offer superior weather resistance and long operational life. Many players are entering strategic collaborations with utility companies to co-develop customized insulator solutions for specific grid challenges. Additionally, global expansion into fast-developing regions like Africa and Southeast Asia helps broaden their customer base.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability landscape

- 3.1.2 Factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis for composite insulators

- 3.8 Emerging opportunities & trends

- 3.8.1 Digitalization & IoT integration

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 High voltage

- 5.3 Medium voltage

- 5.4 Low voltage

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Cables and transmission lines

- 6.3 Switchgears

- 6.4 Transformer

- 6.5 Bus Bars

- 6.6 Others

Chapter 7 Market Size and Forecast, By Product, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Pin insulators

- 7.3 Suspension insulators

- 7.4 Shackle insulators

- 7.5 Other insulators

Chapter 8 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial & Industrial

- 8.4 Utilities

Chapter 9 Market Size and Forecast, By Rating, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 ≤ 11 kV

- 9.3 > 11 kV to ≤ 22 kV

- 9.4 > 22 kV to ≤ 33 kV

- 9.5 > 33 kV to ≤ 72.5 kV

- 9.6 > 72.5 kV to ≤ 145 kV

- 9.7 > 145 kV to ≤ 220 kV

- 9.8 > 220 kV to ≤ 400 kV

- 9.9 > 400 kV to ≤ 800 kV

- 9.10 > 800 kV to ≤ 1,200 kV

- 9.11 > 1,200 kV

Chapter 10 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 Distribution

- 10.3 Transmission

- 10.4 Substation

- 10.5 Railways

- 10.6 Others

Chapter 11 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.2.3 Mexico

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Middle East & Africa

- 11.5.1 Saudi Arabia

- 11.5.2 UAE

- 11.5.3 South Africa

- 11.6 Latin America

- 11.6.1 Brazil

- 11.6.2 Argentina

Chapter 12 Company Profiles

- 12.1 Bonomi

- 12.2 CYG Insulator

- 12.3 CTC Insulator

- 12.4 Deccan Enterprises

- 12.5 ENSTO

- 12.6 Gipro

- 12.7 Hitachi Energy

- 12.8 Hubbell

- 12.9 Izoelektro

- 12.10 Kuvag

- 12.11 Nanjing Electric Technology

- 12.12 Navitas Insulators

- 12.13 Newell Porcelain

- 12.14 Olectra Greentech

- 12.15 Peak Demand

- 12.16 Pfisterer

- 12.17 Rayphen

- 12.18 Siemens Energy

- 12.19 Taporel

- 12.20 TE Connectivity