PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797845

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797845

AMI Gas Meter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

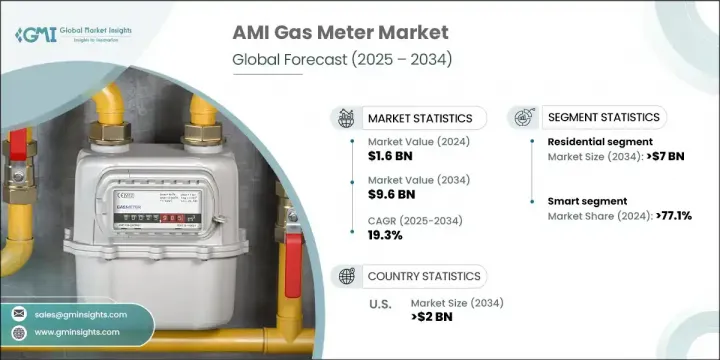

The Global AMI Gas Meter Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 19.3% to reach USD 9.6 billion by 2034. The market is undergoing rapid transformation, powered by emerging technologies, evolving regulatory mandates, and the surging need for intelligent energy management systems. Advanced metering infrastructure (AMI) gas meters enable real-time consumption tracking, remote monitoring, and two-way communication, which significantly enhance operational capabilities compared to conventional metering systems.

The expanding demand is strongly linked to global efforts around energy conservation and the transition to smart urban infrastructure. Countries are upgrading their utility frameworks to cut energy waste and meet sustainability goals. The incorporation of IoT technologies is revolutionizing AMI gas meters by enabling remote diagnostics and predictive analytics. This smart connectivity enhances system efficiency, reduces service interruptions, and delivers more accurate billing. Utility providers benefit from these upgrades by improving asset management and minimizing downtime. The growing acceptance of AMI gas meters across industrial, commercial, and residential environments continues to accelerate market momentum, as customers seek greater transparency in their energy usage and are motivated by tools that promote better consumption control.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $9.6 Billion |

| CAGR | 19.3% |

With demand rising across end-use segments, the residential sector is forecasted to reach USD 7 billion by 2034. This surge is being driven by modern infrastructure policies and initiatives aimed at increasing energy efficiency in households. As AMI gas meter adoption grows in homes, the ability to monitor consumption, detect anomalies, and provide timely insights has become a key driver of residential market growth. Segmentation by application-including residential, commercial, and utility sectors-highlights how AMI solutions are being tailored to meet different operational needs.

The smart meter segment held 77.1% share in 2024 and is expected to grow at a CAGR of 19% through 2034. This growth stems from increased government pressure to replace outdated analog systems with digital smart meters capable of providing two-way data exchange, enhancing customer control, and meeting environmental regulations. Enhanced public understanding around energy savings and smart solutions is also bolstering adoption across key regions.

U.S. AMI Gas Meter Market is projected to reach USD 2 billion by 2034, supported by robust infrastructure development and the presence of well-established energy companies. Technological advancement, strict energy regulations, and heavy investment in smart utility projects contribute to the market's solid foundation. The country continues to expand its footprint in energy innovation, with large-scale projects across sectors like oil and gas reinforcing the push for smart gas metering systems. With 15% of global clean energy spending concentrated in the U.S., the country plays a significant role in the advancement of smart gas infrastructure.

Leading companies steering the AMI Gas Meter Market include Schneider Electric, Aclara Technologies, Landis+Gyr, Itron, and Honeywell International. Major players in the AMI Gas Meter Market are focused on expanding their market presence through technological innovation, strategic alliances, and global expansion. Companies are investing heavily in R&D to develop meters with enhanced connectivity, data analytics, and self-diagnostic capabilities. Collaborations with utility providers and smart grid projects help boost deployment at scale. Firms are also forming partnerships with telecom and IoT companies to strengthen real-time data communication capabilities. Localization strategies, including region-specific product design and regulatory compliance, further support expansion in emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability landscape

- 3.1.2 Factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Import/Export trade analysis

- 3.4 Price trend analysis, by region (USD/Unit)

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 Residential

- 5.3 Commercial

- 5.4 Utility

Chapter 6 Market Size and Forecast, By Type, 2021 - 2034 (USD Million & '000 Units)

- 6.1 Key trends

- 6.2 Basic

- 6.3 Smart

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Sweden

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 UAE

- 7.5.2 Saudi Arabia

- 7.5.3 South Africa

- 7.5.4 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Argentina

Chapter 8 Company Profiles

- 8.1 Aclara Technologies

- 8.2 Ameresco

- 8.3 Apator

- 8.4 Azbil Kimmon

- 8.5 Chint Group

- 8.6 Core & Main

- 8.7 Diehl Stiftung & Co. KG

- 8.8 Holly technology

- 8.9 Honeywell International

- 8.10 Itron

- 8.11 Landis+Gyr

- 8.12 Neptune Technology Group

- 8.13 Osaki Electric

- 8.14 Raychem RPG

- 8.15 Schneider Electric

- 8.16 Sensus

- 8.17 Siemens

- 8.18 Waltero

- 8.19 Wasion Group

- 8.20 Zenner International