PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797868

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797868

Positive Displacement Blowers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

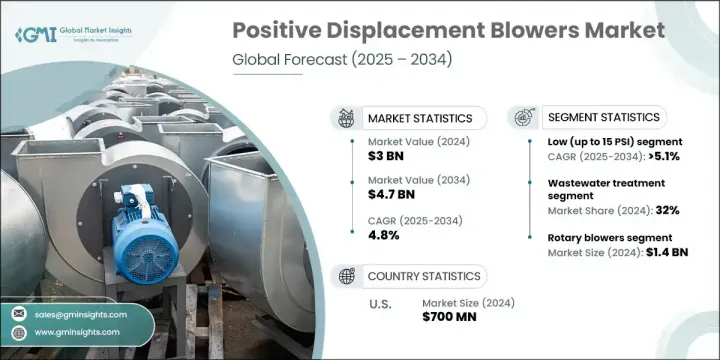

The Global Positive Displacement Blowers Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 4.7 billion by 2034. The market growth is driven by several industrial factors, with key industries such as manufacturing, oil & gas, power generation, and chemicals heavily relying on blowers for vital processes like material handling, combustion air for engines, and pneumatic conveying. Positive displacement blowers are essential for ensuring consistent airflow and play a pivotal role in maintaining air quality, reliability, and the overall efficiency of operations across these sectors. Additionally, rising global demand for clean water and stricter environmental regulations are prompting increased investments in water infrastructure, driving the need for efficient blowers in wastewater treatment plants. Blowers support the biological treatment process by providing the necessary air for aeration tanks to sustain microbial life. With increasing interest in electric vehicles (EVs), blowers are also playing a crucial role in managing the thermal systems of EV batteries. As urbanization grows and industrial processes become more advanced, the demand for reliable and energy-efficient positive displacement blowers is expected to remain strong.

The rotary blowers segment generated USD 1.4 billion in 2024. They are projected to continue their growth at a CAGR of 5.1% during the forecast period. Rotary blowers are highly valued for their durability, minimal maintenance needs, and cost-effectiveness. Their simple mechanical design and ability to operate for long periods without significant wear or breakdown contribute to their popularity in both large and smaller industrial facilities. They offer a substantial reduction in downtime and lower overall operational costs due to their reliability and ease of repair, making them a preferred choice in various industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 4.8% |

The wastewater treatment segment held a 32% share in 2024 and is expected to grow at a CAGR of 5.3% from 2025 to 2034. Positive displacement blowers, particularly rotary lobe blowers, are integral to biological treatment systems, ensuring that aeration tanks receive a continuous and stable volume of air to maintain microbial activity. This process is essential for breaking down organic waste in wastewater treatment facilities. The ability of positive displacement blowers to provide constant airflow, regardless of pressure fluctuations, is a significant advantage in maintaining the efficiency and effectiveness of wastewater management systems.

United States Positive Displacement Blowers Market held a 78% share in 2024, generating USD 700 million. The market is growing due to increasing investments in wastewater treatment infrastructure, stricter environmental standards, and the modernization of industrial applications. Heightened demand for stable and energy-efficient aeration systems is driven by stringent discharge standards set by environmental agencies and the upgrading of aging water treatment plants across the country.

Key companies operating in the Global Positive Displacement Blowers Market include Aerzen, Airtech Blower, AMCL Machinery, Blowvacc Transmission, Busch SE, Eurus Blowers, Greatech Machinery, Hitachi, Howden Group, Ingersoll Rand, Kaeser Kompressoren, KPT Blowers, Mapro International, Roots, and Unozawa-gumi Iron Works. To strengthen their market position, companies in the positive displacement blowers sector are focusing on several strategic initiatives. These include investing heavily in product innovation, specifically in the development of energy-efficient, low-maintenance, and environmentally friendly blowers. Companies are also expanding their geographic presence by entering emerging markets and forming strategic partnerships with large infrastructure projects, particularly in the water treatment and power generation sectors.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By product type

- 2.2.3 By pressure output

- 2.2.4 By application

- 2.2.5 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.2 Rotary blowers

- 5.3 Lobe blowers

- 5.4 Screw blowers

Chapter 6 Market Estimates & Forecast, By Pressure Output, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Low (up to 15 PSI)

- 6.3 Medium (15 PSI - 30 PSI)

- 6.4 High (above 30 PSI)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Million Units)

- 7.1 Key trends

- 7.2 Wastewater treatment

- 7.3 Pneumatic conveying systems

- 7.4 Cement production

- 7.5 Chemical processing

- 7.6 Power generation

- 7.7 Others (metallurgy, vacuum processing, food & beverage, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aerzen

- 10.2 Airtech Blower

- 10.3 AMCL Machinery

- 10.4 Blowvacc Transmission

- 10.5 Busch SE

- 10.6 Eurus Blowers

- 10.7 Mapro International

- 10.8 Greatech Machinery

- 10.9 Hitachi

- 10.10 Howden Group

- 10.11 Ingersoll Rand

- 10.12 Kaeser Kompressoren

- 10.13 KPT Blowers

- 10.14 Roots

- 10.15 Unozawa-gumi Iron Works