PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797874

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797874

North America Microgrid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

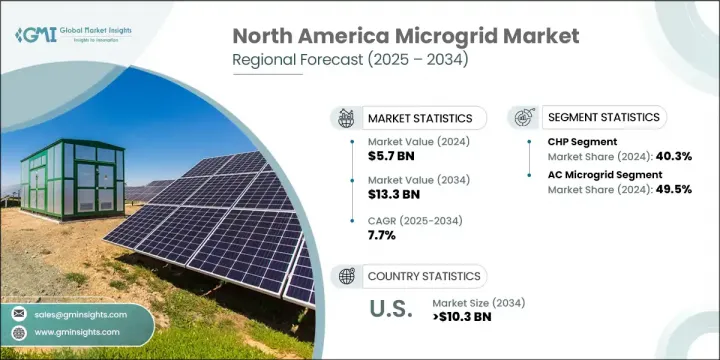

North America Microgrid Market was valued at USD 5.7 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 13.3 billion by 2034. This growth is being propelled by ongoing innovations in energy storage systems, renewable energy technologies, and advanced microgrid control platforms that enhance performance, integration, and resilience. Policies supporting energy resilience and sustainable infrastructure at both federal and state levels, along with financial incentives and procurement schemes, continue to drive the regional market forward. The microgrid model-an integrated local system combining renewables like solar and wind with batteries and conventional grid infrastructure-offers a versatile and dependable energy solution for communities and commercial areas alike.

A growing emphasis on reliable power delivery in response to regional vulnerabilities has prompted investments in microgrids across the U.S., while Canada remains focused on carbon reduction and grid independence, especially in off-grid and rural communities. As the demand for decentralized energy grows, microgrids present a compelling option to meet energy reliability, sustainability, and autonomy needs, reflecting a clear shift toward modern, efficient energy ecosystems across North America.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $13.3 Billion |

| CAGR | 7.7% |

The combined heat and power (CHP) systems segment held a 40.3% share in 2024 and is expected to maintain a CAGR of 7.7% through 2034. Their ability to deliver both power and thermal energy with improved efficiency, while operating autonomously or in tandem with renewable sources, has made them an appealing solution during disruptions or outages. This segment continues to benefit from demand for energy solutions that offer cost-effective performance and reduced emissions compared to traditional systems.

The AC-based microgrids segment held a 49.5% share in 2024 and is projected to grow at a CAGR of 7.5% between 2025 and 2034. Their ease of integration with conventional power grids, compatibility with commercial infrastructure, and widespread adoption of inverters that support both grid-forming and grid-following capabilities contribute to their rising use. Consumers are increasingly leaning toward AC configurations for their affordability, established infrastructure, and regulatory alignment.

U.S. Microgrid Market held 82.7% share in 2024 and will reach USD 10.3 billion by 2034. Major investments in energy generation, grid controls, and storage technologies are reshaping the market outlook. Government-backed financial incentives-ranging from tax credits to grants-support the acceleration of these projects, aligning closely with national grid modernization strategies while driving greater renewable adoption and energy security.

Key players include PowerSecure, Eaton, Siemens Energy, GE Vernova, and Schneider Electric. Major industry participants are leveraging a range of strategies to enhance their market presence. These include expanding microgrid portfolios through integration of advanced digital controllers, smart sensors, and hybrid energy systems. Partnerships with utilities and regional governments allow companies to deploy community-focused solutions that support resiliency and clean energy goals. Companies are also investing in modular microgrid platforms to enable rapid deployment and scalability. Localization of manufacturing and service infrastructure further strengthens operational agility. Additionally, targeted acquisitions and joint ventures are enabling access to new markets and customer segments while aligning solutions with evolving regulatory frameworks and sustainability targets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Grid type trends

- 2.4 Connectivity trends

- 2.5 Power Source trends

- 2.6 Storage device trends

- 2.7 Application trends

- 2.8 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Component suppliers

- 3.1.2 Technology providers

- 3.1.3 System integrators

- 3.1.4 Developers & EPC contractors

- 3.1.5 Utilities & grid operators

- 3.2 Import/export trade analysis

- 3.2.1 Key importing countries

- 3.2.2 Key exporting countries

- 3.3 Price trend analysis, 2021-2034 (USD/MW)

- 3.3.1 By grid type

- 3.3.2 By country

- 3.4 Cost structure analysis

- 3.5 Regulatory landscape

- 3.6 Industry impact forces

- 3.6.1 Growth drivers

- 3.6.2 Industry pitfalls & challenges

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.8.1 Bargaining power of suppliers

- 3.8.2 Bargaining power of buyers

- 3.8.3 Threat of new entrants

- 3.8.4 Threat of substitutes

- 3.9 PESTEL analysis

- 3.9.1 Political factors

- 3.9.2 Economic factors

- 3.9.3 Social factors

- 3.9.4 Technological factors

- 3.9.5 Legal factors

- 3.9.6 Environmental factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.2.3 Mexico

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Grid Type, 2021 - 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 AC microgrid

- 5.3 DC microgrid

- 5.4 Hybrid

Chapter 6 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Grid connected

- 6.3 Off grid

Chapter 7 Market Size and Forecast, By Power Source, 2021 - 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 Diesel generators

- 7.3 Natural gas

- 7.4 Solar PV

- 7.5 CHP

- 7.6 Others

Chapter 8 Market Size and Forecast, By Storage Device, 2021 - 2034 (USD Billion & MW)

- 8.1 Key trends

- 8.2 Lithium-ion

- 8.3 Lead acid

- 8.4 Flow battery

- 8.5 Flywheels

- 8.6 Others

Chapter 9 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion & MW)

- 9.1 Key trends

- 9.2 Healthcare

- 9.3 Educational institutes

- 9.4 Military

- 9.5 Utility

- 9.6 Industrial/ commercial

- 9.7 Remote

- 9.8 Others

Chapter 10 Market Size and Forecast, By Country, 2021 - 2034 (USD Billion & MW)

- 10.1 Key trends

- 10.2 U.S.

- 10.3 Canada

- 10.4 Mexico

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Advanced Microgrid Systems

- 11.3 Ameresco

- 11.4 Bloom Energy

- 11.5 Blue Planet Energy

- 11.6 Black & Veatch

- 11.7 Caterpillar

- 11.8 Eaton

- 11.9 Enchanted Rock

- 11.10 General Microgrids

- 11.11 General Electric

- 11.12 Honeywell

- 11.13 Helia Technologies

- 11.14 Hitachi Energy Ltd

- 11.15 PowerSecure

- 11.16 S&C Electric Company

- 11.17 Schneider Electric

- 11.18 Siemens AG

- 11.19 Tesla

- 11.20 Toshiba Corporation