PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797882

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797882

Busbar Trunking System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

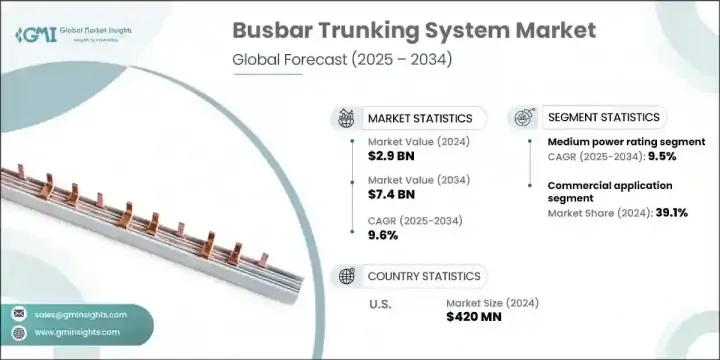

The Global Busbar Trunking System Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 9.6% to reach USD 7.4 billion by 2034. The demand for efficient power distribution solutions is rapidly increasing, as industries and commercial facilities seek ways to optimize space and minimize energy losses. Busbar trunking systems offer a significant advantage over traditional cabling, with their modular design, ease of installation, and scalability making them an ideal solution for modern infrastructure projects. The rise of smart cities and intelligent buildings, which emphasize real-time monitoring, automation, and energy optimization, is further driving the need for these electrical distribution systems.

Furthermore, growing sustainability trends and innovations in materials are shaping the future of electrical distribution. Manufacturers are shifting towards more eco-friendly materials and production processes to meet global environmental standards, with the introduction of materials like TECHNYL 4EARTH, a recycled nylon-based component. As sustainability becomes a greater focus, companies adopting greener solutions are gaining competitive advantage, attracting investment, and boosting market demand for busbar trunking systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $7.4 Billion |

| CAGR | 9.6% |

The medium power rating busbar trunking systems segment held a 29% share in 2024 and is expected to grow at a CAGR of 9.5% through 2034. These systems, typically rated between 800A and 2500A, are increasingly sought after in industrial and infrastructure sectors, as they ensure safe and efficient power distribution. Busbar trunking systems with advanced features, such as sandwich insulation and real-time monitoring capabilities, are becoming more prevalent as digital infrastructure grows globally.

The industrial application segment is projected to grow at a CAGR of 9.5% through 2034. This surge is primarily driven by the increasing demand for reliable, high-capacity power distribution systems in critical industrial environments like manufacturing plants, automotive factories, and logistics hubs. These facilities rely heavily on uninterrupted power to maintain smooth operations, especially when dealing with heavy machinery, complex automation systems, and high-energy requirements. As industries continue to expand and evolve, there is a pressing need for more efficient and scalable power solutions, which busbar trunking systems are uniquely positioned to offer.

U.S. Busbar Trunking System Market held 71% share, generating USD 420 million in 2024. The steady growth of the market in the U.S. is driven by the modernization of aging electrical infrastructure and the increased adoption of smart building technologies. The region's emphasis on energy efficiency, fire safety, and modular construction is accelerating the shift from traditional cabling systems to more advanced busbar trunking solutions.

The top players in the Busbar Trunking System Market include Schneider Electric, Siemens, ABB, Eaton Corporation, and Legrand. To strengthen their market position, companies in the busbar trunking system industry focus on advancing product innovation, particularly in terms of energy efficiency, scalability, and integration with smart infrastructure. They also prioritize sustainability, with many shifting toward eco-friendly materials and processes in response to both regulatory pressures and consumer demand. Strategic partnerships, mergers, and acquisitions are key tactics used to expand market reach and capabilities, especially as demand for smart and sustainable solutions continues to rise. Additionally, companies are investing in research and development to enhance the performance of busbar systems and improve the overall customer experience, ensuring that their products align with evolving industry needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Insulation trends

- 2.1.3 Power rating trends

- 2.1.4 Conductor trends

- 2.1.5 Application trends

- 2.1.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Technology trend

- 3.2.1 Smart grid integration and digitalization

- 3.2.2 Renewable energy integration

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Environmental factors

- 3.7.6 Legal factors

- 3.8 Emerging opportunities & trends

- 3.8.1 Digitalization & IoT integration

- 3.8.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Insulation, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Sandwich

- 5.3 Air insulated

Chapter 6 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Lighting

- 6.3 Low

- 6.4 Medium

- 6.5 High

Chapter 7 Market Size and Forecast, By Conductor, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Copper

- 7.3 Aluminum

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 Industrial

- 8.2.1 Power

- 8.2.2 Oil & gas

- 8.2.3 Process

- 8.2.4 Transportation

- 8.2.5 Manufacturing

- 8.3 Commercial

- 8.4 Utility

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 Italy

- 9.3.4 Spain

- 9.3.5 France

- 9.3.6 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Chile

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Anord Mardix

- 10.3 Bticino

- 10.4 C&S Electric Limited

- 10.5 DBTS Industries Sdn Bhd

- 10.6 EAE

- 10.7 Eaton

- 10.8 Effibar

- 10.9 Entraco Bks Busducts Pvt. Ltd.

- 10.10 Gersan Elektrik A.S

- 10.11 Godrej

- 10.12 Lauritz Knudsen Electrical & Automation

- 10.13 Legrand

- 10.14 MEGABARRE EUROPE SRL

- 10.15 Naxso S.r.l.

- 10.16 NOVA Electrical Co.

- 10.17 Power Plug Busduct Sdn. Bhd.

- 10.18 Schneider Electric

- 10.19 Siemens

- 10.20 Terasaki Electric Co., Ltd.