PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801798

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801798

Endobronchial Ultrasound Biopsy Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

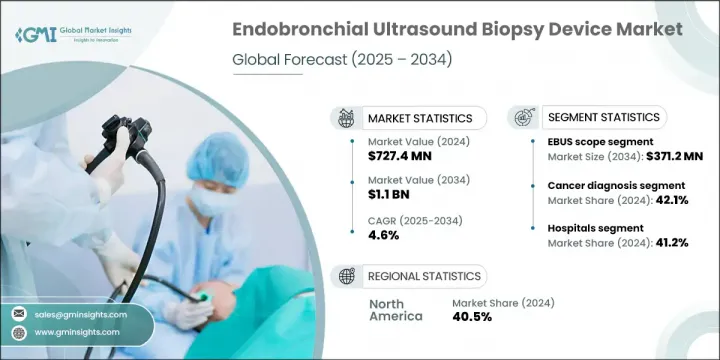

The Global Endobronchial Ultrasound Biopsy Device Market was valued at USD 727.4 million in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 1.1 billion by 2034. Growth in this market is driven by the increasing aging population, a growing incidence of respiratory diseases, rising demand for minimally invasive diagnostic techniques, and ongoing technological advancements in biopsy equipment. These devices are designed to assist clinicians in collecting tissue samples from the lungs and surrounding lymph nodes with high accuracy and minimal patient discomfort. With a shift toward less invasive diagnostics, hospitals, diagnostic labs, and cancer care centers are increasingly adopting these ultrasound-guided solutions to diagnose and stage diseases such as lung cancer and other thoracic conditions. The rising demand for early disease detection and efficient clinical procedures is also contributing to the growing utilization of EBUS tools in routine medical practice.

Technological breakthroughs in biopsy platforms are transforming the landscape of diagnostic procedures. Modern solutions now include features like elastography, AI-enabled navigation, and hybrid imaging, which offer enhanced accuracy and procedural efficiency. These innovations help reduce complication risks, streamline workflow, and contribute to improved patient experiences. Additionally, as healthcare systems emphasize early and accurate diagnosis, there's a higher reliance on these systems for their ability to reduce the need for more invasive surgeries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $727.4 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 4.6% |

The EBUS needle segment generated USD 204.3 million in 2024 and is forecast to reach USD 336.5 million by 2034, growing at a CAGR of 5.2%. The growth of this segment is supported by diverse needle gauge options and echogenic tip technology, which improve visibility during procedures. EBUS scopes, which incorporate ultrasound probes with bronchoscopy, enable real-time imaging of tissues and lymph nodes near the airways. These scopes are essential for performing transbronchial needle aspiration (TBNA), a method that allows clinicians to obtain diagnostic samples without resorting to open procedures. This technique not only minimizes discomfort but also ensures faster recovery and lower risks for patients undergoing lung or thoracic evaluations.

In 2024, the cancer diagnosis application segment held 42.1% share. The increasing incidence of thoracic cancers has sharply raised the need for precise, real-time diagnostic tools. EBUS scopes, TBNA devices, and elastography-equipped probes are vital for staging and early detection, offering clinicians the data necessary to design personalized treatment plans. As cases of cancer continue to rise, healthcare providers are accelerating the adoption of advanced ultrasound-guided biopsy equipment to meet growing diagnostic demands.

United States Endobronchial Ultrasound Biopsy Device Market was valued at USD 269.4 million in 2024. This upward trajectory is attributed to the high prevalence of lung conditions like COPD, tuberculosis, and cancer. Additionally, a well-structured regulatory framework, growing awareness among the population, and strong investments in R&D have supported the widespread integration of advanced EBUS technology in clinical practices across the country.

Notable companies involved in the Global Endobronchial Ultrasound Biopsy Device Market include Siemens Healthineers, B. Braun, Cook Medical, Argon Medical Devices, Fujifilm Holdings, Praxis Medical, Hobbs Medical, Olympus Corporation, Boston Scientific, ACE Medical Devices, GE Healthcare, Koninklijke Philips, Clinodevice, Medi-Globe, and Medtronic. Key players in the endobronchial ultrasound biopsy device market are deploying a range of strategies to strengthen their market presence.

Many are heavily investing in R&D to develop AI-assisted navigation systems, enhanced visualization tools, and more ergonomic biopsy instruments. Several companies are expanding their product portfolios through the launch of devices with improved diagnostic accuracy and patient safety features. Strategic collaborations with hospitals and diagnostic centers are also helping firms to accelerate technology adoption. Partnerships for clinical trials and physician training programs support real-world validation and broaden user competence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising geriatric population

- 3.2.1.2 Increasing prevalence of respiratory disorders

- 3.2.1.3 Rising demand for minimally invasive procedures

- 3.2.1.4 Technological advancements in biopsy devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of equipment

- 3.2.2.2 Lack reimbursement policies in developing countries

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption in specialty clinics for targeted biopsies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 EBUS scopes

- 5.3 EBUS needles

- 5.4 Ultrasound processors and imaging systems

- 5.5 Accessories

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cancer diagnosis

- 6.3 Infection diagnosis

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers (ASCs)

- 7.4 Specialty clinics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Argon Medical Devices

- 9.2 ACE Medical Devices

- 9.3 B. Braun

- 9.4 Boston Scientific

- 9.5 Cook Medical

- 9.6 Clinodevice

- 9.7 Fujifilm Holdings

- 9.8 GE Healthcare

- 9.9 Hobbs Medical

- 9.10 Koninklijke Philips

- 9.11 Medtronic

- 9.12 Medi-Globe

- 9.13 Olympus Corporation

- 9.14 Praxis Medical

- 9.15 Siemens Healthineers