PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801802

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801802

Household Paper Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

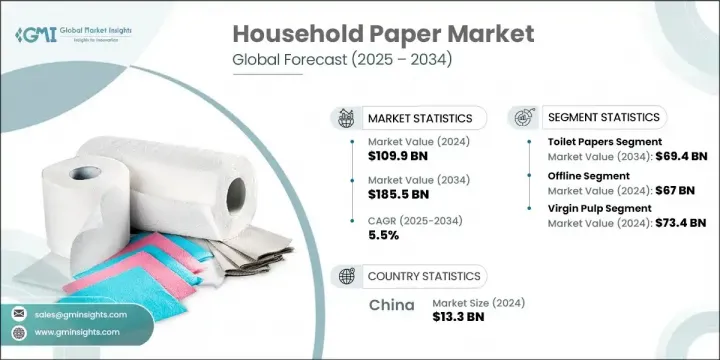

The Global Household Paper Market was valued at USD 109.9 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 185.5 billion by 2034. This upward trend continues as shifting lifestyles, expanding urban populations, and rising disposable incomes reshape consumer habits. As more people move into cities, the demand for convenience and hygiene-related paper products has intensified. Urban living not only leads to busier routines but also brings challenges like limited access to water, increasing the need for disposable hygiene products. In contrast, households in lower-income brackets face restricted access to such products, creating disparities that still influence the global market's trajectory.

Consumers with higher disposable incomes tend to gravitate toward premium paper products that offer better softness, durability, and branded quality. These consumers are more likely to seek added value in essentials such as tissues, paper towels, and toilet paper. Furthermore, growing awareness around hygiene standards worldwide is driving broader demand for disposable paper items. The market is also witnessing dynamic shifts thanks to innovation-new features such as eco-friendly materials, ultra-soft textures, and multi-ply construction are helping brands cater to the evolving preferences of modern buyers focused on comfort and sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $109.9 Billion |

| Forecast Value | $185.5 Billion |

| CAGR | 5.5% |

The toilet paper segment generated USD 39.6 billion in 2024 and is forecast to rise to USD 69.4 billion by 2034. It has maintained its lead as the most dominant household paper category. Its practical nature, widespread acceptance, and growing preference for soft, fragranced, and high-quality variants have driven strong performance across both developed and emerging economies. As income levels rise and urbanization expands, toilet paper continues to solidify its role as a daily-use product within homes worldwide.

In 2024, the offline retail channels segment generated USD 67 billion and is expected to grow at a CAGR of 5.3% during 2025-2034. Offline sales still hold the largest share globally due to factors like easy accessibility, immediate product availability, and consumer trust in physical retail environments. This segment includes retail chains such as supermarkets, convenience stores, and hypermarkets, which offer customers the ability to assess products in person-often influencing purchasing behavior more effectively than online channels.

China Household Paper Market generated USD 13.3 billion in 2024 and is poised for strong growth at a CAGR of 6.2% between 2025 and 2034. China is seeing rapid expansion in this sector due to increasing hygiene consciousness, a swelling middle class, and higher consumer spending power. Modern retail systems and digital platforms are improving product reach and availability, and growing public concern about health-particularly after global health events-continues to reinforce the shift toward regular use of household paper goods.

Prominent companies shaping the Global Household Paper Market include Kimberly-Clark, Essity, Hengan International Group, Georgia-Pacific, Sofidel Group, Asia Pulp & Paper, WEPA Group, SCA Group / Svenska Cellulosa Aktiebolaget, Nippon Paper Industries, Oji Holdings, Procter & Gamble, Kruger Products, Metsa Tissue - Metsa Group, Vinda International Holdings, and Cascades. To remain competitive in the evolving household paper market, leading players have focused on several key strategies. One major area has been investment in product innovation, such as eco-conscious materials and multi-functional designs that appeal to health- and environment-conscious consumers. Companies are also strengthening their distribution networks-particularly in emerging economies-by expanding retail presence and leveraging omnichannel strategies. Strategic partnerships and mergers are helping firms broaden their geographic footprint.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Pricing

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 ($Bn, Tons)

- 5.1 Key trends

- 5.2 Toilet papers

- 5.3 Bathroom tissues

- 5.4 Kitchen papers

- 5.5 Facial tissues

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 ($Bn, Tons)

- 6.1 Key trends

- 6.2 Virgin pulp

- 6.3 Recycled pulp

Chapter 7 Market Estimates & Forecast, By Pricing, 2021-2034 ($Bn, Tons)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Tons)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce website

- 8.2.2 Company owned website

- 8.3 Offline

- 8.3.1 Hypermarket/Supermarket

- 8.3.2 Departmental stores

- 8.3.3 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Asia Pulp & Paper

- 10.2 Cascades

- 10.3 Essity

- 10.4 Georgia-Pacific

- 10.5 Hengan International Group

- 10.6 Kimberly-Clark

- 10.7 Kruger Products

- 10.8 Metsa Tissue - Metsa Group

- 10.9 Nippon Paper Industries

- 10.10 Oji Holdings

- 10.11 Procter & Gamble

- 10.12 SCA Group / Svenska Cellulosa Aktiebolaget

- 10.13 Sofidel Group

- 10.14 Vinda International Holdings

- 10.15 WEPA Group